Background and Bitcoin Bill Amendment Details

On March 7, 2025, the Utah State Senate passed the “Blockchain and Digital Innovation Amendment” (HB230) but removed the key clause that would have allowed the state treasury to invest in Bitcoin. The bill was originally designed to authorize the state treasurer to allocate up to 5% of public funds (approximately USD 1.2 billion) into Bitcoin as a hedge against U.S. dollar inflation. However, after two rounds of deliberations, the Senate voted 19 to 7 to delete that clause, retaining only the protections for citizens’ rights to hold, mine, and stake Bitcoin. The revised bill has been submitted to Governor Spencer Cox for signature.

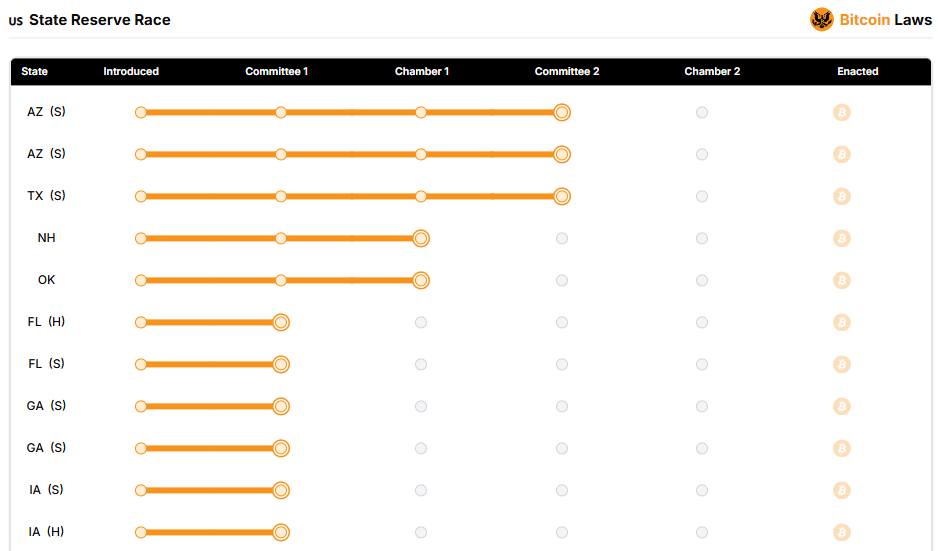

According to Bitcoin legal data, two Bitcoin reserve bills in Arizona and one in Texas are currently the closest to becoming law. These bills have successfully passed their respective Senate committees and are awaiting final Senate votes. Among the 31 Bitcoin reserve state bills enacted so far, 25 remain in effect, including those in Illinois, Iowa, Kentucky, Maryland, Massachusetts, New Hampshire, New Mexico, North Dakota, Ohio, and Oklahoma. Bills proposed in Pennsylvania, Montana, Kentucky, and North Dakota have not passed.

Based on JuCoin data, after the announcement, Bitcoin’s price dropped by 2.3% within 24 hours, and derivative market liquidations reached USD 120 million, reflecting market disappointment with the policy compromise.

Amendment Motives and Controversial Points

The primary motive for amending the bill is risk avoidance amid federal policy uncertainty. Opponents argue that Bitcoin’s high volatility (historical annual volatility around 70%) might jeopardize the safety of public funds. At a current Bitcoin price of USD 82,000, if Utah were to invest 5% of its funds in full, the potential annual loss could be as high as USD 600 million. In addition, disputes over whether crypto assets qualify as securities remain unresolved, meaning state-level fiscal investments could face legal challenges.

Supporters emphasize Bitcoin’s long-term store-of-value function. Representative Jordan Teuscher stated, “Bitcoin is the only digital asset that meets the bill’s criteria (market cap over USD 500 billion), and its decentralized nature can effectively hedge against fiat depreciation.” However, Senator Kirk Cullimore argued in debate that “premature adoption of such policies may trigger uncontrollable risks, and more time is needed to verify market stability.”

Industry Impact and State-Level Competition

Although Utah has removed the fiscal investment clause, its protection of citizens’ crypto rights remains a milestone. The amended bill stipulates that:

- Residents may legally hold, mine, operate nodes, and stake Bitcoin;

- Local governments are prohibited from imposing discriminatory taxes on crypto assets;

- State agencies must accept Bitcoin for public payments (such as taxes and license fees).

These provisions could attract crypto businesses and miners to relocate to Utah. For instance, compliant exchange Gemini plans to establish a regional headquarters in Salt Lake City, leveraging policy advantages to expand its custody services. However, competitive pressures from Texas and Arizona are significant—they are advancing similar bills (SB21 and SB1025) that would allow up to 10% of public funds to be invested in Bitcoin, potentially diverting industry resources away from Utah.

Market reactions have confirmed this trend. Crypto mining firm Riot Platforms announced the suspension of its USD 200 million data center construction in Utah, opting instead to accelerate expansion in Texas.

Future Outlook and Federal Policy Linkage

The revision of the Utah bill is not the end but rather a microcosm of the broader U.S. crypto policy debate. Future developments will hinge on the governor’s decision—Governor Spencer Cox must sign or veto the bill within 15 working days. If signed, Utah will set a benchmark for protecting citizen crypto rights; if vetoed, the House and Senate would need a two-thirds majority to overturn the decision, though that seems less likely.

Moreover, the Utah Treasury has proposed establishing a Citizen Bitcoin Trust Fund, allowing residents to voluntarily invest part of their tax payments in Bitcoin, thereby bypassing the risks associated with public funds. If implemented, this scheme could serve as a model for other states.

Investment Insights and Strategic Recommendations

Although the policy adjustment in Utah has triggered short-term volatility, the wave of state-level legislation continues to accelerate. Investors should:

- Monitor the progress of similar bills in Texas and Arizona, as their passage could boost market confidence;

- Use on-chain tools to track changes in crypto mining firm relocations and institutional holdings;

- Watch for regional opportunities arising from policy divergence, such as compliant custody and payment gateway services.

In the long term, the differentiation in state-level legislation will drive resources toward policy-friendly regions, while federal developments may eventually break the current impasse. Amid the integration of crypto with traditional finance, rational evaluation of policy risks and fundamentals will be key to seizing long-term opportunities.