Content provided by JuCoin Labs Research Institute

Recently, Binance has launched a series of support programs both on-chain and off-chain, covering areas such as Alpha, derivatives, and spot trading, thereby forming a comprehensive incubation system. However, the overall market performance remains weak and quality investment opportunities are becoming increasingly scarce.

In the current environment, a conservative strategy might be the best choice for investors. The Memecoins sector on BNB Chain has entered its mid-to-late stage; with a surge in the number of projects, the supportive effect for top projects is gradually diminishing. For example, Binance’s selected project Mubarak made it into the first coin voting round, yet its token price has not risen significantly—indicating that the market perceives the risks of investing in Memecoins to outweigh the opportunities.

In contrast, holding BNB may be a more strategic choice. As the core asset of the Binance ecosystem, BNB continuously receives official empowerment; its TVL may hit new highs, and users can participate in IDOs and Launchpools to earn extra rewards.

Below, we focus on two projects currently worth watching: KiloEx in the DEX derivatives sector and GUNZ in the GameFi sector.

DEX Derivatives Sector: KiloEx

KiloEx is a project from the sixth Binance Wallet IDO, specializing in the DEX derivatives field. KiloEx launched following the Hyperliquid attack incident, and it is expected to address three major challenges that have long plagued DEXs: high-leverage trading, liquidity black holes, and oracle manipulation. Currently, KiloEx is the DEX with the highest trading volume on opBNB Chain, with a daily volume of US$80 million, and its TVL accounts for 70% of opBNB’s.

Problems Solved

KiloEx tackles several key pain points in the DEX derivatives market:

-

Insufficient Liquidity: Traditional DEX platforms often suffer from significant slippage in derivatives trading due to inadequate market depth. KiloEx improves trading depth through an innovative dynamic liquidity pool model, ensuring smooth transactions even when liquidity is low.

-

High Trading Fees: Trading fees on DEXs are generally high, particularly during periods of market volatility, where fees and slippage become significant issues for users. KiloEx optimizes its trading algorithm and employs a low-fee structure to significantly reduce trading costs.

-

Complex Trading Experience: Traditional derivatives platforms usually have high usage barriers. KiloEx simplifies the user interface and operation process, allowing even new users to quickly get started and improving the overall user experience.

-

Price Manipulation Risk: Many trading platforms are vulnerable to flash crashes or price manipulation. KiloEx uses a median spot price mechanism to effectively prevent such issues.

Key Innovations

-

Layered Liquidity for Risk Isolation:

KiloEx adopts a dual-pool structure consisting of a Base pool and a Buffer pool to achieve effective risk isolation. The Base pool aims for stable growth in net asset value (NAV) with an APR anchored at around 15%-30% to resist volatility. The Buffer pool handles traders’ profit and loss settlements and net funding income; it experiences short-term fluctuations, but over the long term, its value accumulates through trading friction. When the Buffer pool’s balance is positive, benefits are automatically injected into the Base pool; otherwise, the Base pool replenishes the Buffer pool. The bidirectional flow between the two pools effectively addresses the inherent weakness of DEXs against unilateral market moves. -

Zero GAS and Zero Slippage for a Premium User Experience:

Built on opBNB technology (ERC-2771), KiloEx enables near-zero GAS costs and minimal slippage. Its direct liquidity pool trading mechanism allows users to exchange tokens directly with the pool without relying on an order book, controlling slippage and providing a trading experience close to that of centralized exchanges. -

High Asset Applicability:

While traditional DEXs use a Vault model, KiloEx employs a Hybrid Vault model that significantly expands asset applicability. KiloEx offers users a wider range of options by providing high-yield, real USDT returns for LSTs and other assets, addressing the industry pain point of LSTs lacking real yield.

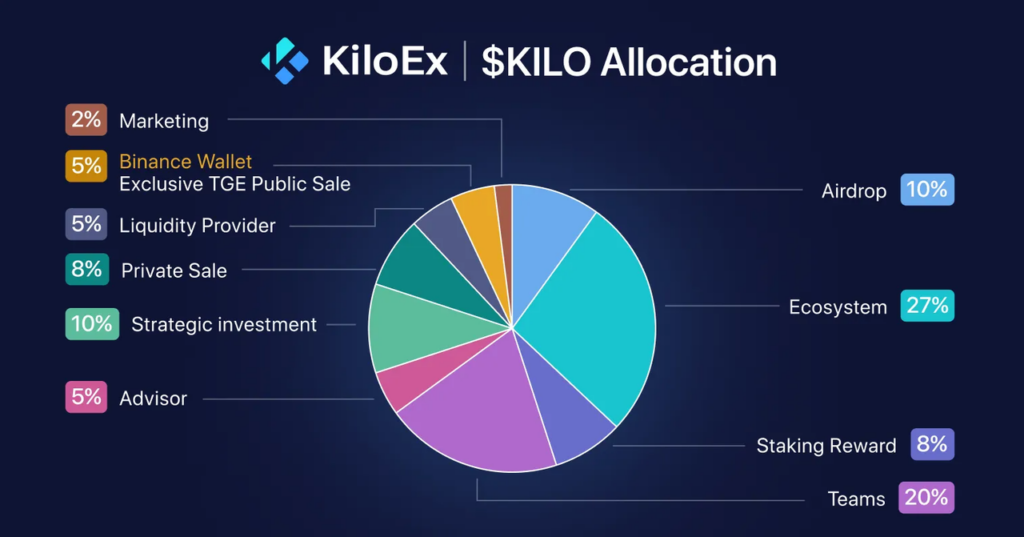

Token Economics

The native token has a total supply of 1 billion tokens, of which approximately 21.17% (211.7 million tokens) are unlocked, and the remaining 78.83% (788.3 million tokens) are locked.

Token allocation is as follows:

-

27% for the ecosystem,

-

10% for strategic investments,

-

8% for the private round,

-

20% for the team,

-

8% for staking rewards, etc.

For trading fees, 40% is allocated to the ecosystem, 30% to $xKILO holders, and 30% to the liquidity pool.

Team and Financing

The co-founders of KiloEx have held key positions at two major centralized exchanges and boast academic backgrounds from Tsinghua University and Beihang University. Other founding team members have extensive experience in CEX operations, DeFi protocol development, and traditional financial derivatives design. KiloEx has received support from institutions including yzilabs, CrescendoVen, ForesightVen, 7upDAO, PoolzVentures, and GTS_Ventures; specific financing amounts have not been disclosed.

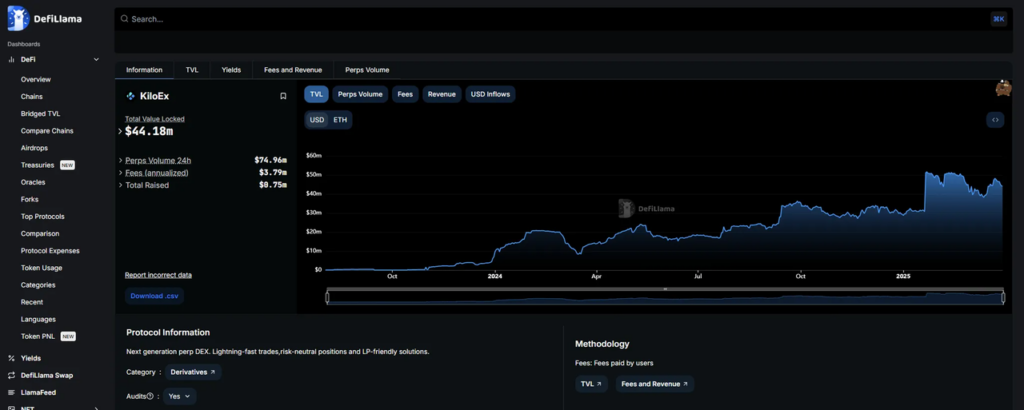

Operational Data

KiloEx currently has a TVL of US$36 billion, a daily trading volume of US$116 million, and over 840,000 total users. Additionally, KiloEx is compatible with BNB Chain, opBNB, Manta, Taiko, and Base, and includes built-in cross-chain bridging functionality that allows users to easily switch between different network environments. According to DefiLlama data, KiloEx ranks 12th in TVL and 9th in trading volume among all derivatives platforms.

IDO Investment Returns

IDO projects have become a recent market focus and currently offer high returns. For example, MyShell in the AI sector achieved an oversubscription of 11,425% during its IDO, with a token issuance price of US$0.022 and a post-IDO market high of US$0.61, yielding a return of 2672.73%. In contrast, KiloEx, from Binance Wallet’s sixth IDO round, raised 442,985 BNB with a target of 1213.94 BNB, oversubscribed approximately 365 times. KiloEx’s token issuance price was US$0.084, and its post-IDO market high was US$0.096, resulting in a return of 14.29%.

Overall, returns from Binance Wallet IDO projects are under market pressure and have been generally declining.

GameFi Sector: GUNZ

GameFi has always been one of the main growth directions in the industry, though its user retention remains a major challenge. According to DappRadar, among newly launched blockchain game projects between 2023 and 2024, 87% had lifespans of less than six months, with a median player retention rate of only 3.2%. Binance Launchpool’s 66th project, GUNZ, is a key project in this sector.

Project Overview

GUNZ is a Layer 1 blockchain developed by Germany’s renowned game developer Gunzilla Games, designed to provide decentralized infrastructure for AAA games. Unlike traditional blockchain games, GUNZ’s core objective is to seamlessly integrate blockchain technology into mainstream gaming, ensuring that players truly own in-game assets while enhancing the overall gaming experience.

Key Innovations

-

AAA-Quality Gaming Experience:

GUNZ combines high-quality gaming with blockchain technology, enabling players to truly own and control in-game assets while enjoying the immersive experience of traditional AAA titles, along with the benefits of a decentralized economic system. -

NFT and Virtual Asset Market:

In-game virtual items are represented as NFTs, allowing players to freely trade and sell them, thereby enhancing asset liquidity and market value. -

High TPS with Zero GAS:

GUNZ employs a customized consensus mechanism to achieve tens of thousands of TPS with near-zero GAS fees. Its smart contracts are compatible with Unity and Unreal engines, allowing developers to seamlessly migrate traditional games to the blockchain and greatly lowering development barriers.

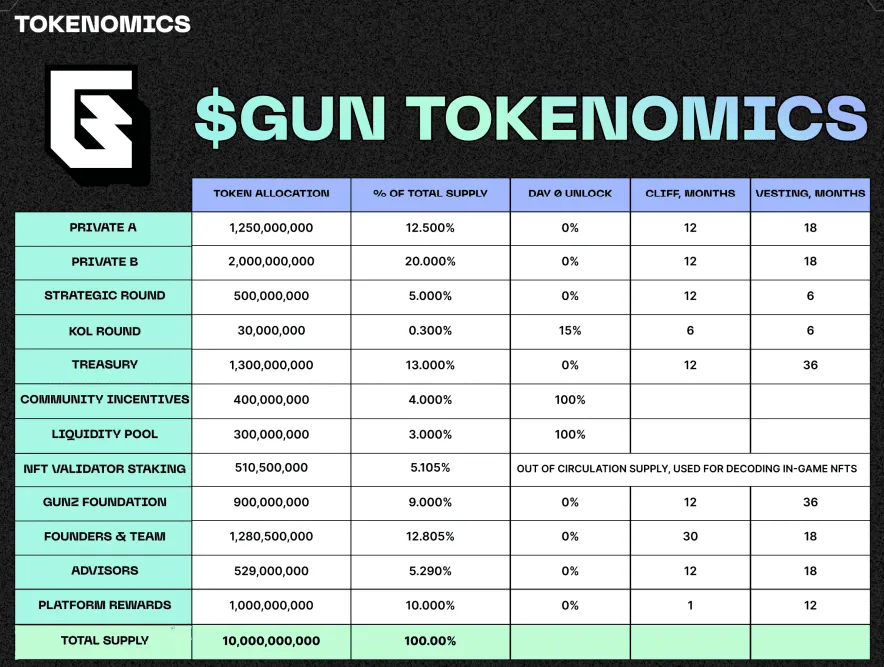

Token Economics

The total supply of the $GUN token is set at 10 billion tokens, with an initial circulation of 645 million (6.05% of total supply). The total allocation for Launchpool is 400 million tokens (4% of total supply). Users can participate in zero-barrier mining by staking BNB, FDUSD, or USDC for three days, with an estimated annual yield of over 150%. Additionally, tokens reserved for ecosystem incentives will be used to continuously empower the gaming ecosystem through NFT assets and Play-to-Earn mechanisms. The largest portion of token allocation is in the private round at 37.8%, followed by Treasury at 13% and community incentives at 8%.

Team and Financing

GUNZ has completed two rounds of financing:

-

In August 2022, it raised US$46 million led by Republic Capital, with participation from Griffin Gaming Partners, Animoca Brands, Jump Crypto, and well-known angel investor and Twitch co-founder Justin Kan.

-

In March 2024, it raised an additional US$30 million led by Blizzard Fund under Avalanche and CoinFund.

Operational Data

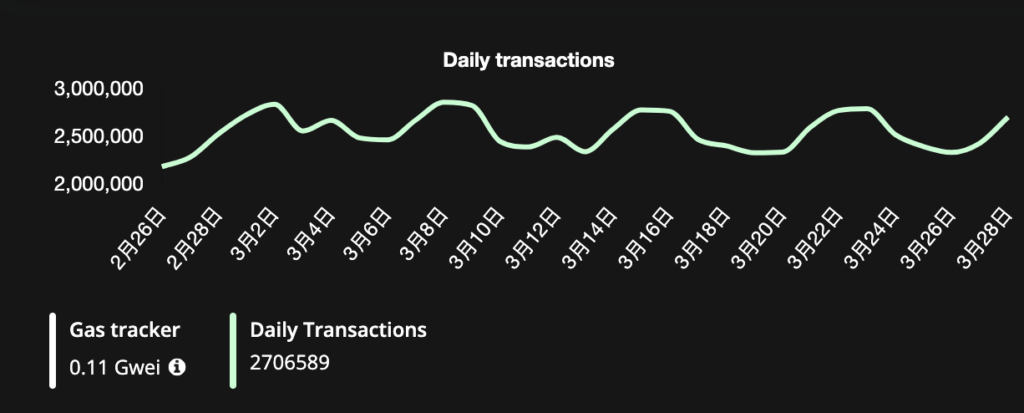

To date, GUNZ has over 13 million wallets, a total transaction count exceeding 370 million, and an average daily transaction count of 2.5 million.

Summary

Overall, GUNZ shows certain advantages in the L1 gaming space and represents a low-risk opportunity through Binance Launchpool, although it still faces challenges with retention rates and economic mechanisms.

In summary, Binance Wallet IDO and Launchpool remain among the lower-risk participation options currently, but investors should closely monitor market trends and the long-term potential of these projects.