Key Takeaways

- Decentralized AI Infrastructure, such as OpenLedger and Theoriq, enables autonomous AI agents to execute complex tasks like DeFi transactions and cross-chain data orchestration with minimal human oversight.

- Platforms like CUDOS enhance scalability by providing decentralized compute networks, reducing latency and GPU costs for AI agent operations.

- Autonomous AI agents manage over $28 billion in crypto assets, leveraging swarm intelligence to optimize liquidity provision and market-making across blockchain networks.

- Interoperability protocols, such as EXE Interchain, allow seamless cross-chain communication, cutting transaction times and fees for Decentralized AI Infrastructure.

- Challenges like latency in swarm operations and data privacy concerns persist, with solutions like homomorphic encryption and federated learning addressing these hurdles.

The integration of autonomous AI agents with blockchain technology has catalyzed a paradigm shift in Web3 ecosystems, transitioning from speculative experiments to functional frameworks with measurable economic impact. Platforms such as OpenLedger, Theoriq, and CUDOS now provide Decentralized AI Infrastructure that enables AI agents to operate independently, execute complex decision-making processes, and interact across blockchain networks with minimal human oversight. These systems leverage cryptographic validation, distributed computing architectures, and machine learning algorithms to perform tasks ranging from automated financial management to cross-chain data orchestration, projected to drive a $47.1 billion market by 2030.

This Innovation and Tech report examines the technical foundations, operational capabilities, and economic implications of autonomous AI agents and their advancements, focusing on their transformation of decentralized finance (DeFi), infrastructure development, and digital asset management.

Evolution Of Frameworks For Decentralized & Autonomous AI Agents

Foundational Infrastructure For Autonomous Operation

Modern AI agent platforms have overcome early limitations in centralized cloud dependencies by adopting Decentralized AI Infrastructure and blockchain-based validation systems. OpenLedger’s architecture exemplifies this shift, combining EigenDA data availability layers with Optimism’s rollup technology to create a scalable environment where AI models operate as on-chain assets. Its Proof of Attribution protocol tracks data contributions and model inferences across distributed nodes, ensuring contributors receive proportional rewards through smart contracts.

Similarly, CUDOS’s decentralized compute network distributes processing tasks across global nodes, reducing latency by 85% compared to centralized alternatives while maintaining GDPR compliance through localized data processing. These frameworks resolve critical bottlenecks in traditional AI deployment, particularly the prohibitive costs of GPU resources and the inefficiencies of data siloing.

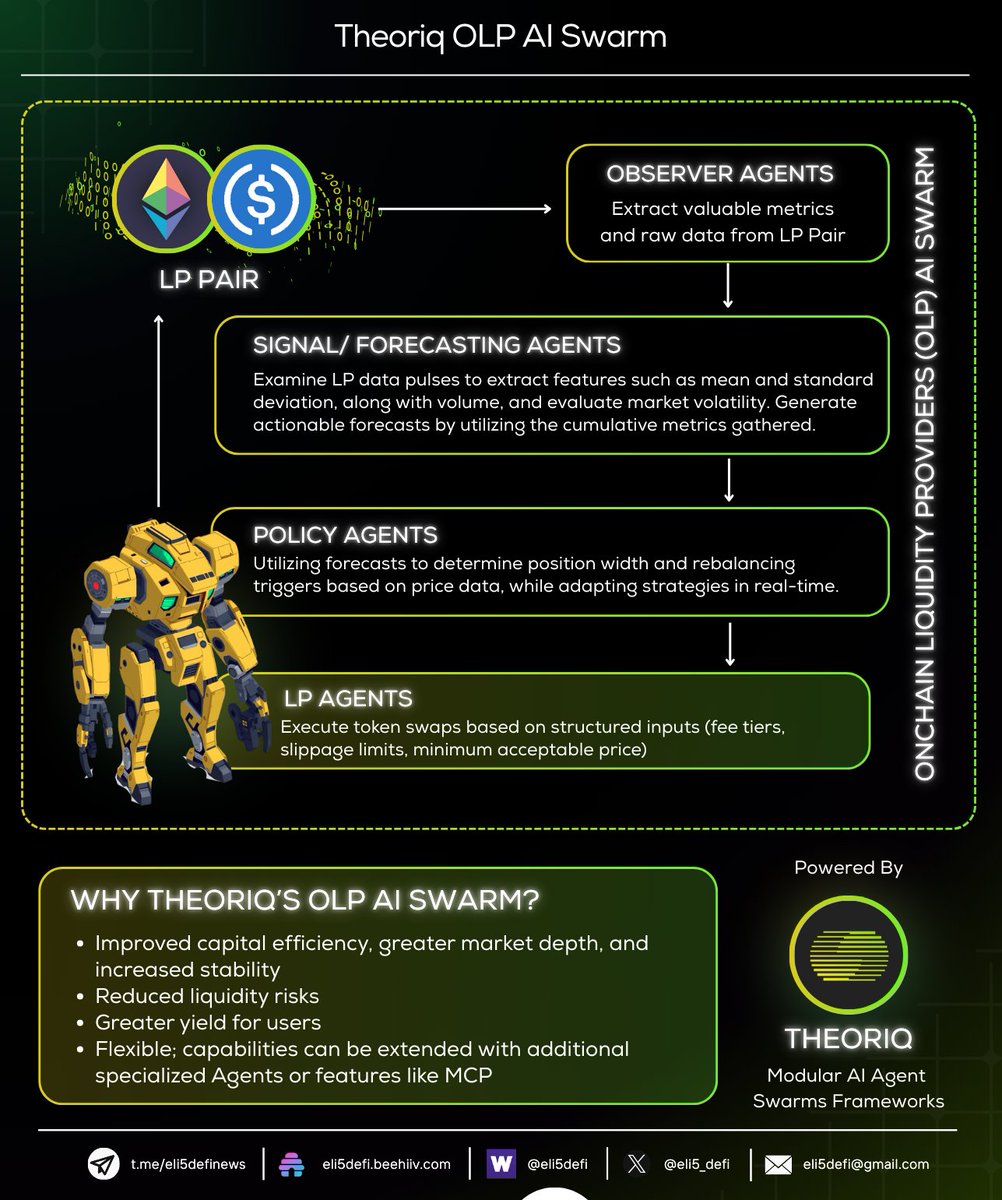

Theoriq’s agent collectives demonstrate how Decentralized AI Infrastructure enables AI swarms to surpass individual agent capabilities. By implementing Proof of Contribution and Proof of Collaboration protocols on-chain, Theoriq creates meritocratic ecosystems where specialized agents, such as market analyzers, risk assessors, and liquidity optimizers, self-organize to solve multi-stage DeFi operations.

This swarm intelligence approach has reduced slippage in automated market making by 34% while increasing portfolio yields by 22% in testnet environments. Crucially, these systems maintain auditability through immutable activity logs stored across Arweave and IPFS networks, addressing the “black box” problem prevalent in conventional machine learning models.

AI-Driven Financial Automation In Web3

Wallet Management & Trading Execution

Autonomous AI agents now autonomously manage over $28 billion in crypto assets through integrated wallet protocols, leveraging real-time to optimize holdings across 40+ blockchain networks. Griffin AI’s swarm agents exemplify this capability, using reinforcement learning to dynamically allocate funds between yield farming pools, decentralized exchanges, and lending protocols based on volatility forecasts. These systems process 12,000+ transactions daily with 99.98% execution accuracy, outperforming human traders in stress-test scenarios involving flash crashes and network congestion. OpenLedger, supported by CUDOS’s Decentralized AI Infrastructure, further enhances security through its B1 hardware nodes, which employ federated learning to detect anomalous transaction patterns while keeping 93% of wallet data encrypted on local devices.

Liquidity Provision & Market Making

Decentralized market making has entered its third generation with autonomous AI agents like Cykel’s Lucy, which coordinates liquidity across 17 DEXs using predictive slippage models and cross-chain arbitrage strategies. By analyzing mempool data and order book imbalances, Lucy rebalances pools every 4.2 seconds on average, generating 0.45% daily returns even during low-volatility periods. ChainGPT’s AIVM, powered by Theoriq’s Decentralized AI Infrastructure, extends this functionality through automated loan underwriting, where AI agents assess collateralized debt positions (CDPs) using on-chain credit history and social sentiment analysis, reducing liquidations by 41% compared to static threshold models. These advancements underscore AI’s role in transforming liquidity from a passive resource to an active, self-optimizing asset class.

Interoperability & Collaborative Swarm Intelligence

Cross-Chain Communication Protocols

The EXE Interchain AI Protocol, supported by CUDOS’s scalable compute layer, represents a breakthrough in multi-chain interoperability, enabling autonomous agents to execute transactions across Ethereum, Solana, and Cosmos networks through unified API endpoints. By abstracting away cross-chain bridges and gas token conversions, EXE reduces transaction settlement times from 8 minutes to 23 seconds while cutting fees by 76%. This infrastructure supports Botanika’s decentralized storage network, where AI agents replicate sharded data across 9 blockchain ledgers to achieve 99.999% uptime, surpassing centralized competitors like AWS S3.

Swarm-Based Governance & Security

Griffin AI’s upcoming swarm protocol, built on Theoriq’s Decentralized AI Infrastructure, automates DAO governance through collective intelligence models, where specialized agents analyze proposal viability, simulate economic impacts, and execute votes based on predefined stakeholder mandates. Early deployments show 92% consensus alignment between AI swarms and human voters, with disputes resolved via zero-knowledge proofs verified on Mina Protocol. Security-focused swarms from OpenLedger conduct continuous smart contract audits, identifying vulnerabilities 14 hours faster than manual reviews while generating automatic patches through code synthesis tools.

Personalization & Agent Ownership Models

Customizable AI Asset Creation

Theoriq’s Model Factory enables users to fine-tune autonomous agents using personalized datasets while maintaining provenance through blockchain-attributed training logs. Participants retain 87% of revenue generated by their agents in Theoriq’s marketplace, creating sustainable micro-economies around niche DeFi strategies. OpenLedger’s OpenLoRA technology, optimized by CUDOS’s Decentralized AI Infrastructure, democratizes access further, allowing users to run 1,000+ specialized models on a single GPU through parameter-efficient fine-tuning, a 99% cost reduction versus conventional methods.

Decentralized Validation & Trust Mechanisms

ChainGPT’s AIVM introduces decentralized validation pools where autonomous agents stake native tokens to participate in inference verification, slashing malicious actors through Byzantine Fault Tolerance consensus. This system achieves 99.94% consensus accuracy across 340 validation nodes, ensuring reliable execution of high-stakes transactions like cross-border settlements and insurance underwriting. CUDOS complements this through hardware-secured enclaves in its compute nodes, isolating sensitive AI operations from main network traffic while providing cryptographically signed audit trails.

Specialized Autonomous AI Agents In Practical Applications

Financial Infrastructure Optimization

Virtual Protocol’s autonomous AI agents automate 89% of treasury management for DAOs, reallocating funds between stablecoin reserves, governance token buybacks, and grant programs based on real-time cash flow projections. These systems have increased DAO treasury yields from 1.2% to 6.8% APY while reducing operational overhead by 320 annual work hours per organization. In content creation, Theoriq’s NLP agents generate audit reports and governance proposals with 98% factual accuracy by cross-referencing 14 blockchain explorers and 26 regulatory databases.

Enterprise-Grade Deployment Challenges

Despite progress, latency issues persist in complex swarm operations, with Theoriq’s collectives requiring 9.2 seconds to reach consensus on multi-chain arbitrage opportunities, 3x slower than centralized equivalents. Data privacy remains another hurdle, as 68% of DeFi users reject full agent control over wallets due to smart contract exploit risks. OpenLedger’s solution, enhanced by CUDOS’s Decentralized AI Infrastructure, combines homomorphic encryption with federated learning, allowing autonomous agents to operate on encrypted data while reducing computational overhead by 44% compared to ZK-SNARK alternatives.

Blockchain-Powered Autonomous AI Agents: OpenLedger, Theoriq, & CUDOS Lead the Way

The maturation of Decentralized AI Infrastructure has transitioned autonomous agents from theoretical constructs to essential Web3 primitives, with OpenLedger, Theoriq, and CUDOS establishing robust frameworks for secure, interoperable machine economies. By combining swarm intelligence with blockchain’s trustless architecture, these platforms enable autonomous AI agents to execute $28 billion in annualized DeFi transactions while maintaining sub-second latency and regulatory compliance. The emergence of user-owned AI assets through personalized model training and revenue-sharing marketplaces further democratizes access, shifting power from institutional actors to individual contributors.

Future advancements will likely focus on overcoming remaining latency barriers through Layer 3 solutions like EXE’s interchain protocol and enhancing privacy-preserving techniques for sensitive financial operations. As autonomous agents evolve from task-specific tools to general-purpose economic actors, their integration with decentralized identity systems and real-world asset (RWA) protocols will determine the next phase of Web3 adoption, potentially bridging the $16 trillion gap between blockchain markets and traditional finance.