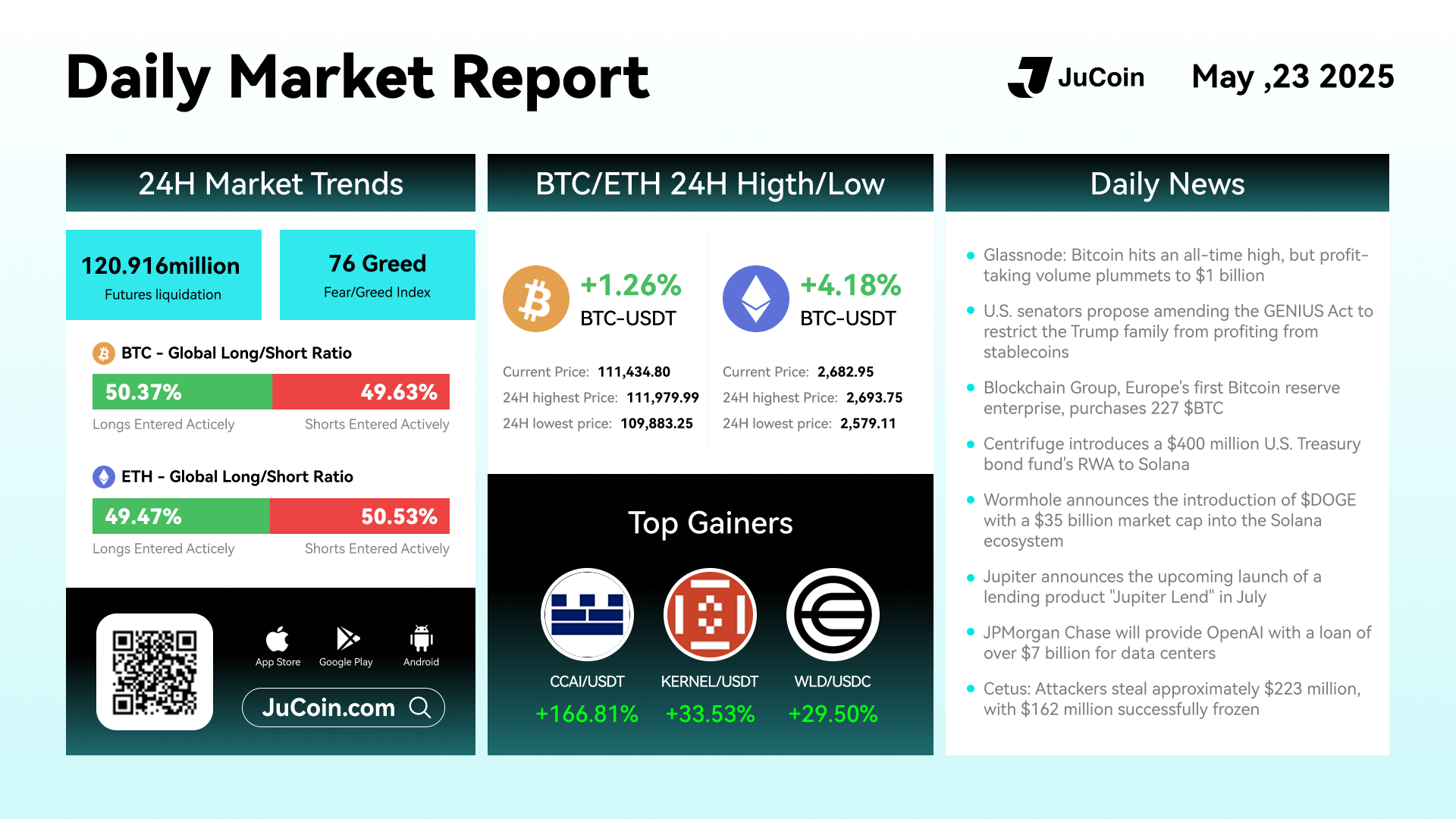

Daily Market Report – May 23, 2025

The crypto market pressed higher today, with Bitcoin (BTC) rising 1.26% to $111,434.80 and Ethereum (ETH) jumping 4.18% to $2,682.95. BTC touched a daily high of $111,979.99 before consolidating, while ETH surged from a low of $2,579.11 to approach $2,700 for the first time this month. Futures liquidations totaled $120.92 million, largely driven by short positions unwinding into strength. Sentiment continued to build, with the Fear & Greed Index climbing to 76—marking the highest reading this quarter and firmly placing the market in “Extreme Greed” territory. Long/short ratios for both BTC and ETH remained close to 50/50, suggesting balanced positioning despite the run-up.

Altcoins followed suit, with top gainers including CCAI/USDT (+166.81%), KERNEL/USDT (+33.53%), and WLD/USDT (+29.50%), led by strong interest in DePIN, AI, and Solana-based assets. On-chain fundamentals remain robust, with the total market cap nearing previous cycle highs.

Institutional momentum also drove the narrative. Glassnode confirmed that BTC has reached an all-time high, while profit-taking fell to just $1 billion, signaling strong holder conviction. U.S. senators proposed an amendment to the GENIUS Act to restrict stablecoin-linked financial gains for politically exposed persons, including the Trump family—further sharpening the focus on regulatory evolution. Meanwhile, Blockchain Group became Europe’s first official Bitcoin reserve enterprise, acquiring 227 BTC for sovereign-grade custody.

Real-world asset tokenization also saw traction. Centrifuge announced a $400 million U.S. Treasury bond RWA fund on Solana, and Wormhole expanded its cross-chain footprint by onboarding Dogecoin (DOGE) into the Solana ecosystem with a $35 billion market cap.

Additional headlines included Jupiter’s upcoming July launch of a new lending product called Jupiter Lend, JPMorgan’s $7 billion loan commitment to OpenAI for AI data infrastructure, and a major DeFi exploit at Cetus totaling $223 million—of which $162 million has reportedly been frozen to mitigate further risk.

The backdrop remains bullish, supported by deepening institutional participation, rising prices, and expanding cross-chain activity.