Key Takeaways

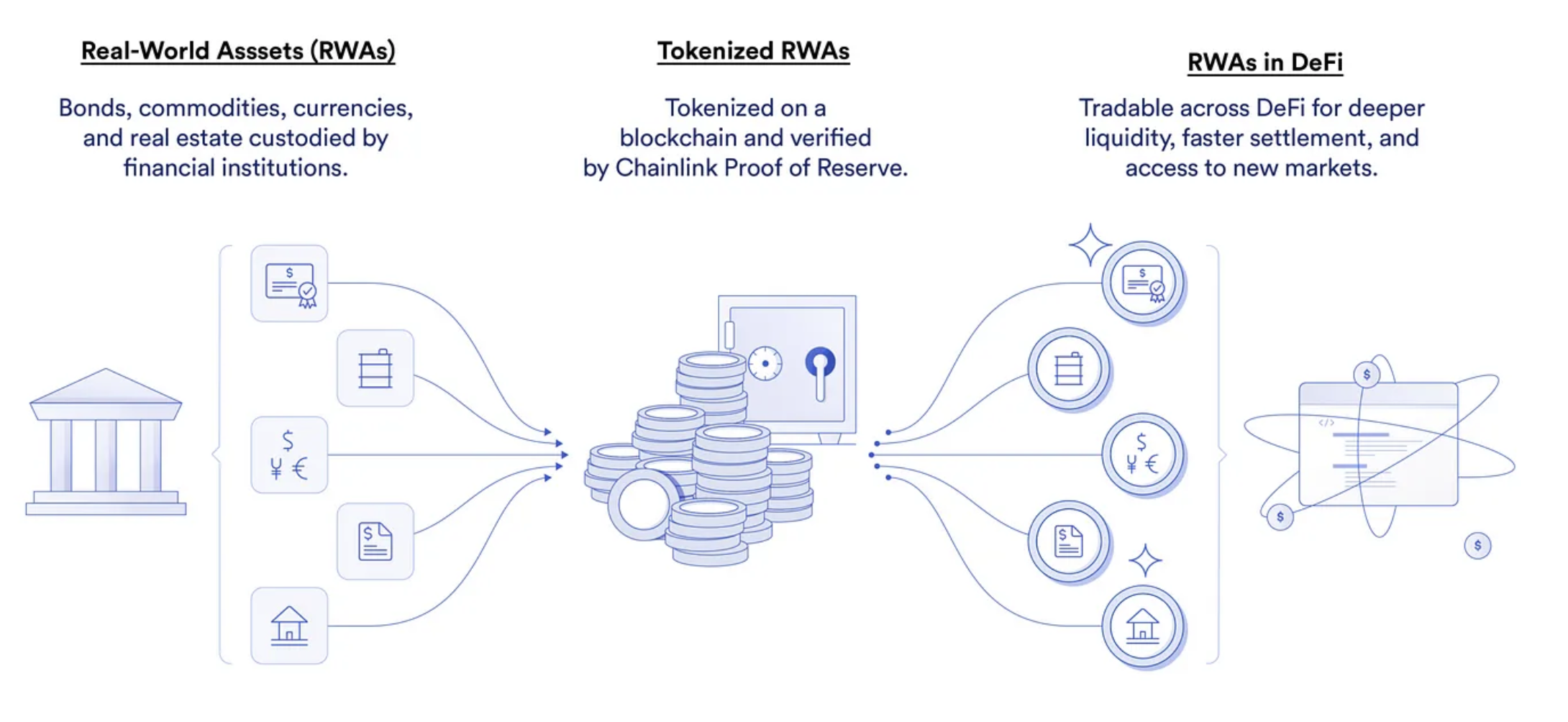

- Real World Asset (RWA) Tokenization Overview: RWA tokenization converts physical assets into blockchain-based tokens, enabling fractional ownership and bridging traditional finance with decentralized ecosystems.

- Liquidity and Accessibility: Tokenization unlocks liquidity in illiquid markets like real estate and art, allowing global investors to participate with minimal capital through fractionalized ownership.

- On-Chain vs. Off-Chain Models: On-chain tokenization offers full transparency by storing ownership records on the blockchain, while off-chain relies on custodians for physical assets, introducing counterparty risks.

- Regulatory and Technical Challenges: To fully realize the potential of RWA tokenization, fragmented regulations, custodial risks, and blockchain scalability issues must be addressed.

- Future Potential: With institutional adoption and emerging technologies like AI and CBDCs, the tokenized asset market could reach $16 trillion by 2030, reshaping global financial systems.

Real World Asset Tokenization represents a transformative convergence of blockchain technology and traditional finance, enabling physical assets to be digitized and traded on decentralized platforms. By converting ownership rights into blockchain-based tokens, this innovation addresses long-standing challenges of liquidity, accessibility, and efficiency in markets historically constrained by physical limitations and intermediaries. The process democratizes investment opportunities, allowing fractional ownership of high-value assets like real estate, art, and commodities, while leveraging blockchain’s inherent transparency and security. As institutional adoption grows and regulatory frameworks evolve, RWA tokenization is poised to redefine global financial systems, though technical, legal, and operational hurdles remain.

Conceptual Foundations Of Real World Asset Tokenization

At its core, RWA tokenization involves creating digital representations of physical or intangible assets on a blockchain, where each token corresponds to a share of ownership or specific rights to the underlying asset. This mechanism bridges traditional finance with decentralized ecosystems, enabling assets to interact with smart contracts, decentralized exchanges, and lending protocols. The digitization of ownership records on an immutable ledger reduces reliance on intermediaries, streamlines transactions, and unlocks liquidity for previously illiquid markets. For instance, a commercial property valued at $10 million can be divided into 10 million tokens, each representing a $1 stake, allowing retail investors to participate without needing substantial capital.

Distinguishing On-Chain & Off-Chain Tokenization

Tokenization strategies fall into two primary categories: on-chain and off-chain. In on-chain tokenization, both the asset’s ownership records and the asset itself, if digital, reside on the blockchain. This approach maximizes transparency, as every transaction and ownership transfer is immutably recorded, and enables peer-to-peer trading without custodians. Real estate deeds, for example, can be fully digitized and managed via smart contracts that automate rental income distribution or enforce property liens. Conversely, off-chain tokenization involves linking blockchain tokens to physical assets held by third-party custodians. Here, the token acts as a claim to the asset, which remains stored in traditional systems. This model suits assets like gold bars or fine art, where physical custody is unavoidable, but introduces counterparty risk if custodians fail to uphold their obligations.

The choice between these models hinges on asset type, regulatory requirements, and desired levels of decentralization. Hybrid approaches are emerging, combining on-chain efficiency with off-chain legal enforceability, such as tokenizing shares in a Special Purpose Vehicle (SPV) that owns a physical real-world asset (RWA).

The Tokenization Workflow: From Asset Selection To Secondary Trading

Tokenizing real-world assets requires meticulous legal, technical, and operational planning.

Asset Evaluation & Legal Structuring

The process begins with selecting an asset with clear ownership rights and measurable value. As tokenization can unlock their latent value, illiquid assets like private equity stakes or infrastructure projects are prime candidates. Legal structuring then ensures tokens comply with jurisdictional securities laws. For example, tokens representing profit-sharing rights in a real estate project may be classified as securities in the U.S., necessitating compliance with SEC regulations. Entities often use SPVs to hold the underlying real-world asset (RWA), with tokens representing equity in the SPV. This structure isolates liability and simplifies regulatory reporting.

Technical Implementation & Token Design

Developers must choose a blockchain platform (e.g., Ethereum, Polygon, or a private ledger) and token standard (ERC-20 for fungible assets, ERC-721 for unique assets). Smart contracts encode ownership rules, dividend distributions, and transfer restrictions. A real estate token might use ERC-20 to fractionalize ownership, with a smart contract automatically distributing rental income proportionally to token holders. Oracles, third-party data feeds, and integrate off-chain information, such as property appraisals or commodity prices, into blockchain workflows.

Issuance & Secondary Market Liquidity

Tokens are typically launched via Security Token Offerings (STOs) or private sales, targeting accredited investors. Post-issuance, secondary trading occurs on specialized exchanges like tZERO or decentralized platforms (DEXs). Regulatory-compliant DEXs use “whitelists” to restrict trading to verified participants, ensuring adherence to KYC/AML laws. Liquidity pools on automated market makers (AMMs) enable 24/7 trading, contrasting with traditional markets’ limited hours.

Advantages Of Tokenizing Real-World Assets

Liquidity Enhancement & Fractionalization

Tokenization’s most profound impact lies in liquefying illiquid markets. Fine art, which typically requires buyers to purchase entire pieces, can be divided into fractional tokens, enabling collective ownership. Platforms like Maecenas have tokenized artworks by Picasso and Warhol, allowing investors to trade shares on secondary markets. Similarly, private equity stakes, traditionally locked for years, become tradable through security tokens, offering early exit opportunities for investors.

Operational Efficiency & Cost Reduction

Blockchain’s automation reduces administrative overhead. Smart contracts replace manual processes for dividend payments, corporate actions, and regulatory reporting. In trade finance, tokenizing letters of credit eliminates paperwork and accelerates settlement from days to minutes. A Deloitte study estimates that blockchain can reduce financial institutions’ operational costs by 30% by automating reconciliation and compliance.

Global Accessibility & Transparency

Geographical barriers dissolve as tokens trade on global platforms, broadening investor bases. A farmer in Kenya can invest in Manhattan real estate, while a European retiree gains exposure to Australian infrastructure projects. Blockchain’s transparency also deters fraud: every transaction is publicly auditable, and smart contracts execute predefined rules without bias.

Prominent Use Cases & Industry Adoption

Real Estate: Democratizing Property Investment

Real estate dominates RWA tokenization, with platforms like RealT and REITChain offering tokenized properties. Investors earn rental yields and capital appreciation without property management hassles. In 2023, Mountain Protocol tokenized a $75 million commercial complex in Dubai, selling 40% of the tokens to international investors within hours. Tokenization also facilitates cross-border investments; U.S. investors can bypass foreign ownership restrictions by holding tokens in a locally incorporated SPV.

Commodities: Digitizing Raw Materials

Gold and oil markets are leveraging tokenization to enhance liquidity. Paxos’ PAXG token, backed 1:1 by physical gold stored in vaults, enables instant settlement and fractional trading. Similarly, VAKT’s blockchain platform tokenizes North Sea oil barrels, allowing traders to hedge positions without physical delivery.

Intellectual Property & Royalty Streams

Musicians, filmmakers, and inventors tokenize royalty rights to monetize future earnings. In 2024, a Grammy-winning artist tokenized 20% of their song royalties, raising $2 million from fans and institutional investors. Token holders receive automatic royalty payouts via smart contracts, demonstrating blockchain’s utility in creative industries.

Regulatory & Technical Challenges

Fragmented Regulatory Frameworks

Jurisdictional disparities complicate compliance. The EU’s Markets in Crypto-Assets (MiCA) regulation classifies tokens as either utility or financial instruments, imposing strict disclosure requirements. Conversely, Singapore’s Payment Services Act exempts certain utility tokens from securities laws, fostering innovation. In the U.S., the SEC’s enforcement actions against platforms like LBRY highlight the risks of misclassifying security tokens. Projects must navigate these regimes, often requiring legal teams in multiple countries.

Custodial Risks & Oracle Reliability

Off-chain tokenization relies on custodians to safeguard physical assets. The 2023 collapse of a Swiss vault holding tokenized gold revealed vulnerabilities when auditors discovered a 15% shortfall in reserves. Oracles, which feed external data to blockchains, present another risk: a manipulated price feed could incorrectly value collateral in a lending protocol, triggering unjust liquidations.

Scalability & Interoperability

Public blockchains like Ethereum face congestion during peak usage, delaying transactions and inflating fees. Layer-2 solutions (e.g., Polygon) and alternative networks (e.g., Solana) aim to resolve these issues but fragment liquidity across chains. Cross-chain bridges, such as Wormhole, enable token transfers between networks but have suffered exploits, including a $325 million hack in 2022.

The Evolving Regulatory Landscape

Progressive Jurisdictions Leading Adoption

Switzerland’s “blockchain nation” strategy provides legal clarity, recognizing blockchain-based securities under the Distributed Ledger Technology Act. The Dubai Financial Services Authority (DFSA) allows tokenized securities to trade on licensed exchanges, attracting firms like Securitize and Securrency. Meanwhile, Japan’s revised Payment Services Act recognizes stablecoins as legal tender, easing tokenized asset settlements.

Central Bank Digital Currencies (CBDCs) & Tokenization

CBDCs are expected to complement RWA tokenization by providing regulated settlement rails. The European Central Bank’s digital euro pilot integrates with blockchain platforms to enable instant settlement of tokenized bonds. Similarly, Hong Kong’s Project mBridge uses a CBDC network for cross-border commodity token settlements, reducing reliance on correspondent banks.

Future Trajectories & Market Potential

Institutional Adoption & Hybrid Models

Major financial institutions are entering the space: J.P. Morgan’s Onyx platform settles tokenized collateral for derivatives trades, while BlackRock’s BUIDL fund offers tokenized U.S. Treasury bonds. These initiatives signal growing institutional confidence. Hybrid models, mixing decentralized and traditional infrastructure, are gaining traction. For example, Sygnum Bank’s Desygnate platform links blockchain tokens to conventional bank accounts, enabling seamless fiat conversions.

AI & Zero-Knowledge Proofs

Artificial intelligence enhances asset valuation and risk assessment for tokenized portfolios. Startups like Solidus Labs use AI to detect market manipulation on token exchanges. Zero-knowledge proofs (ZKPs), cryptographic methods enabling transaction verification without revealing sensitive data, address privacy concerns. A ZK-based real estate token could prove ownership without disclosing the holder’s identity, balancing transparency and confidentiality.

Long-Term Market Projections

The Boston Consulting Group forecasts that the tokenized asset market will reach $16 trillion by 2030, driven by institutional adoption. Real estate and equities are expected to dominate, followed by art and carbon credits. Success hinges on resolving regulatory fragmentation, improving scalability, and establishing industry-wide standards for interoperability.

Unlocking Liquidity & Access Through Real World Asset (RWA) Tokenization

Real world asset tokenization is redefining ownership, investment, and value exchange in the digital age. By overcoming traditional market inefficiencies, it promises to democratize access, enhance liquidity, and reduce costs across asset classes. However, realizing this potential requires addressing regulatory uncertainties, custodial risks, and technical limitations. Collaborative efforts among governments, financial institutions, and blockchain innovators will determine whether tokenization evolves into a mainstream financial infrastructure or remains a niche tool. As the sector matures, its integration with emerging technologies like AI and CBDCs could catalyze a new era of inclusive, efficient, and transparent global markets.