Key Takeaways

- Cryptocurrency prediction markets in cryptocurrency use blockchain to create trustless, transparent platforms for forecasting future events.

- Platforms like Augur, Gnosis, Polymarket, and Omen achieve up to 79% prediction accuracy with high transaction volumes.

- Smart contracts on Ethereum automate market operations, ensuring efficiency and eliminating intermediaries.

- Integration of AI and sentiment analysis enhances Prediction Markets’ accuracy in volatile cryptocurrency environments.

- These markets aggregate diverse global insights, outperforming traditional forecasting in price and event predictions.

Cryptocurrency prediction markets represent a revolutionary convergence of blockchain technology and traditional forecasting mechanisms, creating decentralized platforms where participants can stake digital assets on the outcomes of future events. These platforms, including Augur, Gnosis, Polymarket, and Omen, have transformed the landscape of information aggregation by eliminating centralized authorities and enabling global, pseudonymous participation in predictive modeling.

Recent developments show impressive results, with some platforms achieving 79% prediction accuracy while generating hundreds of thousands of monthly transactions, demonstrating the maturation of crypto-based forecasting systems. The integration of artificial intelligence and sentiment analysis has further enhanced these platforms’ capabilities, particularly in cryptocurrency price prediction where traditional volatility poses significant challenges. This Innovation and Tech articles dives into the topic of cryptocurrency prediction markets.

Fundamentals Of Decentralized Cryptocurrency Prediction Markets

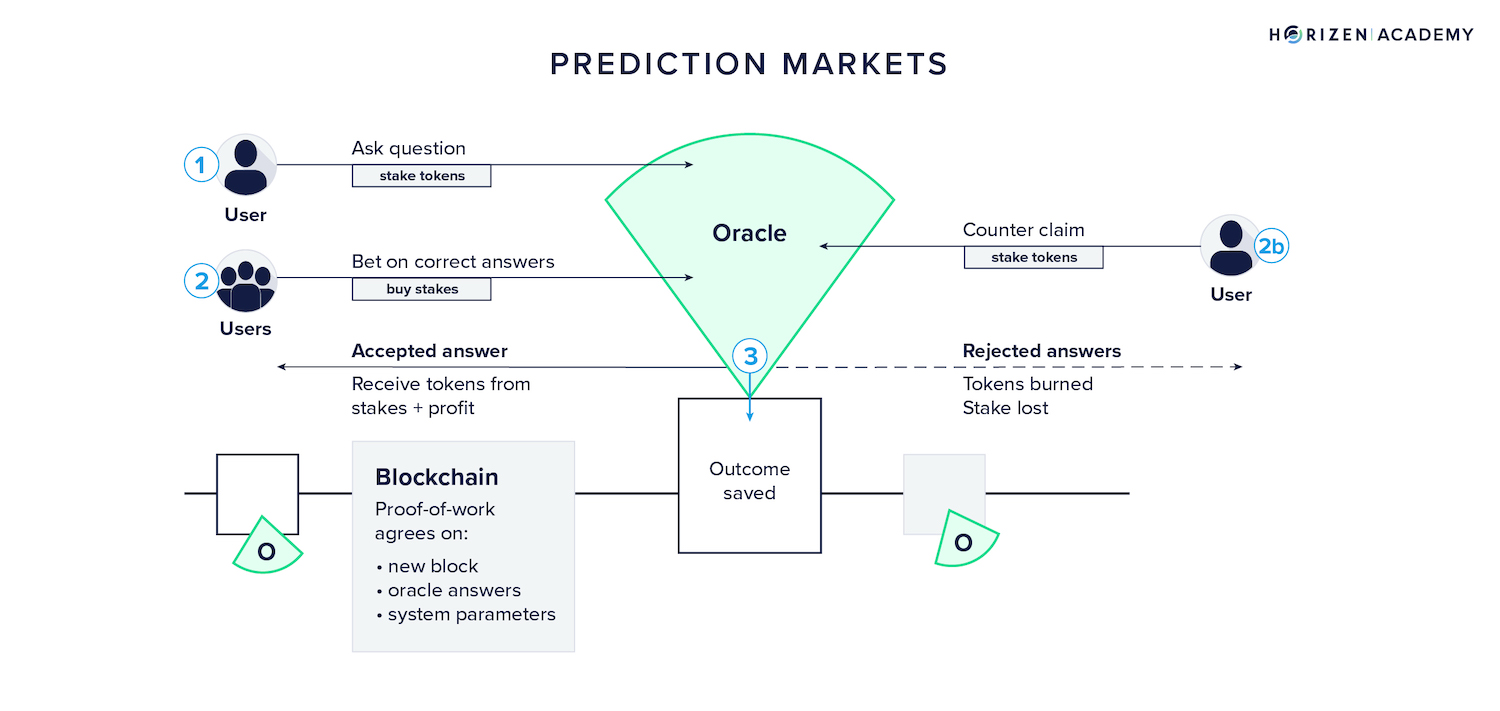

Prediction Markets function as information aggregation mechanisms where participants purchase shares representing different potential outcomes of future events, with market prices reflecting collective beliefs about probability distributions. In the cryptocurrency context, these prediction markets leverage blockchain technology to create trustless, transparent, and globally accessible platforms that operate without traditional intermediaries. The theoretical foundation rests on the principle that market participants are incentivized to reveal their true beliefs when financial stakes are involved, leading to more accurate crowd-sourced predictions than conventional polling or expert opinions.

The decentralized nature of cryptocurrency prediction markets addresses several limitations of traditional centralized platforms, including geographical restrictions, censorship concerns, and single points of failure. These platforms utilize smart contracts on blockchain networks, primarily Ethereum, to automate market operations, settlement processes, and dispute resolution mechanisms. The integration of cryptographic tokens as both collateral and rewards creates a native digital economy where prediction accuracy directly translates to financial incentives, fostering participation from globally distributed users who contribute diverse perspectives and information sources.

The economic theory underlying these cryptocurrency prediction markets suggests that prediction accuracy improves as more participants with varied information sources contribute to price discovery mechanisms. This principle has been validated in various applications, from epidemiological forecasting in Taiwan where prediction markets outperformed historical averages in disease outbreak predictions, to complex cryptocurrency price movements where decentralized consensus has shown superior performance compared to traditional forecasting models.

Major Cryptocurrency Prediction Markets & Technological Architectures

Augur stands as the pioneering decentralized cryptocurrency prediction markets, launching on Ethereum in 2018 after raising $5.5 million in one of the first initial coin offerings in 2015. The platform utilizes REP tokens to incentivize accurate reporting of market outcomes, with token holders receiving portions of trading fees generated across the network. Augur supports both categorical markets with up to seven discrete outcomes and scalar markets offering numerical spectrum betting, enabling complex predictive scenarios beyond simple binary choices.

Gnosis emerged as another significant player, developing an Ethereum-based protocol that emphasizes standardization and reliability in prediction markets infrastructure. The platform has recently integrated with Olas to deploy autonomous AI agents, creating what they term an “agent economy” that uses artificial intelligence to improve prediction accuracy and market efficiency. This integration has resulted in over 300 daily active agents generating more than 340,000 monthly transactions, representing a substantial portion of all transactions on Gnosis Chain.

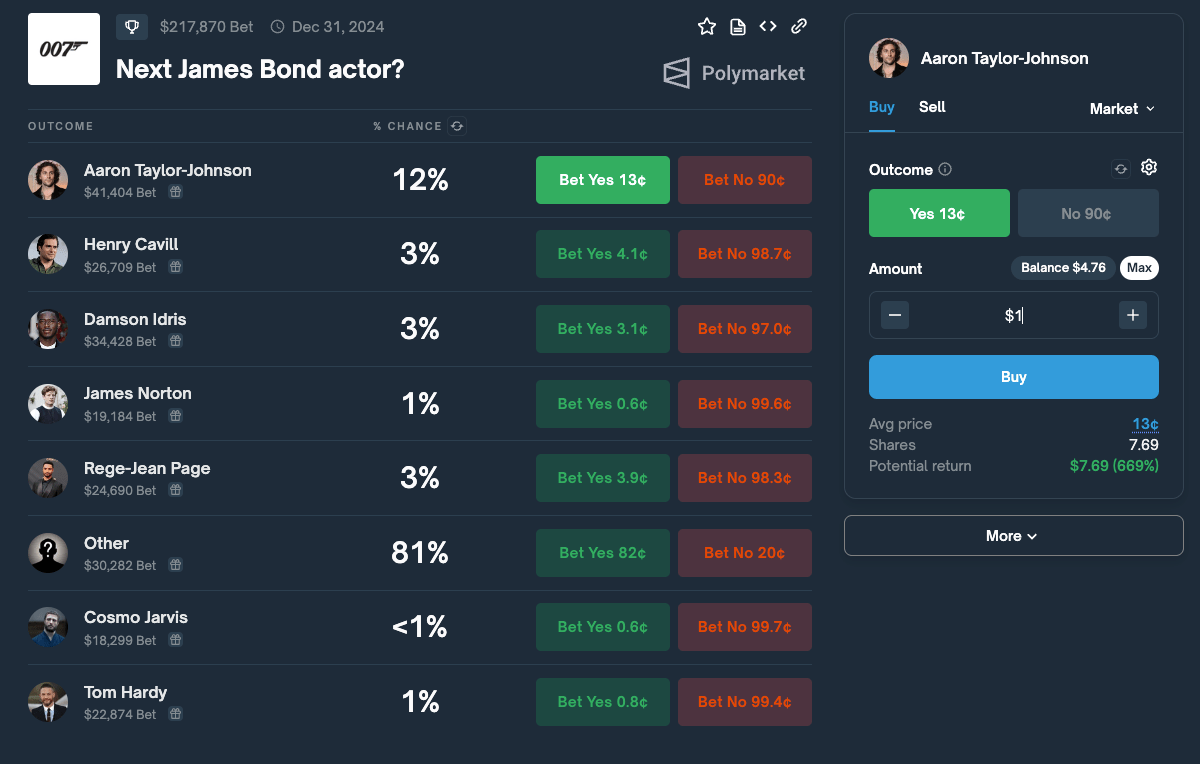

Polymarket has gained prominence as a non-custodial decentralized betting platform that focuses on real-world events including elections, sports, and current affairs. Built on Ethereum with Polygon technology for improved scalability, Polymarket differentiates itself by not taking profits from bets and maintaining complete transparency through blockchain automation. The platform presents binary yes-or-no questions about verifiable future events, creating cryptocurrency prediction markets that seek to predict cryptocurrency asset prices, socioeconomic metrics, and various global events.

Omen operates as an information marketplace where users develop and engage with Prediction Markets across diverse themes including cryptocurrency, sports, and politics. The platform’s architecture converts initial liquidity deposits into outcome tokens, with a sophisticated mechanism for converting collateral into conditional tokens that represent different market outcomes. Users receive pool tokens representing their stake in market creation, while subsequent participants can purchase specific outcome tokens based on their predictions.

Market Mechanics & Token Economics

The operational mechanics of cryptocurrency prediction markets center on sophisticated token economic models that align participant incentives with prediction accuracy. When users create markets, they typically deposit collateral that gets converted into conditional tokens representing different possible outcomes, with market makers providing initial liquidity through automated market maker algorithms. The pricing mechanisms reflect collective probability assessments, with token prices adjusting dynamically as new information enters the market through participant trading activities.

Settlement processes rely on decentralized oracle systems and community-driven reporting mechanisms to determine actual outcomes and distribute rewards to successful predictors. Augur’s approach involves REP token holders serving as reporters who stake their tokens on outcome validity, with incorrect reporting resulting in token redistribution to accurate reporters. This creates a cryptoeconomic security model where the cost of manipulating outcomes exceeds potential benefits, ensuring market integrity through game-theoretic incentives.

The fee structures in these cryptocurrency prediction markets typically involve small percentage charges on trading activities, with proceeds distributed to token holders, market creators, or platform development funds depending on the specific protocol design. These economic models create sustainable ecosystems where prediction accuracy generates direct financial rewards, encouraging continued participation and information contribution from diverse market participants across global time zones and information sources.

Applications In Cryptocurrency Forecasting

Cryptocurrency prediction markets have found particular relevance in forecasting digital asset prices, where traditional financial modeling faces significant challenges due to extreme volatility and limited historical data. Recent research demonstrates that machine learning approaches combined with market sentiment data can achieve substantial improvements in cryptocurrency price prediction accuracy, with some models incorporating social media sentiment, Google Trends data, and technical indicators to forecast returns.

The application of cryptocurrency prediction markets to cryptocurrency forecasting extends beyond simple price movements to include broader ecosystem events such as protocol upgrades, regulatory decisions, and adoption metrics. These prediction markets aggregate diverse information sources including technical analysis, fundamental blockchain metrics, macroeconomic indicators, and community sentiment to generate probability distributions for complex cryptocurrency-related outcomes. The decentralized nature of these platforms enables global participation from traders, developers, researchers, and enthusiasts who contribute specialized knowledge about different aspects of cryptocurrency markets.

Advanced forecasting techniques have emerged that leverage limit order book data, Hawkes models, and neural network architectures specifically designed for cryptocurrency market prediction. These approaches recognize the unique characteristics of crypto markets, including 24/7 trading, high volatility, and the influence of social media sentiment on price movements. The integration of prediction markets mechanisms with these sophisticated forecasting models creates hybrid systems that can potentially outperform traditional financial prediction methods while maintaining the transparency and accessibility benefits of decentralized platforms.

Prediction Markets Reshaping Crypto Forecasting

Cryptocurrency prediction markets represent a significant evolution in both forecasting methodology and decentralized finance applications, combining blockchain technology’s transparency and accessibility with sophisticated market mechanisms for information aggregation. The success of platforms like Augur, Gnosis, Polymarket, and Omen demonstrates the viability of decentralized cryptocurrency prediction markets, particularly when enhanced with artificial intelligence and advanced analytical techniques that can achieve prediction accuracies approaching 80% while generating substantial transaction volumes and user engagement.

The future of cryptocurrency prediction markets appears increasingly promising as technological innovations address current limitations around liquidity, user participation, and prediction accuracy in volatile cryptocurrency environments. The integration of autonomous AI agents, sophisticated sentiment analysis, and hybrid forecasting models creates new possibilities for more accurate and efficient prediction markets that could transform how both cryptocurrency markets and broader prediction mechanisms operate in an increasingly digital and decentralized economic landscape.