Whale Trading Dynamics and Market Impact

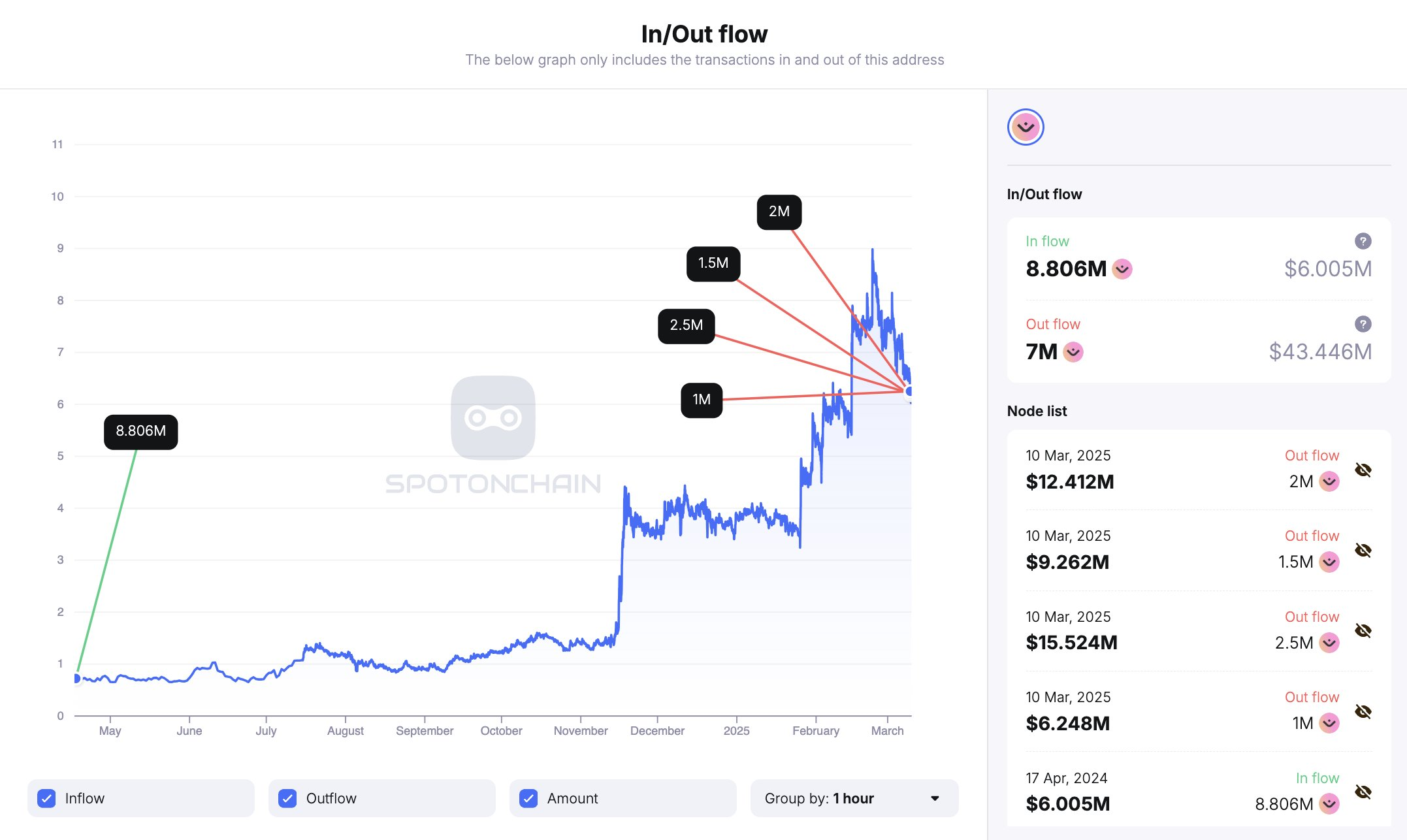

Recently, the OM token (the native token of the MANTRA ecosystem) experienced significant market turbulence due to a series of whale trades. On March 10, a whale who had held OM tokens for 281 days unlocked 8.67 million OM and transferred them to the Binance exchange, cashing out approximately USD 43.45 million, while the remaining 1.67 million OM yielded a floating profit of USD 10.20 million, resulting in a total profit of 793%. This operation attracted considerable attention, causing the OM price to drop by 14% within 24 hours after the news broke, before rebounding to around USD 6.10. The frequent abnormal activities of whale accounts indicate that the OM token is facing dual risks of liquidity concentration and short-term price manipulation.

OM’s top 10 addresses hold 67% of the circulating supply, significantly higher than the industry average of 45%. This high concentration means that trading actions by a few large holders can have a substantial impact on the market. For example, on March 10, a large sell-off led to a 34% shrinkage in the OM/USDT liquidity pool, with the bid-ask spread widening to 2.3%, thereby considerably increasing trading costs for retail investors.

Whale Trading Patterns and Market Signals

On-chain data reveals that OM whales have recently exhibited a “buy low, sell high” pattern. Such operations typically coincide with rising market volatility — OM token’s 30-day volatility increased from 45% to 62%, which is higher than Bitcoin’s 35% and Ethereum’s 40% during the same period.

Notably, the on-chain liquidity distribution of OM is extremely uneven. Approximately 80% of liquidity is concentrated on a few exchanges (such as Binance, OKX, and JuCoin), while smaller platforms suffer from insufficient trading depth, further exacerbating price swings.

Liquidity Risks and Investor Strategies

The current liquidity risk of the OM token primarily manifests in three aspects:

- Whale Control: The top 10 addresses hold nearly 70% of the circulating supply, which means that coordinated actions by a few large holders can significantly affect prices.

- Exchange Dependence: With liquidity highly concentrated on centralized exchanges, the trading volume on decentralized platforms (such as Uniswap) accounts for less than 5%.

- Staking Imbalances: About 30% of OM tokens in the ecosystem are staked, yet the annual staking yield is only 3.2%, which is far below the industry average of 8%, creating pressure for capital outflow.

To mitigate risks, regular investors can adopt the following strategies:

- Monitor On-Chain Data: Use blockchain analytics tools to track large transfers and changes in exchange balances to identify potential sell-off signals.

- Diversify Trading Platforms: Avoid relying on a single exchange; take advantage of low-slippage platforms like JuCoin for gradual accumulation.

- Set Stop-Loss Thresholds: Dynamically adjust stop-loss levels based on volatility metrics—for instance, if the 30-day volatility exceeds 60%, raise the stop-loss threshold to 15% above the cost basis.

Future Outlook and Key Indicators

In the short term, OM tokens may continue to experience high volatility. If whales persist in selling, the price might test the USD 3.5 support level (comparable to the December 2024 low). Conversely, if the ecosystem’s staking rate increases to over 40%, prices could rebound to the USD 8 resistance zone. Investors should pay close attention to net inflows on exchanges—persistent net inflows indicate ongoing selling pressure—and to the balances in staking contracts, as growing balances signal renewed confidence among long-term holders.

Amid overall market stress in the crypto space, OM token’s trend will depend on whether the project can attract retail participation through ecosystem incentives (such as increased staking rewards) and break the whale control deadlock. Rational analysis of on-chain data and market sentiment will be key to avoiding risks and seizing opportunities.