Market Data and Shifting Competitive Landscape

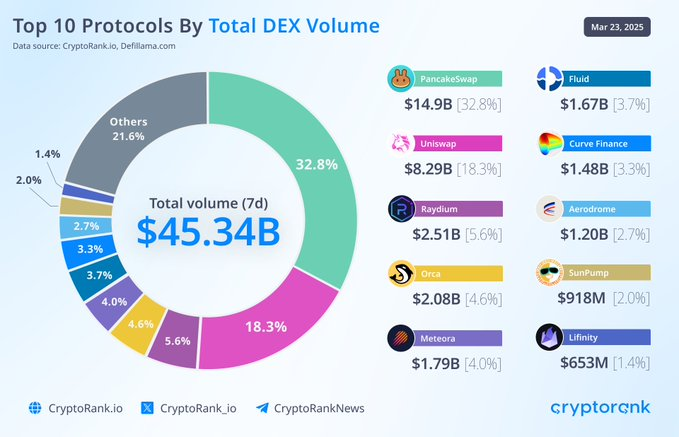

In March 2025, the decentralized exchange (DEX) market underwent a restructuring—PancakeSwap, based on BNB Chain, achieved a weekly trading volume of $14.168 billion and a market share of 29.18%, surpassing Uniswap of the Ethereum ecosystem to become the world’s top DEX by trading volume. Data show that although Uniswap still maintains a daily TVL of $3.93 billion, its weekly trading volume has dropped to $8.611 billion (a decline of 50.56%), highlighting a significant disconnect between high TVL and low trading volume.

The core driver behind this shift is the comprehensive recovery of the BNB Chain ecosystem. With a transaction cost of only $0.001 per transaction (just 1/3000 of that on Ethereum mainnet), BNB Chain has attracted a large number of high-frequency traders and meme coin projects. As PancakeSwap is the leading DEX on BNB Chain, capturing over 90% of its trading volume, it has become a direct beneficiary of the meme coin surge.

Ecosystem Drivers: Synergy between Low Gas Fees and Meme Coin Traffic

The low gas fee advantage of BNB Chain is magnified in meme coin trading scenarios. In early 2025, meme coins on BNB Chain (such as Four.meme and Catcoin) saw explosive growth, with daily trading volumes peaking above $6 billion. These tokens typically rely on high-frequency trading and community hype, and PancakeSwap’s V3 version, through its concentrated liquidity pool design, has boosted capital efficiency by over 30%, perfectly catering to the high volatility demands of meme coins.

Meanwhile, the ecosystem synergy provided by Binance—via activities such as Launchpool and new coin mining—further strengthens PancakeSwap’s market position. For example, users staking BNB to participate in the Four.meme project’s liquidity mining can directly profit through PancakeSwap trading. This “exchange + DEX” dual-driven model creates a unique moat of user traffic on BNB Chain.

Technical Architecture Upgrades and Innovative Operational Strategies

PancakeSwap’s technical iteration underpins its market breakthrough. It now supports multi-chain deployment, having expanded to nine chains including Base and Arbitrum, enabling seamless cross-chain asset transfers (for example, via JuCoin asset migration). Its V3 liquidity optimization introduces a “position manager” function that automatically adjusts liquidity ranges to help LPs reduce impermanent loss and enhance yields. Additionally, PancakeSwap has launched a “new coin launch portal” for meme coin issuance, lowering the barrier for project listing; in Q1 2025, over 500 tokens were launched via this tool, contributing approximately 40% of trading volume.

Moreover, PancakeSwap’s operational strategy focuses on community incentives. For instance, CAKE token holders can participate in governance voting to determine the development priorities for new features; meme coin project teams are required to inject a portion of their tokens into PancakeSwap’s liquidity pool in exchange for traffic support.

Potential Risks: Meme Bubble and Regulatory Pressure

Despite strong short-term performance, PancakeSwap’s leadership faces several challenges:

-

Meme Coin Market Volatility: In March 2025, the total market cap of meme coins plummeted from $137 billion to $55 billion. If market sentiment remains weak, PancakeSwap’s trading volume may shrink significantly. CAKE token prices have dropped 60% from their 2024 peak, reflecting the risk of divergence between market cap and trading volume growth.

-

Increased Regulatory Scrutiny: The U.S. SEC is investigating whether cross-chain asset flows on BNB Chain involve unregistered securities issuance, which, if confirmed, could restrict PancakeSwap’s access to US and European users.

-

Network Performance Bottlenecks: During peak trading, BNB Chain has experienced block delays; relying on Layer 2 solutions (such as opBNB) for scaling is essential, yet its ecosystem integration lags behind competitors.

Industry Implications and Future Competitive Focus

PancakeSwap’s rise reveals a shift in the competitive logic of the DEX market:

-

Performance and Cost Priority: Users prefer on‑chain trading with low gas fees and high speed over merely relying on TVL scale.

-

Vertical Ecosystem Synergy: The deep integration of exchanges and DEXs (as seen with Binance and PancakeSwap) will be key in the battle for user traffic.

-

Derivatives Market Expansion: PancakeSwap plans to launch perpetual contracts to compete directly with derivatives DEXs such as dYdX and Hyperliquid, aiming to capture 10% of that market share.

Meanwhile, Uniswap is attempting to counter with its V4 “hook contracts” and dynamic fee model, though its success will depend on the adoption speed of Ethereum Layer 2 solutions. In the future, DEX market competition will revolve around compliance (e.g., integrating on‑chain KYC tools), user experience (e.g., one‑click cross‑chain trading), and asset diversity (e.g., RWA tokenization), and PancakeSwap’s ability to maintain its lead will depend on its ecosystem resilience and adaptability to market cycles.