The following content is published by JuCoin Labs Research Institute:

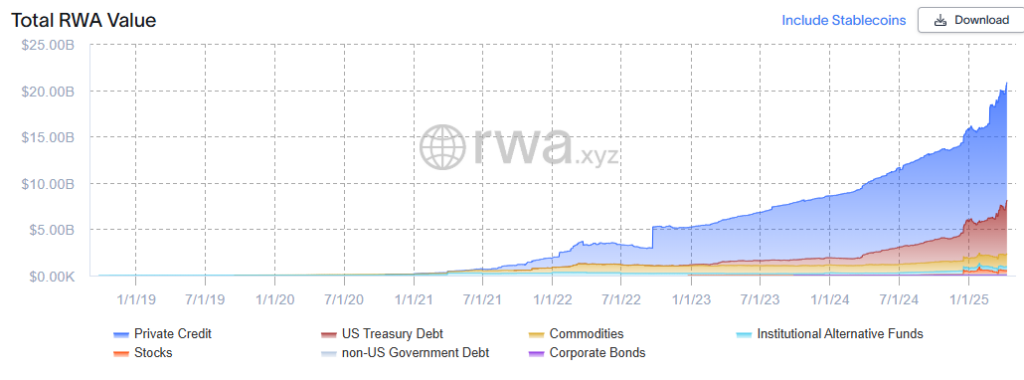

Amid a generally sluggish market under the backdrop of U.S. tariff policies, RWA remains one of the few sectors showing continued growth. According to rwa.xyz, as of the time of writing, the total RWA market size (excluding stablecoins) stands at $20.83 billion, with a 30-day market cap increase of 12.15%. Moreover, with traditional asset management firms like BlackRock and Fidelity beginning to enter the RWA space, RWA is undoubtedly the next growth frontier.

Plume Network, a representative project in the RWA sector, secured funding from YZi Labs in March and later received investment from top Wall Street asset management firm Apollo Global Management (which manages over $700 billion in assets) on April 8. Plume Network has recently garnered widespread market attention through Binance’s community listing vote. It aims to build a dynamic and composable RWAFI ecosystem. By integrating RWA with DeFi, Plume Network seeks to enhance the liquidity of real-world assets and generate additional yield through lending, staking, and other operations—bringing DeFi’s power to real assets.

As a major project to watch in the RWAFI space, Plume Network holds promise in addressing the low trading volume and limited attention traditional RWA projects typically face. The following is a deep dive into Plume Network, covering its project overview, core functionalities, team and funding background, ecosystem status, and more.

I. Project Overview

Plume Network is a modular Layer 1 blockchain specifically designed for RWA. It aims to tokenize real-world assets from traditional finance—such as real estate, consumer credit, corporate debt, carbon credits, GPU resources, and even luxury goods—and seamlessly integrate them into the blockchain ecosystem.

It is the first chain-level ecosystem focused solely on RWAFI. Its key innovation lies in deeply embedding asset tokenization processes and compliance mechanisms into the chain architecture. This significantly lowers the entry barriers for traditional asset issuers and institutional investors, enabling them to benefit from blockchain’s transparency and composability without needing technical know-how or additional infrastructure.

II. Core Architecture

To solve RWA liquidity issues, Plume Network utilizes yield-generating assets to attract real users. It predetermines asset issuance formats (e.g., bundled assets or NFTs) at the time of onboarding to improve liquidity and returns while reducing risk. The core architecture includes the following four components:

-

Plume ARC

A one-stop asset issuance platform for issuers. ARC allows users to tokenize RWA on-chain within minutes, featuring modular smart contracts, tokenization tools, KYC/KYB compliance, on-chain registration, and asset bridging. It also supports conversion between fiat and tokenized assets. -

Plume Passport

Designed to boost RWA asset liquidity, Passport leverages smart wallet architecture and a full-stack compliance infrastructure to integrate RWA into the DeFi ecosystem. Key features include a smart wallet abstraction layer, embedded compliance engine, and yield distribution infrastructure that links on-chain and off-chain assets. -

Plume Nexus

Nexus addresses challenges around RWA data authenticity, timeliness, and compliance. Features include Skylink for cross-chain interoperability, real-time NAV calculations, risk alerts, and compliance data embedding. It aggregates off-chain data from SEDA, Stork, OpenLayer, etc., including real estate valuation, carbon credit pricing, and bond yields.

III. Key Features

- Plume USD: A USD-pegged stablecoin backed indirectly by USDC and USDT. Users can mint Plume USD by depositing USDC or USDT and redeem it later for the original assets.

- Nest: A staking protocol for RWA holders to earn institutional-level yields by staking their tokenized assets.

IV. Team & Funding Background

According to RootData, Plume Network has completed four funding rounds:

- May 23, 2024 – $10M seed round led by Haun Ventures, Superscrypt, Galaxy, SV Angel, A.Capital

- Dec 18, 2024 – $20M Series A round with Haun Ventures, Superscrypt, Galaxy, Faction

- Mar 17, 2025 – YZi Labs investment (undisclosed amount)

- Apr 8, 2025 – Apollo Global Management investment (undisclosed amount)

V. Tokenomics

-

Token Supply & Allocation

$PLUME has a total supply of 1 billion tokens, distributed as follows:

• 40% – Governance and community incentives

• 20% – Ecosystem and partners

• 15% – Team and advisors

• 10% – Early investors

• 15% – Foundation and reserves

Initial circulation is 20% at TGE, with the rest gradually released via staking and ecosystem incentives. -

Token Utility

• Governance: Token holders can participate in major platform decisions

• Staking & Rewards: Users can stake $PLUME to earn rewards and transaction fees

• Payments: Used for trading, services, and governance vote fees -

Inflation & Value Capture

• Vesting: Gradual unlock over 5 years; increasing demand expected with ecosystem growth

• Value Capture: Platform fees, staking rewards, and LP incentives will drive long-term token value

VI. Ecosystem Status

-

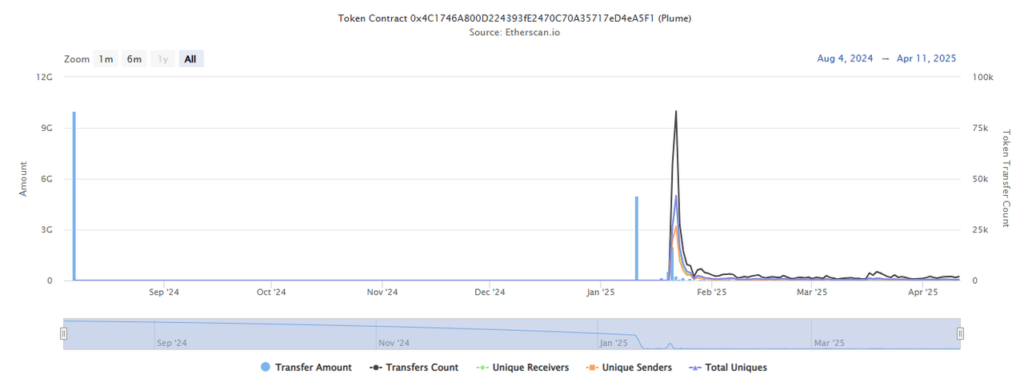

On-chain Data

During testnet, over 18 million wallets registered, with 265 million transactions.

On mainnet:

• 35,491 token holders

• 339,093 total transactions

• Top 3 addresses hold over 89% of total supply

Post-mainnet activity dropped, with limited address growth. -

Ecosystem Projects (180+ total)

Key segments include RWAFI, DeFi, infrastructure, and social platforms:

RWAFI

- ASX – Tokenizes traditional assets like real estate and art for investment

- Adapt3r – Decentralized RWA platform offering global compliant asset management solutions

DeFi

- Ambient Finance – Low-cost, low-slippage DEX with efficient liquidity algorithms

- Angle – Stablecoin protocol tied to RWA with decentralized governance

Infrastructure

- Brickken – Asset tokenization platform for real estate and art

- Centrifuge – DeFi protocol bridging RWA to liquidity pools

Social Platforms

- Barrel – Decentralized trading for rare spirits with strong compliance mechanisms

- Cornermarket – Crypto-powered marketplace for real-world goods

VII. Valuation Analysis

Main competitor: Ondo Finance

- Ondo FDV: $8.76B; MC: $2.76B

- Plume FDV: $1.54B; MC: $300M

Considering Plume’s token dilution, smaller exchange presence, and ecosystem/community growth potential, its valuation has considerable upside.

Target FDV = ~$4.5B → $PLUME price could reach ~$0.45.

VIII. Conclusion

Plume Network offers strong prospects in the RWA sector. As one of the few infrastructures capable of integrating real-world assets with blockchain, its full-stack architecture gives it a competitive edge. Through RWAFI, Plume accelerates asset digitization and DeFi integration.

Long-term, Plume aims to attract institutional clients by providing a complete RWA tokenization service suite. RWAFI bridges traditional finance and DeFi, supported by top VCs and ecosystem momentum.

Overall, Plume Network shows high potential for strong secondary market performance.