Key Takeaways

- Regenerative Finance (ReFi) redefines blockchain’s role by prioritizing ecological restoration over mere sustainability, fostering a positive environmental focus.

- ReFi leverages blockchain technologies like smart contracts and tokenization to create transparent, decentralized financial systems for environmental solutions.

- Projects like KlimaDAO and Regen Network demonstrate ReFi’s potential to fund carbon reduction and regenerative agriculture with an environmental focus.

- Tokenized ecological assets, such as carbon and biodiversity credits, make green investments accessible, supporting ReFi’s mission of environmental regeneration.

- Despite challenges like regulatory uncertainty, Regenerative Finance (ReFi) is a top cryptocurrency trend for 2025, bridging finance and environmental sustainability.

Regenerative Finance (ReFi) represents a transformative shift in the cryptocurrency landscape, emerging as one of the most significant trends for 2025 according to recent analyses. This movement aims to fundamentally realign blockchain technology and financial systems with ecological restoration and sustainability goals. As environmental concerns continue to dominate global discourse, Regenerative Finance (ReFi) offers a compelling framework for using decentralized technologies to address climate change, biodiversity loss, and other pressing environmental challenges with a strong environmental focus.

Understanding The Regenerative Finance Movement

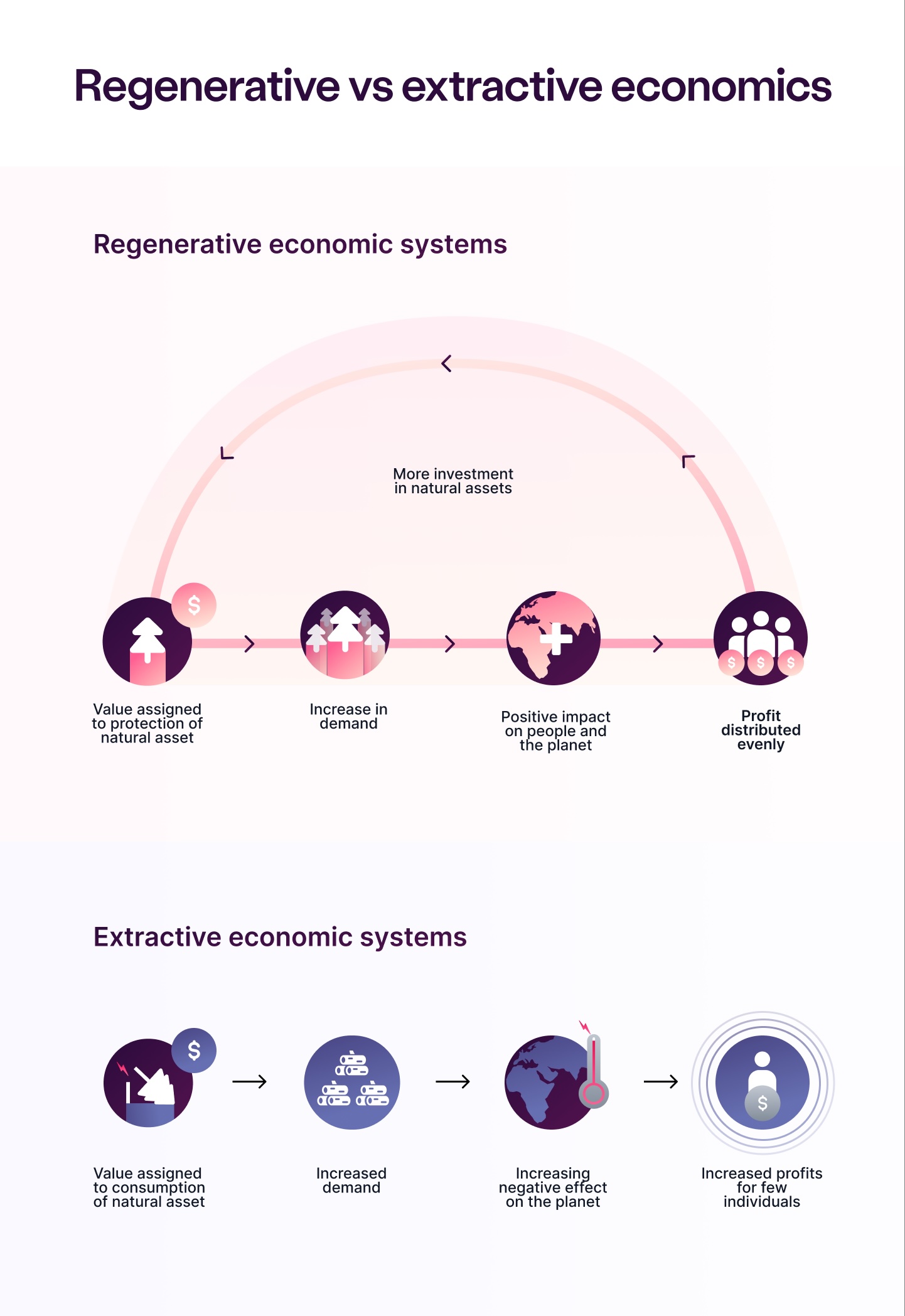

Regenerative Finance (ReFi) extends beyond traditional sustainability approaches by actively seeking to repair and enhance ecological systems rather than merely reducing harm. Unlike conventional finance, which often prioritizes short-term profits at the expense of long-term environmental health, ReFi integrates social, environmental, and economic well-being into its core principles. It is designed not just to sustain but to regenerate ecosystems and communities, ensuring that financial activities contribute positively rather than depleting resources.

The ReFi movement draws its philosophical underpinnings from regenerative economics, which advocates for an economy that continuously renews and enhances its foundational structures. By leveraging Web3 technologies like blockchain, decentralized finance (DeFi), and smart contracts, Regenerative Finance (ReFi) introduces transparent, equitable, and decentralized financial models that support climate action and sustainable development with an environmental focus.

At its core, ReFi operates under the belief that finance should actively restore and improve the world, not just do less harm. This paradigm shift enables ReFi projects to tackle urgent environmental challenges through circular economy principles, regenerative investments, and ethical financial systems.

The Environmental Mission Of ReFi In The Blockchain Space

The environmental focus of ReFi addresses one of the most significant criticisms of the cryptocurrency industry: its environmental impact. While cryptocurrencies have revolutionized finance, their environmental footprint has drawn widespread criticism, particularly in the case of energy-intensive blockchain networks.

Regenerative Finance (ReFi) aims to transform the governance of global common pool resources (CPRs), such as the atmosphere, which continue to degrade despite international efforts. The movement accomplishes this through digital monitoring, reporting, and verification (D-MRV), tokenization of environmental assets, and decentralized governance approaches.

In practice, ReFi funds ecological restoration projects through blockchain technology. It goes beyond sustainability to actively repair environmental damage, leveraging financial incentives that align economic activities with ecological regeneration. This approach represents a fundamental departure from traditional finance, addressing the negative impacts of over-financialization and commoditization on the natural world with a clear environmental focus.

Blockchain Technology As An Environmental Solution

Blockchain technology serves as the technological backbone of Regenerative Finance (ReFi), enabling financial models that are transparent, decentralized, and impact-driven. While blockchain itself has faced criticism for energy consumption, ReFi leverages its positive aspects to create environmental solutions. The immutable ledgers of blockchain track financial flows, ecological assets, and impact metrics, eliminating greenwashing and ensuring authenticity. This transparency is crucial for building trust in environmental markets, where verification has traditionally been challenging. Digital Measurement, Reporting, and Verification (dMRV) systems built on blockchain help prevent double counting in ecological credits and ensure that funds are allocated based on real impact.

Smart contracts automate financial agreements for environmental projects, reducing the need for intermediaries and lowering costs. For instance, smart contracts can automate the distribution of funds to environmental projects or manage decentralized green bonds, ensuring that all processes are carried out as intended. This automation increases efficiency and ensures that environmental commitments are upheld, reinforcing ReFi’s environmental focus.

Tokenized Ecological Assets: Making Environmental Markets Accessible

One of Regenerative Finance (ReFi)’s most significant contributions to environmental finance is the tokenization of ecological assets. Carbon credits, biodiversity credits, and renewable energy certificates are being tokenized and traded on blockchain networks, creating more accessible and liquid markets for environmental assets.

Moss.Earth exemplifies this approach by selling tokenized carbon credits that verify and track carbon credit transactions, ensuring transparency and reducing fraud risk. By purchasing these tokens, companies and individuals can offset their carbon emissions, supporting conservation projects in the Amazon rainforest with a strong environmental focus.

Similarly, Toucan has launched the world’s first liquid market for biochar carbon credits, responding to escalating interest from carbon credit buyers and developers. Biochar, created through the pyrolysis of organic matter, can store carbon for extended periods while offering multiple co-benefits beyond carbon removal.

The tokenization of ecological assets democratizes access to green investments, allowing a broader range of investors to participate in sustainable finance. This inclusivity is crucial for scaling up environmental solutions and accelerating the transition to a sustainable economy through Regenerative Finance (ReFi).

Notable ReFi Projects Driving Environmental Change

Several pioneering projects exemplify how Regenerative Finance (ReFi) is transforming environmental finance through innovative blockchain applications. These initiatives demonstrate the practical implementation of ReFi principles in addressing specific environmental challenges with an environmental focus.

KlimaDAO stands out as a decentralized autonomous organization aiming to combat climate change by leveraging blockchain technology to create a carbon-backed cryptocurrency. The native KLIMA token is a floating algorithmic reserve currency backed by carbon offsets, ensuring that each token is supported by at least one carbon tonne. The protocol incentivizes the development of high-impact carbon reduction projects by tokenizing carbon credits and promoting transparency in the voluntary carbon market.

Regen Network has released its marketplace application for tokenized carbon and ecological assets, which brings transparency and public governance to voluntary carbon markets. The platform allows farmers, foresters, and land stewards to bring high-quality, nature-based carbon credits to markets, catalyzing Regenerative Finance (ReFi) solutions to the climate crisis.

These projects, among others, showcase how ReFi is creating tangible environmental impact through blockchain-based solutions. By providing innovative funding mechanisms for conservation, carbon reduction, and sustainable agriculture, ReFi is helping to address some of the most pressing environmental challenges of our time.

How ReFi Appeals To Environmentally Conscious Investors

As awareness of environmental and social issues grows, so does the demand for sustainable finance. Regenerative Finance (ReFi) meets this need by providing innovative mechanisms for environmentally conscious investors to align their financial goals with their values, emphasizing an environmental focus.

ReFi creates investment opportunities that generate both financial returns and positive environmental impact. Unlike traditional green investments, which often lack transparency and verification, ReFi’s blockchain-based approaches provide unprecedented levels of traceability and accountability.

For institutional investors seeking to meet environmental, social, and governance (ESG) criteria, Regenerative Finance (ReFi) offers verifiable impact metrics and transparent reporting. Individual investors can participate in environmental markets that were previously accessible only to large institutions or specialized entities.

As Forbes noted in a recent article discussing cryptocurrency trends for 2025, Regenerative Finance (ReFi) is positioned to transform public perception of the crypto industry by aligning it with global environmental goals. This alignment addresses growing concerns about the environmental impact of blockchain technology and appeals to environmentally conscious investors seeking sustainable alternatives with a strong environmental focus.

Challenges & Future Outlook For ReFi

Despite its promising potential, Regenerative Finance (ReFi) faces several significant challenges that must be addressed to achieve mainstream adoption. Public perception remains a hurdle, as ReFi needs to differentiate itself from speculative cryptocurrency projects and establish credibility as a legitimate environmental solution with a clear environmental focus.

Usability presents another barrier, with many ReFi platforms being complex and challenging for non-technical users to navigate. Simplifying these interfaces and improving user experience will be crucial for broader adoption. Additionally, there’s a risk of over-financialization, which could transform ReFi into another speculative market rather than a genuine tool for environmental regeneration.

Regulatory uncertainty creates challenges for ReFi projects operating in areas like carbon credits, microfinance, and decentralized governance. Clear legal frameworks will be essential for Regenerative Finance (ReFi) to scale securely and effectively.

Despite these challenges, the future outlook for ReFi appears promising. According to Forbes, Regenerative Finance (ReFi) is one of the top cryptocurrency trends to watch in 2025, alongside central bank digital currencies and decentralized artificial intelligence. As blockchain technology evolves and environmental concerns become increasingly pressing, ReFi is well-positioned to bridge the gap between financial innovation and ecological restoration with a strong environmental focus.

Bridging Finance & Ecology: ReFi’s Environmental Focus In Action

Regenerative Finance (ReFi) represents more than just another financial innovation—it embodies a fundamental shift in how we conceptualize the relationship between finance and the environment. By leveraging blockchain technology to create transparent, accessible, and impactful environmental markets, ReFi is helping to reconcile economic prosperity with ecological regeneration.

For environmentally conscious investors, Regenerative Finance (ReFi) offers unprecedented opportunities to align financial activities with environmental values. The ability to verify impact, track outcomes, and participate in previously inaccessible markets makes ReFi particularly attractive to those seeking both returns and positive environmental change.

As we navigate the complex challenges of climate change, biodiversity loss, and resource depletion, Regenerative Finance (ReFi) provides a promising framework for channeling financial resources toward solutions rather than problems. While challenges remain, the growing interest in ReFi from both the cryptocurrency community and environmental advocates suggests that this movement has the potential to significantly reshape our approach to finance and sustainability in the coming years with a steadfast environmental focus.