Technical Evolution of Ronin Network and the Background of Its Collaboration with OpenSea

Ronin Network was initially launched in 2021 by Sky Mavis, the developer behind the blockchain game Axie Infinity, to address Ethereum network congestion and high gas fees while providing high-performance infrastructure for game assets. As an EVM-compatible Layer-1 blockchain optimized for NFTs and gaming, Ronin migrated to a Delegated Proof-of-Stake (DPoS) consensus mechanism in 2024, expanding its validator nodes from 9 to 24 and introducing independent enterprises such as Google Cloud and Nansen as validators. This significantly enhanced both decentralization and security.

The collaboration with OpenSea marks Ronin’s transformation from a “game-exclusive chain” to an open ecosystem. Previously, Ronin had processed over USD 4.3 billion in NFT trading volume, though its native marketplace, Mavis Market, mainly served game assets like those from Axie Infinity. By integrating with OpenSea, Ronin can reach a broader audience of NFT users, particularly creators in the art and collectibles sectors, and leverage OpenSea’s liquidity to boost asset circulation efficiency.

Technical Integration: Cross-Chain Liquidity and User Experience Optimization

The integration between Ronin and OpenSea is achieved via an EVM-compatible layer that enables seamless cross-chain interactions. Users can trade NFTs on Ronin directly on OpenSea without needing to use a cross-chain bridge, thereby eliminating the traditional gas costs of about USD 15–30 per cross-chain operation. This design significantly lowers the transaction barrier, especially attracting users in emerging markets.

Key technical highlights include:

-

Zero Gas Fee Transactions: Ronin’s low gas fee feature (approximately 1/100 of Ethereum mainnet) combined with OpenSea’s batch trading functionality makes small-value NFT trades economically viable;

-

Real-Time Data Synchronization: Ronin’s Archive Nodes ensure that OpenSea can quickly index on-chain data, reducing transaction latency;

-

Enhanced Security: The penalty rules under the DPoS mechanism (such as imprisoning malicious validators and slashing their staked tokens) safeguard the security of cross-chain transactions.

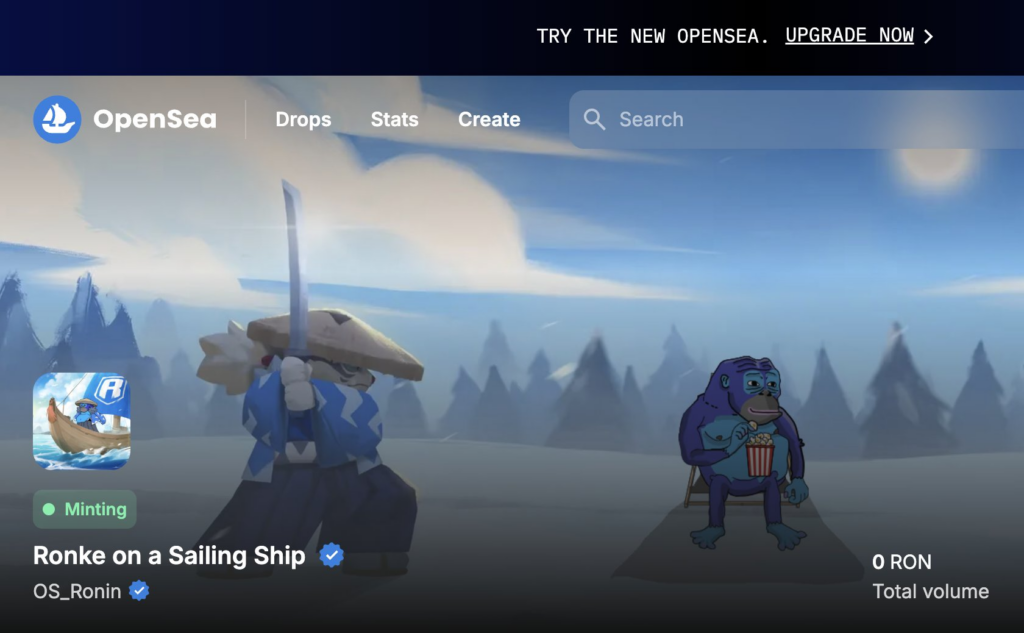

User Incentives: Free NFT Minting and Ecosystem Expansion

To celebrate the collaboration, Ronin has launched two limited NFT series—Jin (1 million pieces) and Ronke (500,000 pieces)—which users can mint for free. Holders of Jin NFTs will be eligible for future beta testing lotteries within the gaming ecosystem, while Ronke NFTs may serve as governance tokens. This strategy attracted over 800,000 new user registrations within 24 hours, with on-chain active addresses increasing by 320%.

The economic rationale behind the free minting is to drive user growth: by enabling zero-cost participation, it lowers entry barriers and attracts NFT creators beyond the gaming space; ecosystem binding is achieved by planning to introduce NFT staking protocols that allow users to earn gaming token rewards from holding Jin NFTs; and liquidity is guided by secondary market speculation (with some Jin NFTs reaching prices of USD 50), thereby drawing external capital into the Ronin chain.

Market Impact and Industry Implications

OpenSea’s Sidechain Strategic Breakthrough: This is OpenSea’s first time supporting a sidechain outside the Ethereum mainnet, which may trigger similar moves by other gaming chains (such as ImmutableX). OpenSea is also exploring tiered fee models, with sidechain transaction fees potentially dropping below 1% to capture market share.

The Crossover Effect on the Gaming Ecosystem: Ronin’s user base is evolving from predominantly gamers to a more diversified group. Data indicates that 65% of newly minted NFTs are art-related, while only 35% are directly linked to gaming IPs. This expansion is expected to inject external liquidity into gaming assets, with Axie character NFTs, for example, potentially appreciating in value due to increased cross-chain exposure.

Risks and Regulatory Challenges

-

Asset Bubble: If the secondary market prices of Jin NFTs diverge from their intrinsic utility, and future benefits are not realized, it may trigger sell-offs;

-

Securities Scrutiny: The U.S. SEC is evaluating the securities attributes of NFTs, and the “future benefits” design in free NFT minting may prompt regulatory intervention.

Future Outlook: From a Gaming Chain to an Open Ecosystem

Ronin plans to launch an upgrade in Q2 2025, featuring: NFT Staking Protocol: Allowing users to earn gaming tokens by staking NFTs, integrated with RWA (Real World Assets) modules to support on-chain representation of physical goods; zkEVM Integration: A zero-knowledge proof virtual machine built on Polygon CDK that will enable gaming projects to independently launch L2 chains on Ronin, further expanding the ecosystem.

In the long term, Ronin may become the first public chain driven by both gaming and open market dynamics. Its on-chain KYC tools, developed in collaboration with Binance, will also enhance compliance and meet the requirements of the EU’s MiCA regulation. For investors, this collaboration not only implies improved NFT liquidity but also heralds deeper integration of gaming assets with the traditional crypto market.

For more insights, please follow the JuCoin Research Institute!