Key Takeaways

- Self-custody empowers cryptocurrency users with full control over their private keys, aligning with the decentralized ethos of blockchain technology.

- Adoption of self-custody solutions, like Bitget Wallet’s 80 million users by mid-2025, highlights growing distrust in centralized exchanges and a shift toward autonomy.

- Self-custody enhances security by distributing assets across individual wallets, protecting against hacks, insolvency, and regulatory risks.

- Self-custodial wallets enable seamless interaction with the Web3 ecosystem, including DeFi and dApps, fostering a new era of digital ownership.

- Future innovations, such as MPC and intuitive interfaces, are making self-custody more accessible, promising mainstream adoption without compromising security.

In the rapidly evolving world of cryptocurrency, a profound shift is underway as investors increasingly turn to self-custody solutions to secure their digital wealth. This movement transcends mere technical preference; it embodies a return to the foundational principles of decentralization that ignited the cryptocurrency revolution.

Self-custody, the practice of retaining complete control over one’s private keys and digital assets, has become a cornerstone for security-conscious investors. As the market matures, users are confronting the vulnerabilities of centralized platforms, prompting a widespread transition from custodial services to self-custody solutions. This evolution is redefining how individuals engage with their digital assets, fostering a new paradigm of financial independence and resilience in an increasingly digital economy.

This Innovation and Tech article explores how self-custody is redefining digital asset ownership by empowering users with direct control, enhanced security, and seamless access to the Web3 ecosystem.

Understanding Self-Custody: Principles & Fundamentals

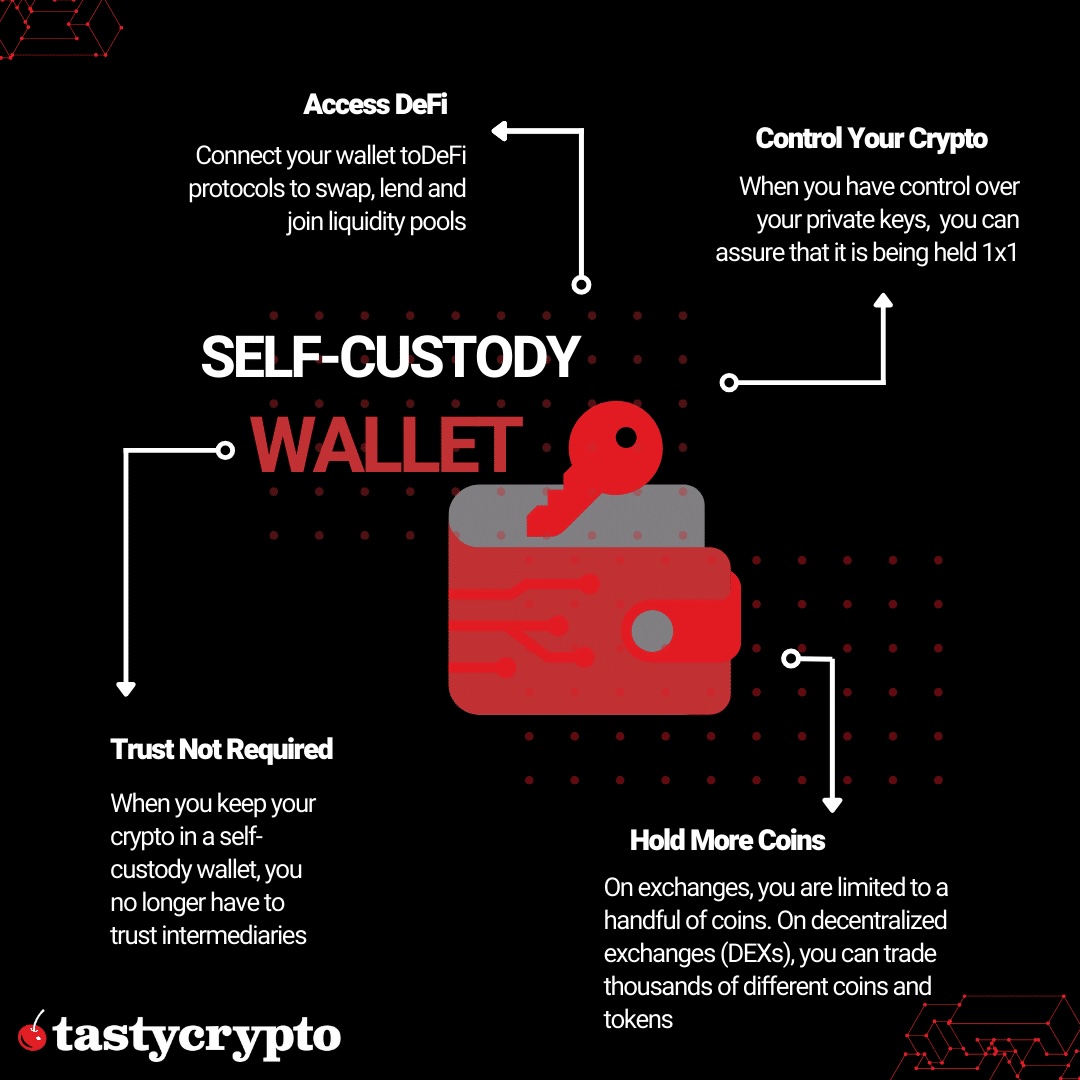

Self-custody in cryptocurrency represents a transformative approach to managing digital wealth. At its heart, self-custody ensures that you, and only you, hold the private keys that grant access to your cryptocurrency assets. Unlike custodial arrangements, where exchanges or third-party services control your keys, self-custody places the full responsibility and authority in the hands of the individual. This direct control is the essence of cryptocurrency’s original vision: a financial system free from intermediaries, enabling true peer-to-peer transactions. By adopting self-custody, users reclaim sovereignty over their assets, aligning with the ethos of blockchain technology that prioritizes trustlessness and autonomy.

This principle hinges on a fundamental truth in cryptocurrency: ownership of private keys equates to ownership of the associated assets. When users rely on custodial services, such as centralized exchanges, they effectively relinquish control, entrusting their assets to third parties. The crypto community’s mantra, “not your keys, not your coins,” underscores the precarious nature of this arrangement; without possession of private keys, users’ claims to their cryptocurrency are vulnerable.

Self-custody wallets, whether hardware devices, software applications, or paper-based solutions, ensure that these critical keys remain exclusively in the user’s possession, safeguarding their assets against external interference.

The distinction between custodial and non-custodial approaches reflects divergent philosophies in asset management. Custodial services mirror traditional banking: convenient, yet reliant on trust in institutions to protect assets and process withdrawals. Self-custody, by contrast, empowers individuals with unparalleled control, placing the responsibility for security squarely on their shoulders.

This shift restores the principle of personal sovereignty, allowing users to manage their financial security independently of centralized entities that may face insolvency, regulatory pressures, or malicious actions. Moreover, self-custody fosters a deeper connection to the decentralized ethos, encouraging users to engage directly with blockchain networks and take ownership of their financial destiny.

The Growing Momentum Behind Self-Custody Solutions

The cryptocurrency ecosystem is witnessing a surge in self-custody adoption, driven by growing awareness of custodial risks and a maturing user base. By mid-2025, a leading non-custodial crypto wallet reported surpassing 80 million users globally, a testament to its prominence in its seventh year of operation. This remarkable growth reflects a broader trend: both seasoned investors and newcomers are gravitating toward these solutions, often bypassing centralized exchanges entirely. New users, in particular, are entering the crypto space with a preference for self-custody, drawn to its promise of control and security.

This shift signals a cultural change within the industry, as users prioritize autonomy over convenience.

Market trends further underscore this momentum. The 2025 Cryptocurrency Adoption and Consumer Sentiment Report reveals that approximately 28% of American adults, roughly 65 million people, now own cryptocurrencies, nearly doubling since 2021. A significant driver of self-custody adoption is the reported difficulties faced by nearly one in five crypto owners when accessing or withdrawing funds from custodial platforms.

These experiences have fueled distrust in centralized systems, pushing users toward these alternatives. Despite widespread enthusiasm for cryptocurrency, 40% of owners express concerns about security and safety, further accelerating the adoption of self-custody solutions that offer enhanced control and peace of mind.

This growing preference for self-custody is not merely a reaction to custodial shortcomings; it reflects a broader embrace of cryptocurrency’s decentralized ethos. These solutions empower users to engage directly with blockchain networks, fostering a sense of ownership and agency. As the cryptocurrency market expands, particularly in regions with limited access to reliable banking infrastructure, self-custody is becoming a vital tool for financial inclusion. By enabling users to manage their assets independently, these solutions are paving the way for a more resilient and equitable financial ecosystem, where individuals can participate without reliance on traditional gatekeepers.

Security Benefits & Sovereignty Advantages

Self-custody offers robust security advantages that address the inherent vulnerabilities of centralized systems. Custodial services, such as exchanges, create concentrated targets for hackers, with billions of dollars in cryptocurrency stolen over the past decade. Self-custody disrupts this dynamic by distributing assets across millions of individual wallets, significantly reducing the risk of large-scale breaches. This decentralized approach not only mitigates external threats but also protects against internal risks, such as exchange insolvency, asset freezes, or mismanagement. By holding their own private keys, users ensure that their assets remain secure, even in the face of institutional failures.

Beyond security, self-custody grants unparalleled financial autonomy. Users with self-custodied assets can transact freely across borders without requiring intermediary approval, preserving their privacy and accessing funds at any time. This sovereignty marks a stark departure from traditional financial systems, where access to assets often depends on institutional relationships that can be disrupted.

In regions with unstable banking systems or restrictive capital controls, self-custody provides a parallel financial infrastructure, enabling users to maintain control over their wealth regardless of local conditions. This capability is particularly transformative for individuals in underserved markets, offering a pathway to financial independence.

Self-custody also serves as a gateway to the burgeoning Web3 ecosystem. With self-custodial wallets, users can seamlessly interact with decentralized applications (dApps), participate in decentralized finance (DeFi) protocols, and explore emerging technologies like decentralized social networks. Unlike custodial platforms, which often limit access to certain blockchain features, self-custody enables direct engagement with these networks, preserving user control over data and assets.

This direct connection embodies the vision of a decentralized internet, where individuals maintain ownership of their digital identities and assets across diverse platforms, from NFT marketplaces to governance protocols, fostering a new era of digital empowerment.

The Future: Evolving Solutions & Simplified Experiences

The future of self-custody lies in solutions that preserve its security benefits while enhancing accessibility for a broader audience. Leading wallet providers like MetaMask are reimagining self-custody for the Web3 era, with significant product updates planned for 2025. These advancements prioritize intuitive interfaces, streamlined onboarding processes, and safeguards against common errors, making self-custody viable for users with limited technical expertise. By lowering barriers to entry, these improvements aim to democratize self-custody, ensuring that its benefits, security, sovereignty, and Web3 integration, are accessible to mainstream audiences seeking control over their digital assets.

Technological innovations are rapidly transforming the landscape. Multi-party computation (MPC) technology is enabling wallet designs that eliminate single points of failure, offering robust security without the need for complex seed phrase management. Social recovery systems are also gaining traction, allowing users to designate trusted guardians who can collectively restore wallet access in emergencies. Zero-knowledge technologies further enhance privacy, enabling secure verification without compromising sensitive information. These advancements promise to deliver solutions that combine ease of use with uncompromising security, paving the way for widespread adoption.

Additionally, the integration with emerging blockchain technologies is expanding its utility. Innovations like account abstraction are simplifying wallet interactions, enabling users to customize security settings and automate transactions without sacrificing control. As Web3 ecosystems grow, self-custody solutions are evolving to support cross-chain interoperability, allowing users to manage assets across multiple blockchains seamlessly. These developments position self-custody as a cornerstone of the decentralized future, empowering users to navigate an increasingly complex digital landscape with confidence and autonomy.

Redefining Digital Wealth

The rise of self-custody marks a pivotal realignment with cryptocurrency’s core vision of financial sovereignty and personal control. As centralized exchanges face growing regulatory scrutiny and users grapple with the risks of delegated asset management, these solutions have emerged as a practical necessity for security-conscious investors. By empowering users with direct control over their private keys, self-custody restores the decentralized ethos that defines cryptocurrency, fostering a financial ecosystem rooted in autonomy and resilience.

Looking ahead, this evolution will hinge on its ability to balance robust security with user-friendly experiences. As innovations like MPC, social recovery, and account abstraction mature, self-custody is poised to become the default choice for a diverse range of users, from crypto novices to seasoned investors. In an increasingly uncertain financial world, direct control over one’s digital assets will remain a defining feature of cryptocurrency’s value proposition. Its success in delivering on this promise will determine whether cryptocurrency realizes its potential as a transformative force, reshaping how individuals interact with wealth and technology in the digital age.