The following content is published by JuCoin Labs Research:

As an innovative Layer 1, Sui has become a focal point in the blockchain space thanks to its unique technical architecture and strong scalability. Sui adopts an object-oriented data model based on the Move language, enabling parallel transaction processing, significantly increasing blockchain throughput and transaction speed, and reducing latency. These advantages make Sui an ideal platform for building efficient decentralized applications (DApps) and decentralized finance (DeFi) projects.

As Sui rapidly evolves and advances technologically, its capabilities in DeFi continue to grow—especially through the integration of native USDC and the release of the Mysticeti consensus engine, which have driven a rapid increase in TVL and further validated Sui’s potential in capital efficiency and ecosystem construction. In addition, Sui has formed partnerships—including with World Liberty Financial (WLFI), a decentralized finance protocol supported by Trump—expanding its influence in the global market, particularly in the United States.

Therefore, attention on Sui stems not only from its technological innovation but also from its potential as a foundational infrastructure project. Its continuously expanding ecosystem and the addition of partners will bring more opportunities.

I. Overview of SUI

1. Project Introduction

Sui is the first Layer 1 blockchain built on the Move language developed by Mysten Labs. It aims to enhance scalability, security, and development efficiency through a brand-new architecture. As the first blockchain built with an object-centric data model, Sui empowers developers to build decentralized applications with parallel execution, low latency, and high throughput. Launched on mainnet in May 2023, Sui has now become one of the most closely watched Layer 1s in the U.S. after Solana.

2. Core Advantages

- In September 2024, Sui integrated native USDC, strengthening its DeFi capabilities and pushing its TVL past $1.12 billion, ranking it among the top 10 blockchains by TVL. As an emerging Layer 1, Sui has the following technical highlights:

- Parallel execution architecture: Sui uses the Narwhal consensus protocol and Tusk asynchronous transaction ordering to achieve high parallelism and solve the serial bottleneck of traditional blockchains.

- Sui Move language: Built on Facebook’s Move language, Sui Move features strong modularity and composability, enhancing smart contract execution efficiency and security.

Innovative consensus mechanism: In July 2024, Sui released the Mysticeti consensus engine, reducing consensus latency to around 390 milliseconds and improving transaction processing speed.

3. Team and Fundraising

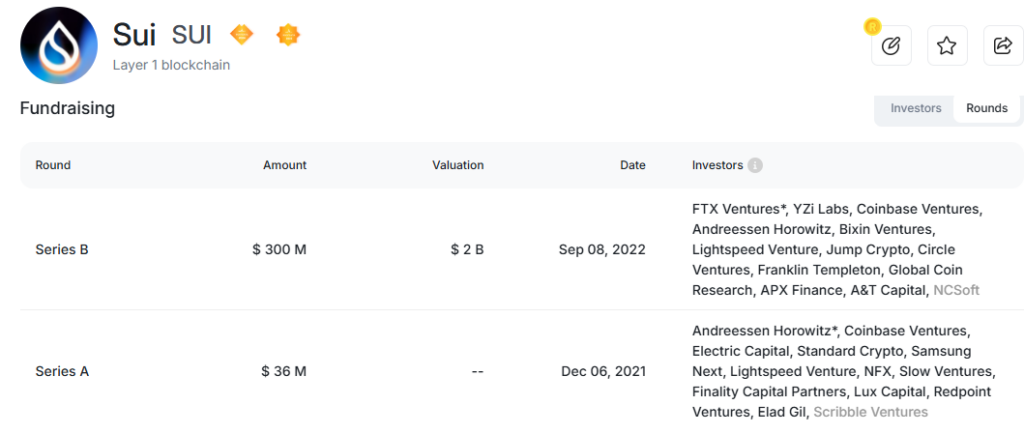

Sui is developed by Mysten Labs, founded by core members of Meta’s Diem project. The team has deep expertise in cryptography, system architecture, and distributed systems. Sui secured two rounds of early-stage investment from top institutions such as a16z, Binance Labs, and Jump Crypto, raising over $300 million with a valuation exceeding $2 billion. Key financing events include:

- Dec 6, 2021: Raised $36 million from a16z, Coinbase Ventures, Electric Capital, Standard Crypto, Samsung Next, etc.

- Sep 8, 2022: Raised $300 million from YZi Labs, Coinbase Ventures, a16z, Jump Crypto, Circle Ventures, Franklin Templeton, Global Coin Research, and others.

4. Tokenomics

The total supply of SUI tokens is 10,000,000,000. Tokens are used for ecosystem participation, gas payments, governance, and incentives.

- Initial distribution: 50% allocated to the community (managed by the Foundation), 20% to early contributors, 14% to investors, 10% to the Mysten Labs treasury, and 6% to community access programs and application testers.

- Inflation mechanism: Sui adopts a dynamic gas model where users bid for gas prices, and the system balances network resources using a tallying rule. A portion of gas fees is burned, introducing a deflationary mechanism.

II. On-Chain Data

1. Total Active Accounts

The number of active addresses reflects the user stickiness of a public chain. The rapid growth of Sui’s active accounts demonstrates a solid user base. As of this writing, the total number of active Sui accounts has surpassed 130 million.

2. TVL Data

TVL (Total Value Locked) is a key metric for measuring the development of the DeFi ecosystem. A higher TVL indicates stronger network liquidity and broader service coverage. According to DefiLlama, Sui’s ecosystem TVL has exceeded $1.78 billion, ranking among the top 10 public blockchains.

3. Daily Transaction Volume

In terms of daily transaction volume, user activity in the Sui ecosystem is very high. As of this writing, the total number of Sui transactions has exceeded 9.6 billion, with a peak daily transaction count of 300 million.

III. Ecosystem Projects

1. DeFi

According to DefiLlama, based on TVL rankings, the top five DeFi protocols in the Sui ecosystem are:

Suilend, NAVI Protocol, Cetus Protocol, Haedal Protocol, and Scallop.

-

Suilend: An automated lending platform on Sui with a TVL exceeding $200 million. It offers lending services for multiple assets and plans to launch its native token SEND to further expand its DeFi product line.

-

NAVI Protocol: A leading lending protocol in the Sui ecosystem with over $500 million in TVL. It supports multi-asset lending, leverage vaults, and DEX aggregation. After acquiring Volo LST, it expanded into liquid staking and became a core liquidity hub.

-

Cetus Protocol: The largest DEX on Sui, utilizing a Concentrated Liquidity Market Maker (CLMM) model to enable efficient trading and liquidity provision. It has a TVL of ~$170 million and continues to grow in daily volume and users.

-

Haedal Protocol: A liquid staking protocol on Sui that allows users to stake SUI and receive haSUI as a receipt token for use across DeFi. TVL is about $22.51 million and features an auto-compounding mechanism to boost returns.

-

Scallop: A lending protocol offering high-yield deposits and low-cost loans. It is supported by incentives from the Sui Foundation and has a TVL of ~$42.94 million.

2. NFT and Digital Asset Platforms

-

BlueMove: A dual-chain NFT marketplace on Sui and Aptos, offering minting, trading, and staking functions. It leads in transaction volume in the Sui NFT market.

-

KeepSake: A creator-friendly NFT platform on Sui that supports socialized NFT creation and collection. It emphasizes interaction with creators and has a UI suitable for non-crypto native users.

-

Souffl3: An NFT launchpad and multichain marketplace that supports high-quality projects. It collaborates with various NFT games and provides liquidity and initial sale services.

3. Infrastructure and Tools

-

Ethos Wallet: A native wallet on Sui with a user-friendly interface. It supports built-in DApp browsing and NFT display, available on mobile and Chrome extension. Officially recommended.

-

Typus: A gamified DeFi/NFT platform on Sui that guides users to explore ecosystem projects via missions and rewards. A key early traffic tool.

-

Surf Wallet: A developer-oriented wallet on Sui, supporting modular integration and advanced debugging tools for seamless DApp integration of identity and signature logic.

4. GameFi / SocialFi

-

Abyss World: An open-world RPG built with UE5 by Metagame Industries, invested by Mysten Labs. It deeply integrates Web3 and game economies.

-

Panzerdogs: A turn-based tank shooter focused on PvP and asset utility, with off-chain matching and on-chain settlement—an early NFT-based combat and income model on Sui.

-

SuiFrens: A pet-nurturing social app combining NFT, interaction, and casual gameplay. A social + gaming experiment used widely for airdrops and OG check-ins.

-

Final Stardust: A card battle game emphasizing strategy and asset collection, exploring a mature PvP model for blockchain games.

-

Cosmocadia: A pixel-style simulation game with strong social features. Emphasizes community governance and building; NFTs are used for land, resources, and avatars—typical of Social+GameFi.

5. Meme

-

$HIPPO: The top-valued meme coin in the Sui ecosystem, inspired by Thai baby hippo “Moo Deng”. Since launching in Oct 2024, it has reached a market cap of $260 million and $106 million in 24h volume. Known for its charity donations, including 5 million THB (~$150K) to Khao Kheow Zoo in Thailand.

-

$BLUB: Branded as “the dirtiest fish in Sui’s ocean”, blending Pepe culture with aquatic themes. Total supply: 420.69 trillion. 75% to liquidity pool, 10% to marketing, with staking incentives for long-term holders.

-

$AAA: A cat-themed meme coin, created on Move Pump in 2024 by community member Drippy. Inspired by a black cat photo, it quickly rose to become one of Sui’s most beloved memes.

IV. Valuation Analysis

As of May 2025, Sui’s circulating market cap is approximately $4.78 billion, with a fully diluted valuation (FDV) of around $21.7 billion. The circulation ratio stands at 27.6%. Currently, Sui’s TVL is $1.78 billion, which corresponds to a market cap/TVL (M/TVL) ratio of 2.6—lower than Solana’s 6.1—indicating that its on-chain capital efficiency is at a moderate level.

However, Sui’s TVL growth heavily relies on ecosystem incentives rather than organic user demand. On-chain activity and actual usage scenarios still need consolidation.

From a long-term potential perspective, if the SUI token reaches $10, its market cap would rise to around $29.3 billion. If benchmarked against Solana’s 2021 bull market peak market cap of $78.2 billion, the theoretical SUI price range would lie between $13.85 and $26.71. However, its current TVL/FDV ratio is only 0.082—much lower than Aptos (0.2989) and Sonic (0.6917)—indicating that its valuation is relatively high and that its ecosystem’s capital retention and sustainability remain under pressure.

V. Risks

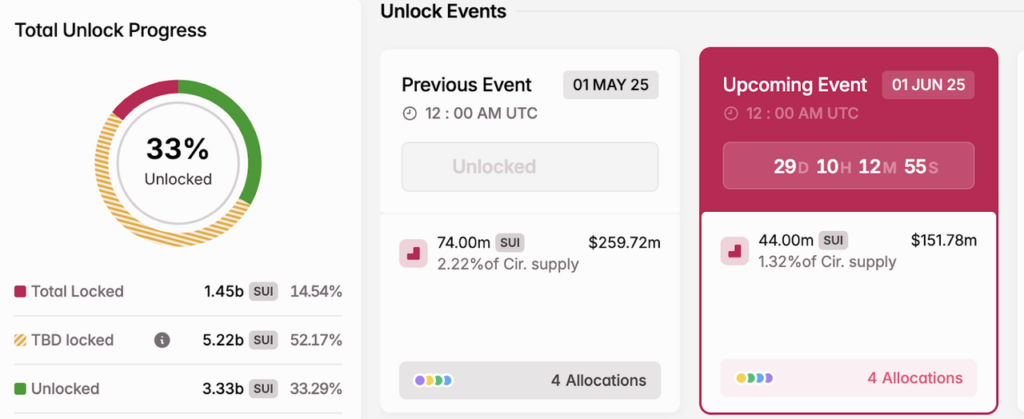

Sui faces two primary risks: frequent token unlocks and heavy reliance on ecosystem incentives. As of this writing, 1.45 billion SUI tokens are locked, accounting for approximately 14.54% of the total supply. The amount pending unlock reaches 5.22 billion, which is 52.17% of the total supply.

Additionally, in its early development, Sui attracted users and developers by offering liquidity incentives to DeFi protocols. While this strategy may temporarily boost platform activity and TVL, it is not a sustainable growth model. Nonetheless, Sui has made significant progress in both technical innovation and ecosystem incentives.

If its ecosystem can transition from incentive-driven to organic user retention, its current valuation may be well supported. Otherwise, it may face downside valuation risks.

VI. Conclusion

Sui is a high-performance Layer 1 blockchain developed by Mysten Labs, founded by former members of the Meta Diem team. It is based on the Move language and adopts an object-centric parallel execution architecture, significantly enhancing scalability and development efficiency.

Since its mainnet launch in May 2023, Sui has introduced the Mysticeti consensus engine and integrated native USDC. TVL has exceeded $1.78 billion, active addresses have surpassed 130 million, and Sui has quickly become one of the top 10 global blockchains.

On the ecosystem front, Sui has built a diversified application framework covering DeFi (NAVI, Suilend, Cetus), NFTs (BlueMove, Souffl3), GameFi (Abyss World, Final Stardust), and Meme tokens ($HIPPO, $BLUB). Supported by strong developer engagement and sustained incentive programs, Sui has processed a cumulative 9.6 billion transactions, with peak daily volume exceeding 300 million—showcasing highly active on-chain user behavior.

Currently, Sui’s circulating market cap is about $4.78 billion, FDV is approximately $21.7 billion, and the M/TVL ratio of 2.6 reflects a mid-tier position among mainstream public chains. While token incentives are still critical to its short-term activity, the token unlock schedule poses pressure.

If Sui can successfully transition from incentive-driven to organic user adoption and continue promoting DeFi, gaming, and consumer-grade applications, it has the potential to enter a more sustainable growth trajectory and become one of the leading public chains.