Key Takeaways

- Tether is launching Tether AI, an open-source, decentralized platform to revolutionize AI with peer-to-peer technology and cryptocurrency integration.

- The global stablecoin market, led by Tether’s USDT, is projected to grow from $234 billion to $2 trillion by 2028.

- Kyrgyzstan’s USDKG, a gold-backed stablecoin, introduces a novel model pegged to the U.S. dollar for cross-border trade.

- Major payment networks like Mastercard and Visa are integrating stablecoins, enabling seamless transactions at millions of merchant locations.

- Regulatory clarity and institutional adoption are key drivers shaping the future of the stablecoin ecosystem.

The current stablecoin landscape is experiencing significant transformation as market leaders diversify their offerings and new entrants emerge with innovative models. This report examines recent stablecoin ecosystem developments, focusing on Tether’s expansion into artificial intelligence (Tether AI), market growth dynamics, emerging stablecoin models, and integration with traditional financial infrastructure.

Tether AI: Tether’s Strategic Expansion Into Artificial Intelligence

Tether, the world’s largest stablecoin issuer, has announced its entry into the artificial intelligence sector with the upcoming launch of Tether AI. This open-source platform represents a significant departure from centralized AI service models, designed to operate on a decentralized, peer-to-peer network without reliance on centralized control points or API keys. The architecture enables the system to function across distributed networks, eliminating single points of failure while providing enhanced security and privacy protections.

At the core of Tether AI is the company’s “Personal Infinite Intelligence,” a modular and composable AI runtime capable of adapting to any hardware or device configuration. This approach emphasizes individual autonomy and decentralization, consistent with Tether’s broader mission of creating peer-to-peer systems that operate without unnecessary intermediaries.

The platform will natively support cryptocurrency payments, with integrated functionality for USDT and Bitcoin transactions processed directly on the peer-to-peer network. This integration leverages Tether’s Wallet Development Kit (WDK), introduced in November 2024, enabling developers to build mobile, desktop, and web wallet applications, facilitating self-custodial asset management. The system architecture ensures users maintain complete control over their funds without relying on centralized intermediaries.

CEO Paolo Ardoino has positioned Tether AI as a response to the current AI industry’s heavy reliance on centralized APIs and cloud platforms, stating that the platform “will change that by offering a fully open-source AI runtime that works anywhere and doesn’t require any centralized access.” Though not yet operational, the platform was initially announced in December 2024 with a targeted launch by the end of Q1 2025. The initiative forms part of Tether’s strategic restructuring announced in April 2024, which established dedicated business units focused on AI tools and peer-to-peer technology development.

Global Stablecoin Market Dynamics & Growth Projections

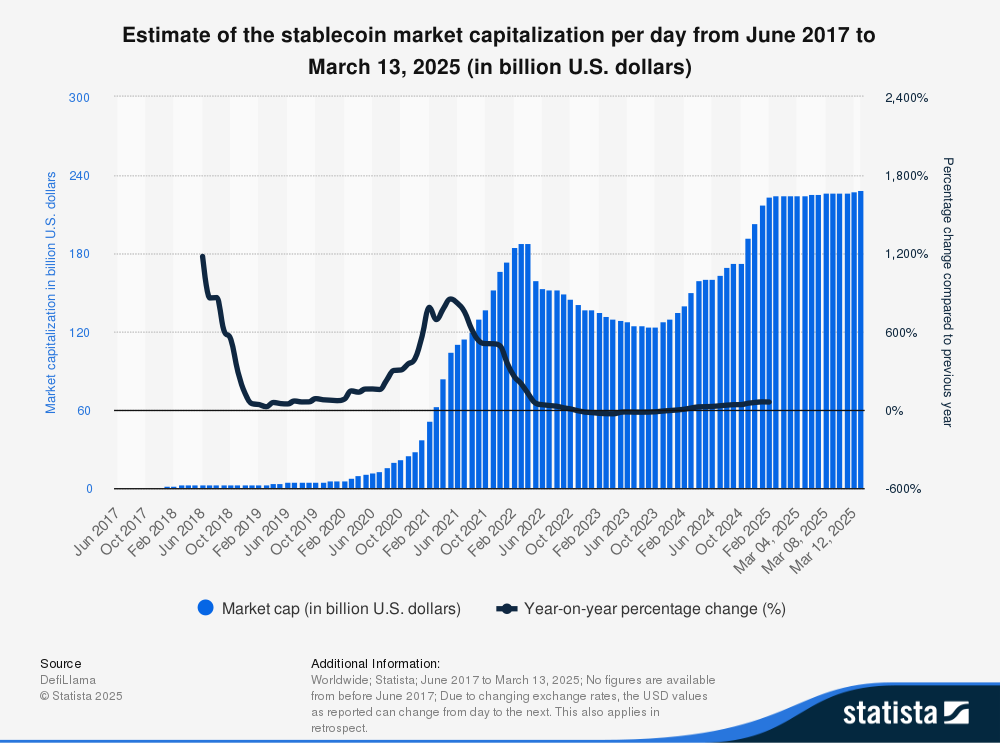

The stablecoin market continues to expand rapidly, with current market capitalization reaching approximately $234 billion as of April 2025. USD-pegged stablecoins dominate this market, representing over 99% of total capitalization. Within this segment, Tether maintains significant market dominance with USDT, which reached a record high of $145.6 billion in April 2025, an increase of over $8.5 billion since the beginning of the year.

Market analysis projects substantial growth potential, with some forecasts indicating stablecoin supply could reach approximately $2 trillion by 2028. This projected 8.3x increase reflects growing institutional adoption, expanding merchant integrations, and regulatory clarity. The stablecoin ecosystem’s expansion has material implications for treasury markets, with stablecoin issuers currently estimated to hold more than $120 billion in U.S. Treasury bills. Further growth could generate additional demand for these instruments, approaching $900 billion, potentially at the expense of traditional bank deposits.

Interestingly, the relationship between stablecoin dominance metrics and cryptocurrency market movements provides valuable market signals. The USDT Dominance ratio (USDT.D), which measures USDT’s market share relative to total cryptocurrency market capitalization, has shown an inverse correlation with Bitcoin price movements, declining USDT.D typically precedes Bitcoin price appreciation. This pattern reflects capital flows from stablecoins into other cryptocurrencies during bullish market phases.

Emerging Stablecoin Models: Kyrgyzstan’s Gold-Backed USDKG Initiative

A notable innovation in the stablecoin landscape is Kyrgyzstan’s planned introduction of USDKG, a gold-backed stablecoin pegged to the U.S. dollar, scheduled for launch in the third quarter of 2025. The project, supported by the country’s Ministry of Finance, will initially maintain $500 million in gold reserves as collateral, with plans to increase this backing to $2 billion over time.

Unlike digital assets such as Paxos Gold (PAXG) or Tether Gold (XAUT) that track real-time gold prices, USDKG is designed to maintain a stable value through direct pegging to the U.S. dollar while using gold as the underlying reserve asset. This structure aims to shield users from gold market volatility while providing the security of physical asset backing. The project will implement overcollateralization as an additional safeguard, ensuring reserve values exceed the total supply of USDKG in circulation.

The USDKG initiative focuses primarily on facilitating cross-border transfers and international trade, with initial concentration on Central Asia before planned expansion into Southeast Asia and the Middle East. This use case is particularly relevant to Kyrgyzstan, where remittances constitute approximately 30% of GDP. The stablecoin could potentially offer a more efficient alternative to traditional remittance channels if it delivers faster, more cost-effective transactions.

The project has notable government backing, with the President of Kyrgyzstan, Sadyr Japarov, personally engaging with cryptocurrency industry leaders including Binance founder Changpeng Zhao, who has been appointed as a public adviser to the Kyrgyz Republic on digital asset development.

Integration Of Stablecoins Into Traditional Financial Infrastructure

Major payment networks are actively incorporating stablecoins into their existing infrastructure, bridging the gap between cryptocurrency and traditional payment rails. Mastercard has unveiled comprehensive capabilities to facilitate stablecoin transactions from digital wallets to merchant checkpoints through partnerships with cryptocurrency exchanges and service providers. This approach enables consumers to access, spend, and manage stablecoins across Mastercard’s global merchant network.

Similarly, Visa has partnered with Bridge, a stablecoin orchestration platform, to launch stablecoin-linked Visa cards. This collaboration allows fintech developers utilizing Bridge’s services to offer their end customers stablecoin-linked payment cards through a streamlined API integration. The system enables cardholders to make everyday purchases using stablecoin balances at any location accepting Visa payments, approximately 150 million merchant locations globally.

The integration mechanism functions by deducting the appropriate amount from the customer’s stablecoin balance during transactions, converting it to fiat currency, and ensuring merchants receive payment in their local currency. This seamless conversion process removes a significant barrier to stablecoin adoption by enabling cryptocurrency holders to utilize their assets for everyday purchases without merchants needing to directly accept digital currencies.

These developments represent a significant advancement in stablecoin utility, transforming them from primarily crypto trading instruments to practical payment solutions for everyday transactions. The involvement of established financial institutions provides critical infrastructure and legitimacy to accelerate mainstream adoption for Tether AI.

Regulatory Developments & Future Market Outlook

The stablecoin ecosystem’s continued growth depends significantly on regulatory frameworks, with current developments showing progress toward greater clarity. In the United States, proposed legislation such as the GENIUS Act aims to establish comprehensive guidelines for stablecoin issuers. These regulatory developments could substantially influence market growth trajectories, with several key factors determining adoption velocity.

A Treasury Advisory Committee report identifies multiple potential growth enablers for the stablecoin market, including interest-bearing stablecoin models, designated capital and liquidity treatment guidelines, permissibility for bank holding companies to utilize public blockchains, increased institutional participation in cryptocurrency markets, and migration of wholesale market activities to blockchain systems.

The stablecoin market’s evolution creates implications for traditional financial systems, potentially affecting bank deposits if stablecoins offer superior yield or operational payment features compared to conventional banking products. Additionally, during market volatility or confidence crises, rapid shifts between stablecoins and other assets could amplify liquidity pressures in treasury markets.

Tether AI Meets Stablecoin Growth

The stablecoin ecosystem stands at an inflection point, evolving beyond its original function as a volatility hedge within cryptocurrency markets toward broader integration with traditional finance and novel technological domains such as artificial intelligence. Tether’s expansion into AI through Tether AI represents a significant case study in how stablecoin issuers are diversifying their offerings and leveraging their established infrastructure to develop adjacent technologies and services.

Market projections indicating potential growth to $2 trillion by 2028 suggest stablecoins may become an increasingly important component of the global financial system. The emergence of asset-backed models like Kyrgyzstan’s USDKG alongside integration efforts by established payment networks creates multiple pathways for adoption across different use cases and geographies.

As regulatory frameworks mature and financial institutions increase their engagement with stablecoin technologies, the boundary between traditional finance and cryptocurrency systems continues to blur. The convergence of stablecoins, payment networks, and decentralized technologies like the Tether AI platform may represent the early stages of a more fundamental transformation in how value is transferred, stored, and interacted with in the digital economy.