Key Takeaways

- HyperLiquid’s ecosystem has seen significant growth in 2025, with $1.36M daily revenue and $848.86M TVL, rivaling centralized exchanges.

- USDe integration across HyperCore and HyperEVM enhances liquidity and introduces yield-generating opportunities for users.

- Daily trading volume averages $6.4B, outpacing competitors like Jupiter Perps by 88%, solidifying HyperLiquid’s DeFi dominance.

- New fee structures and HYPE token staking tiers incentivize user activity and long-term ecosystem participation.

- Strategic DeFi protocol integrations, like Keiko Finance and Hyperunit, expand HyperLiquid’s financial utility and interoperability.

The HyperLiquid ecosystem has demonstrated remarkable expansion across multiple metrics during the first half of 2025, establishing itself as a dominant force in decentralized finance. Recent platform developments, particularly the strategic integration of Ethena’s USDe stablecoin across both HyperCore and HyperEVM chains, have catalyzed new growth vectors for the ecosystem. This comprehensive analysis examines HyperLiquid’s financial performance metrics, technical platform enhancements, cross-protocol integrations, and the transformative impact of USDe deployment. The findings reveal a maturing ecosystem with deepening liquidity pools, sophisticated financial infrastructure, and increasingly diverse use cases that position HyperLiquid as a formidable competitor to traditional centralized exchanges.

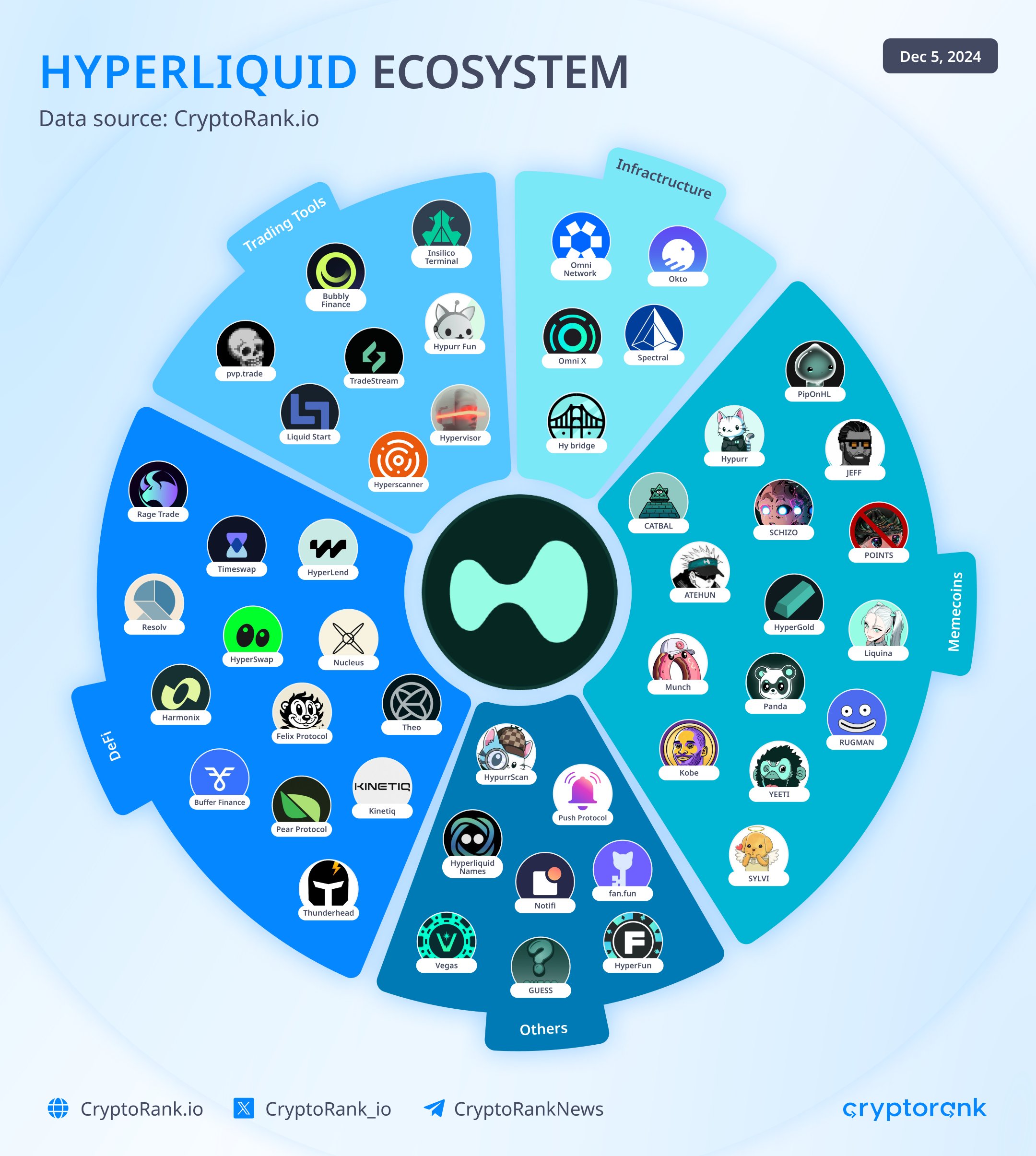

HyperLiquid Ecosystem Growth Metrics

The financial performance of the HyperLiquid ecosystem has consistently demonstrated robust expansion throughout early 2025. Daily revenue figures have reached impressive heights, with the platform generating approximately $1.36 million in daily revenue according to recent DefiLlama data, contributing to accumulated all-time fees exceeding $321.2 million. This revenue performance represents a significant achievement for a decentralized platform, especially considering that HyperLiquid managed to flip Ethereum in seven-day revenues earlier in February 2025, generating approximately $12.8 million compared to Ethereum’s $11.5 million over the same period. The platform’s revenue growth trajectory has continued its upward momentum since this milestone, reflecting increasing adoption and transaction volume across the HyperLiquid ecosystem.

Total Value Locked (TVL) metrics further substantiate HyperLiquid’s expanding market presence, with current figures reaching $848.86 million with a positive 24-hour growth rate of 3.87%. This TVL growth represents significant capital inflows from both retail and institutional participants seeking exposure to HyperLiquid’s financial products and services. The platform’s trading volume has similarly demonstrated impressive performance, with Blockworks Research reporting that HyperLiquid averaged $6.4 billion in daily trading volume over a three-month period ending in April 2025. This trading activity significantly outperforms HyperLiquid’s closest competitor, Jupiter Perps, which averaged only $704 million in daily volume, a differential of 88% that underscores HyperLiquid’s market dominance in the decentralized derivatives sector.

Open interest (OI) metrics provide additional evidence of HyperLiquid’s growing market significance, with Bitcoin open interest on the platform reaching $1.4 billion by mid-April 2025. This figure represents 15% of Binance’s $9.2 billion, 46% of OKX’s $3 billion, and 25% of Bybit’s $5.6 billion, remarkable proportions considering HyperLiquid’s relatively recent market entry compared to these established centralized exchanges. The platform’s total open interest had previously reached record levels exceeding $4.3 billion in December 2024, demonstrating consistent growth in this key metric that reflects market participants’ confidence in HyperLiquid’s infrastructure. These impressive open interest figures indicate deep liquidity pools and sophisticated market-making activity that contribute to competitive execution for traders.

USDe Integration Implementation

The May 2025 integration of Ethena’s USDe synthetic dollar represents a strategic milestone in HyperLiquid’s ecosystem development. Formally launched on May 5th, 2025, USDe has been deployed across multiple components of the HyperLiquid ecosystem, including HyperCore (the platform’s order book exchange), HyperEVM (the EVM-compatible blockchain), and Unit (a related financial service). This comprehensive USDe integration across multiple infrastructure components demonstrates an integrated approach to stablecoin implementation that maximizes utility and accessibility. The introduction of USDe provides HyperLiquid users with an additional USD-pegged asset that combines stability with yield-generating characteristics, expanding the ecosystem’s financial primitives.

The implementation architecture for USDe on HyperLiquid features several technical components designed to maximize interoperability and capital efficiency. Users can acquire USDe directly through the order book on HyperCore or transfer existing holdings from other chains via LayerZero bridge with Stargate Finance integration. Additionally, HyperLiquid has deployed a dedicated “Core Transfer” functionality that enables seamless conversion of USDe between HyperCore and HyperEVM directly within the platform interface, eliminating the need for external bridging services for cross-chain transfers within the ecosystem. This technical implementation reduces friction for users while maintaining functional equivalence of USDe across different components of the HyperLiquid ecosystem, though current liquidity remains primarily concentrated on the HyperCore trading platform during the initial launch phase.

A distinctive feature of the USDe integration is its incentive structure, which is designed to encourage adoption and utilization. HyperCore users maintaining a minimum balance of 100 USDe automatically receive daily rewards delivered through the Merkl platform, an incentive system that calculates rewards based on 24-hour average balances. These rewards are automatically credited to users’ USDe spot exchange balances, creating a seamless passive income mechanism that enhances the appeal of holding USDe within the HyperLiquid ecosystem. This incentive design aligns with broader industry practices of rewarding early adopters while bootstrapping liquidity for newly deployed assets.

Platform Infrastructure Enhancements

HyperLiquid has implemented comprehensive fee structure enhancements that became operational on May 5th, 2025, representing a significant platform infrastructure upgrade. The new fee system introduces tiered pricing based on 14-day rolling volume calculations, with a sophisticated approach that weights different transaction types according to their market impact and liquidity characteristics. Specifically, the new structure counts spot trading volume at double weight compared to perpetual contract volume when determining a user’s fee tier, an approach designed to incentivize spot market activity while recognizing the different margin requirements and capital efficiency of these transaction types. The implementation of volume-based tiering creates graduated incentives for traders to increase their activity on the HyperLiquid platform, potentially reducing effective costs for high-volume participants.

A central component of the fee structure enhancement is introducing HYPE token staking tiers that provide fee discounts based on staking commitment levels. The staking tiers follow a graduated structure, with “Wood” tier requiring more than 10 HYPE tokens and providing a 5% discount, through Bronze (>100 tokens, 10% discount), Silver (>1,000 tokens, 15% discount), Gold (>10,000 tokens, one 20% discount), and ultimately Platinum tier (>100,000 tokens), which offers a substantial 30% fee reduction. This staking mechanism creates additional utility for the HYPE token while incentivizing long-term holding behavior, potentially reducing token velocity and increasing token value capture. Furthermore, the implementation includes a cross-account binding feature that allows users to apply staking benefits from one account to trading activities on separate accounts, enhancing flexibility for institutional and sophisticated traders utilizing multiple trading entities.

Beyond fee structure enhancements, HyperLiquid has improved its technical infrastructure to support increasing transaction volumes and integration complexity. The platform has demonstrated the capacity to process substantial transaction volumes, handling approximately $6.4 billion in daily trading activity according to Blockworks Research. This technical performance indicates a robust infrastructure capable of managing high-frequency trading and complex order types without significantly degrading execution quality. Furthermore, the platform maintains detailed analytics that are accessible through its stats portal. It provides transparency into key metrics, including trader behavior, liquidation patterns, and market-specific trading activity that contribute to market efficiency and price discovery.

DeFi Protocol Integrations

The HyperLiquid ecosystem has fostered diverse protocol integrations extending the utility of the platform’s infrastructure and assets. Keiko Finance represents a significant integration, operating as a permissionless collateralized debt position (CDP) protocol deployed on the HyperLiquid network. This integration lets users deposit supported HyperLiquid-based assets as collateral to borrow KEI stablecoin, creating leveraged positions or accessing liquidity without selling underlying assets. The Keiko Finance integration demonstrates how HyperLiquid’s infrastructure can support traditional DeFi primitives like lending and borrowing, expanding the ecosystem’s financial capabilities beyond trading and market-making activities.

The USDe integration has catalyzed additional protocol integrations that further enhance the HyperLiquid DeFi landscape. Strategic partnerships with projects such as Hyperunit will expand USDe’s utility by enabling its use as collateral for borrowing Unit BTC, ETH, and SOL on platforms including Euler Finance and Felix Protocol. These integrations create synthetic exposure opportunities to major cryptocurrencies while maintaining capital efficiency through collateralization rather than direct ownership. Additionally, USDe and its staked variant sUSDe can be paired with various tokens to access additional yield incentives from Ethena Labs, creating diversified earning opportunities that attract liquidity to the HyperLiquid ecosystem while rewarding participants for providing critical financial infrastructure.

Future protocol integrations outlined in development roadmaps indicate HyperLiquid’s commitment to expanding cross-chain interoperability and financial sophistication. Plans include enhancing LayerZero bridge integrations to facilitate seamless asset transfers between HyperLiquid and other major blockchains, developing fixed interest products in collaboration with Pendle, and deploying advanced automated market-making models through partnerships with Valantis Labs. These forthcoming integrations will further extend HyperLiquid’s functional capabilities while enhancing capital efficiency across the broader DeFi landscape. The deliberate cultivation of complementary protocol integrations demonstrates HyperLiquid’s strategic focus on creating a comprehensive financial ecosystem rather than an isolated trading venue.

USDe Integration Shapes HyperLiquid’s 2025 DeFi Future

The HyperLiquid ecosystem has demonstrated remarkable growth across multiple dimensions during early 2025, establishing itself as a formidable competitor in the decentralized finance landscape. The platform’s financial metrics reveal substantial revenue generation, expanding TVL, and impressive trading volumes that increasingly challenge established centralized exchanges. The strategic USDe integration across the HyperLiquid ecosystem represents a significant milestone that enhances liquidity options while creating new yield-generating opportunities for participants. Platform infrastructure enhancements, particularly the sophisticated fee structure with HYPE staking tiers, create aligned incentives for continued ecosystem growth while rewarding long-term participants.

The diversity of protocol integrations within the HyperLiquid ecosystem demonstrates the platform’s evolution beyond a simple trading venue toward a comprehensive financial infrastructure layer. Partnerships with specialized protocols create synergistic relationships that expand use cases and capital efficiency opportunities for ecosystem participants. Looking forward, HyperLiquid’s growth trajectory appears poised to continue its upward momentum as additional integrations come online and market participants increasingly recognize the platform’s competitive advantages in execution quality, capital efficiency, and yield generation. The ecosystem’s development represents a case study in successful decentralized finance implementation that balances technical innovation with practical financial utility.