Key Takeaways

- Pendle revolutionizes DeFi by enabling users to tokenize and trade future yields, separating yield-bearing assets into Principal Tokens (PT) and Yield Tokens (YT).

- The protocol transforms variable yields into fixed-rate products through its specialized AMM, allowing users to hedge yield exposure or speculate on future rates.

- Pendle’s custom AMM design features concentrated liquidity and negligible impermanent loss concerns, making it attractive for liquidity providers.

- With over $2.9 billion in Total Value Locked (TVL) and integration across multiple blockchains, it has established itself as the dominant fixed income protocol in DeFi.

- Pendle has achieved product-market fit through its role in major DeFi narratives, including liquid staking tokens (LSTs), restaking, and yield stablecoins.

Pendle has emerged as a transformative force in decentralized finance, offering an innovative solution to one of DeFi’s most persistent challenges: yield predictability. As a yield-management protocol, Pendle enables users to tokenize and trade the future yield from yield-bearing assets, creating new possibilities for both yield farmers and yield traders. The protocol has experienced explosive growth by capturing the intersection between principal yield trading and points leverage, cementing its position as a cornerstone of DeFi infrastructure.

Recent developments include significant trading volume milestones, with daily trading exceeding $500 million in March 2025, and the ongoing implementation of its ambitious 2025 roadmap focused on expanding yield trading capabilities beyond traditional DeFi. As of April 24, 2025, PENDLE is trading at approximately $3.25, with a circulating supply of 161.89 million tokens and a market capitalization of around $527 million.

What Is Pendle?

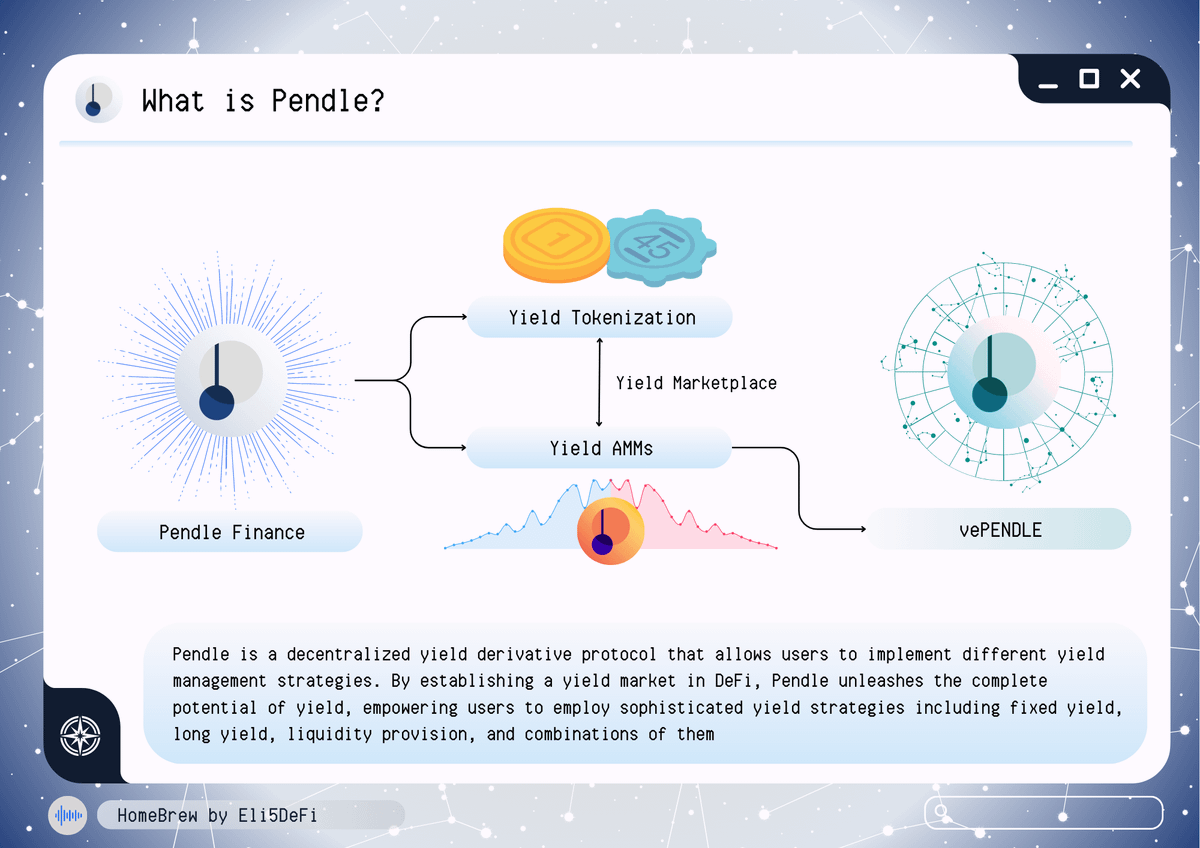

Pendle is a decentralized protocol that provides a market for the yields of supported yield-bearing tokens. At its core, Pendle addresses a fundamental limitation in traditional DeFi platforms – the unpredictability of yields. While platforms like Aave or Compound offer variable yields that fluctuate with market conditions, the protocol introduces a mechanism to separate principal from yield, allowing users to lock in fixed returns or speculate on future yield rates.

The protocol accomplishes this by splitting yield-bearing tokens into two distinct components: Principal Tokens (PT), which represent the initial capital and are redeemable for the full value of the underlying asset at maturity, and Yield Tokens (YT), which capture all future yield generated until maturity. This separation creates a versatile financial instrument within the DeFi ecosystem, enabling users to hedge against yield volatility, secure predictable returns, or gain leveraged exposure to yield movements. By facilitating this market, Pendle effectively creates a fixed-income layer for DeFi, bridging traditional finance concepts with blockchain technology.

Who Is Behind Pendle?

Pendle was co-founded in 2020 by a team of experienced developers and DeFi enthusiasts, including TN Lee, Vu Nguyen, GT, and YK. The project was initially introduced under the name “Benchmark” before evolving into Pendle. TN Lee currently serves as a co-founder and remains actively involved in the protocol’s development and strategic direction, regularly sharing updates through social media and community channels.

The protocol has established strategic partnerships with prominent players in the DeFi space. In March 2023, Pendle expanded to Arbitrum with support for GMX’s GLP token, followed by launches on BNB Smart Chain in July 2023 and Optimism in August 2023. This rapid expansion across multiple chains demonstrates its commitment to accessibility and its ability to form productive ecosystem partnerships. The protocol has progressively built its reputation through these strategic alignments, allowing it to integrate with various yield-generating platforms and expand its utility across the broader DeFi landscape.

How Pendle Works: A Technical Explanation

Pendle’s core technology revolves around yield tokenization and its specialized Automated Market Maker (AMM). The yield tokenization process begins with the SY (Standardized Yield) EIP-5115 token standard, which wraps various yield-bearing assets into a standardized format. Once a yield-bearing asset is wrapped as an SY token, it can be separated into Principal Tokens (PT) and Yield Tokens (YT). This separation is the fundamental innovation that enables Pendle’s ecosystem to function.

The Pendle AMM represents a significant advancement over traditional AMMs, as it’s specifically designed for yield trading with features that address the unique characteristics of yield-bearing assets. Unlike conventional AMMs that suffer from impermanent loss when trading assets with time decay (like yield tokens), its AMM incorporates concentrated liquidity and a dual fee structure that minimizes these risks. In Pendle V2, the protocol introduced a single liquidity pool that pairs SY and PT tokens while enabling YT trades through the same pool via flash swaps, dramatically improving capital efficiency.

This technical architecture creates three primary use cases for users. First, traders can buy PT tokens at a discount to the underlying asset, effectively locking in a fixed yield if held until maturity. Second, users can purchase YT tokens to speculate on yield rates, benefiting if the actual yield exceeds the implied rate priced into the market. Third, liquidity providers can supply capital to Pendle pools, earning trading fees while experiencing minimal impermanent loss compared to traditional AMMs. Additionally, Pendle has become central to points leverage strategies, allowing users to obtain exposure to points distributions (like those from Eigenlayer and LRT projects) without committing the full principal amount.

The protocol’s governance is secured through vePENDLE, a vote-escrowed version of the PENDLE token based on the ve(3,3) mechanism. By locking PENDLE tokens, users receive vePENDLE, which grants them voting rights to influence protocol parameters, fee distribution, and incentive allocation. This governance system aligns the interests of token holders with the long-term health of the protocol while providing additional utility through fee sharing and boosted rewards for liquidity providers.

Current Status Of Pendle In The Wider Ecosystem

In the competitive landscape of DeFi yield protocols, Pendle has emerged as the dominant fixed-income platform. With over $2.9 billion in Total Value Locked (TVL) as of April 2025, it commands approximately 50% of TVL in the yield space, outpacing its closest competitors by a significant margin. This dominance reflects its success in establishing product-market fit across multiple DeFi narratives, particularly in the Ethereum liquid staking and restaking ecosystems.

Pendle has proven particularly valuable within the liquid staking token (LST) ecosystem, where it enables users to unlock liquidity from staked assets while maintaining yield exposure. The protocol’s $eETH pool became one of the most active in DeFi following the rise of Ethereum restaking, demonstrating its ability to capitalize on emerging trends. Similarly, Pendle has become instrumental in the yield stablecoin space, providing liquidity and yield trading mechanisms for tokens like USDe from Ethena.

The on-chain yield derivatives market that Pendle has pioneered reflects one of the largest segments in traditional finance: interest rate derivatives, a market worth over $500 trillion globally. Even capturing a fraction of this market represents a multi-billion-dollar opportunity for DeFi. By offering fixed-rate products through a transparent and composable system, the protocol has positioned itself at the intersection of DeFi innovation and traditional financial structures, appealing to both crypto natives and institutional participants seeking yield stability.

Recent trading milestones underscore Pendle’s growing adoption, with daily trading volume exceeding $500 million in March 2025. This trading activity indicates robust market interest in yield derivatives and validates Pendle’s approach to creating liquid markets for future yield. The protocol’s expansion across multiple blockchains, including Ethereum, Arbitrum, BNB Chain, Optimism, and Mantle, further cements its position as a cross-chain yield infrastructure layer.

Price Journey

The PENDLE token has experienced significant price movements since its introduction to the markets. Following its initial token distribution in April 2021, PENDLE gained modest traction before experiencing substantial growth during the DeFi resurgence of late 2023 and early 2024. This growth period coincided with the rise of Ethereum liquid staking and restaking narratives, where it established a vital role.

PENDLE reached an all-time high of approximately $7.52 on April 11, 2024, during peak excitement around yield tokenization and DeFi structural products. However, like many DeFi tokens, PENDLE subsequently experienced a correction, with prices declining by approximately 56% to its current level of $3.25 as of April 24, 2025. Despite this correction, PENDLE has demonstrated resilience compared to many peer protocols, maintaining a substantial market capitalization and consistent trading volume.

The token’s price movements have been primarily influenced by protocol adoption metrics, including TVL growth, trading volume, and new integrations. As Pendle continues to expand its ecosystem and implement its 2025 roadmap, particularly the introduction of Boros for trading various yield types, market participants will be closely monitoring how these developments impact token valuation. With fixed income solutions gaining increased relevance in the current market environment, PENDLE’s value proposition as the governance token for the leading yield trading protocol remains compelling.

Current Data & Interesting Statistics About Pendle

- Pendle has achieved over $2.96 billion in Total Value Locked (TVL) as of April 2025, making it the dominant protocol in the yield trading sector.

- The protocol has facilitated approximately $35 billion in cumulative trading volume, demonstrating substantial market adoption of yield derivatives.

- Pendle’s AMM can process trades with minimal slippage due to its concentrated liquidity design, handling millions in daily volume efficiently.

- The Market Cap to TVL ratio for Pendle stands at approximately 0.1776, suggesting potential undervaluation compared to the protocol’s secured assets.

- Pendle’s governance system has attracted significant participation, with a substantial portion of circulating PENDLE locked in vePENDLE contracts for governance rights and enhanced rewards.

- The protocol captures a 3% fee from all yield accrued by YT tokens, with 100% of this fee currently distributed to vePENDLE holders.

- Pendle has expanded beyond Ethereum to five additional blockchains, including Arbitrum, Optimism, BNB Chain, and Mantle, with plans for further cross-chain deployment.

What Is The Future Of Pendle?

Pendle’s 2025 roadmap outlines an ambitious vision focused on three core pillars: enhancing the existing V2 product, expanding PT tokens as collateral across both EVM and non-EVM networks, and introducing Boros, a new product for trading yields from diverse sources, including DeFi, CeFi, and traditional finance. This expansion beyond purely on-chain yield sources represents a significant evolution, potentially allowing users to trade markets like LIBOR or mortgage rates alongside crypto funding rates.

The protocol aims to position itself as the fixed income layer for all of DeFi, with plans to introduce institutional-grade KYC-compliant PT products to allow traditional financial institutions to access crypto-native fixed yields. By bridging the gap between DeFi innovation and institutional capital requirements, Pendle could unlock substantial new liquidity sources. As tokenized real-world assets and stablecoins continue their exponential growth, Pendle is well-positioned to become the yield management infrastructure powering the next wave of DeFi adoption. The protocol’s vision extends beyond simply facilitating yield trading to becoming the universal gateway for yield interactions across financial ecosystems.

Your Guide To The Future Of Yield Trading

Pendle has established itself as a foundational protocol in the DeFi landscape by transforming how users interact with yield-bearing assets. By separating principal from yield and creating liquid markets for future returns, it addresses one of the most significant challenges in decentralized finance: the unpredictability of yields. As traditional finance increasingly embraces digital assets and DeFi continues to mature, Pendle’s fixed income infrastructure provides a critical bridge between variable DeFi yields and the predictable returns institutional and retail investors seek.

The protocol’s expansion across multiple chains, growing integration with major DeFi platforms, and ambitious roadmap position it as a pivotal player in the next evolution of yield management. With its innovative approach to yield tokenization and trading, Pendle is not merely participating in DeFi’s growth but actively shaping how yield will be structured, traded, and optimized in tomorrow’s financial systems.