Key Takeaways

- Raydium is an automated market maker (AMM) built on Solana that offers significantly faster transactions and lower fees compared to Ethereum-based alternatives.

- The platform features permissionless pool creation, allowing any user or project to create liquidity pools without restrictions.

- Raydium offers two types of liquidity pools: Concentrated Liquidity (CLMM) for advanced traders and Constant Product Pools for more straightforward token swaps.

- The RAY token serves multiple functions within the ecosystem, including staking for protocol fees, governance voting, and earning IDO allocations.

- As of April 23, 2025, Raydium has approximately $1.35 billion in Total Value Locked (TVL), making it a significant player in the Solana DeFi ecosystem.

Raydium represents a significant innovation in the decentralized finance (DeFi) space, offering an automated market maker built specifically for the Solana blockchain. This platform enables users to swap tokens, provide liquidity, and earn rewards with the speed and low costs that Solana is known for. Launched in February 2021, Raydium has quickly established itself as a cornerstone of the Solana ecosystem, facilitating millions of transactions and supporting numerous projects through its launchpad services.

Recent developments include the launch of its V3 interface in March 2024, which introduced enhanced user experience features, mobile optimization, and revamped AMM pools. As of April 23, 2025, Raydium (RAY) is trading at $2.56 USD, with a circulating supply of approximately 290.8 million tokens and a market capitalization of $746.95 million.

What Is Raydium?

Raydium is an automated market maker (AMM) decentralized exchange built on the Solana blockchain. Unlike traditional exchanges that use order books to match buyers and sellers, Raydium uses liquidity pools where users can swap tokens through permissionless pools. What sets Raydium apart from other AMMs is its ability to leverage the efficiency of the Solana blockchain, resulting in transactions that are magnitudes faster than Ethereum-based alternatives and gas fees that are a fraction of the cost.

The platform offers two main types of liquidity pools: standard AMM model (also known as Constant Product Pools) and the Concentrated Liquidity Market Maker (CLMM) model. The CLMM model enables increased capital efficiency by allowing liquidity to be concentrated at certain price ranges, which means traders experience lower slippage due to liquidity being concentrated around the current price point.

Liquidity providers, on the other hand, can earn increased fees when they provide liquidity within the price range where trading activity occurs. Notably, Raydium also provides order flow and shares liquidity with OpenBook’s on-chain central limit order book, creating a hybrid approach that maximizes liquidity across the ecosystem.

Who Is Behind Raydium?

Raydium was co-founded by pseudonymous members known as AlphaRay, XRay, and GammaRay in February 2021. AlphaRay, who has a background in algorithmic trading for commodities and transitioned to market-making in the cryptocurrency space in 2017, serves as the chief of strategy and operations. GammaRay handles marketing and communications, while XRay leads the technology and development team.

One of the prominent team members with a public identity is Timon Peng, who serves as a Co-Founder and Senior Full-Stack Engineer. With over 11 years of experience in the crypto industry, Peng was responsible for building various aspects of the platform, including the front-end, API, SDK, and cross-chain functionalities.

The development of Raydium began in Q4 2020 after the team identified inefficiencies in Ethereum-based DeFi, such as high fees and long wait times. They collaborated with the Serum team, aligning with their vision to enhance DeFi accessibility and functionality on Solana. This partnership helped establish Raydium as a foundational protocol within the Solana ecosystem.

How Raydium Works: A Technical Explanation

At its core, Raydium functions as an automated market maker that facilitates token swaps through liquidity pools. When users swap tokens on Raydium, they are essentially trading with a pool of tokens rather than directly with another user. This process is governed by a mathematical formula (typically x * y = k for constant product pools) that determines the price based on the ratio of tokens in the pool. This approach ensures that tokens are always available for trading, regardless of market conditions.

Raydium offers two main types of liquidity pools, each with distinct characteristics. The Concentrated Liquidity Market Maker (CLMM) pools allow for asymmetric liquidity distribution, enabling liquidity providers to focus their assets within specific price ranges. This model increases capital efficiency as liquidity is concentrated where it’s most needed, resulting in lower slippage for traders and potentially higher fees for providers. However, this comes with an increased risk of impermanent loss for LPs since position weights change more quickly due to the tighter price range. CLMM pools are typically preferred for less volatile assets or by more advanced users.

In contrast, Constant Product pools follow the standard AMM model where liquidity is distributed across the entire price curve. These pools are more versatile and straightforward to deploy, making them ideal for token launches and price discovery. Raydium offers two programs for Constant Product pools: the newer Constant Product Market Maker (CPMM) pools, which are anchor-compatible and support the Token-2022 standard, and the legacy AMMv4 pools, which are the most distributed on Solana.

Beyond its core functionality as an AMM, Raydium also offers additional features to enhance its ecosystem. The platform includes a proprietary liquidity locker called “Burn & Earn” that allows projects to renounce access to their liquidity while maintaining the right to claim pool trading fees. Raydium also features a smart routing contract that enables fast, cheap swaps through its pools, accessible directly on Raydium.io and through its SDK. Furthermore, the platform’s AcceleRaytor launchpad facilitates token sales for new projects, helping them raise capital and establish liquidity from the outset.

Current Status Of Raydium In The Wider Ecosystem

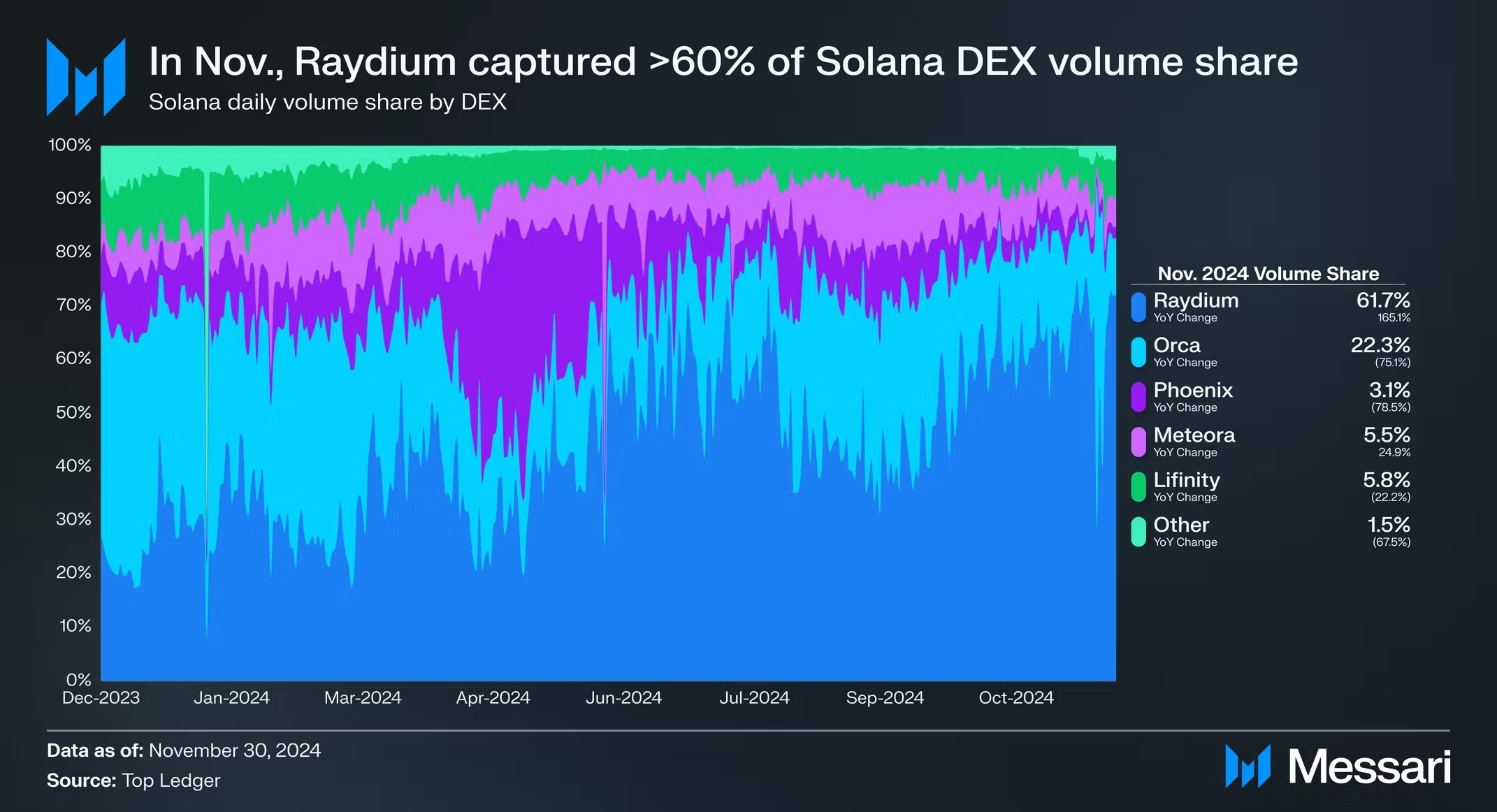

Raydium has established itself as a cornerstone of the Solana DeFi ecosystem. As of April 2025, the platform boasts approximately $1.35 billion in Total Value Locked (TVL), making it one of the most significant liquidity providers on Solana. This substantial TVL indicates strong user confidence and adoption, particularly considering the competitive nature of the DeFi space.

Within the broader AMM sector, Raydium has emerged as a strong contender. Its ability to offer lightning-fast transactions at minimal costs thanks to Solana’s efficiency has attracted users who might otherwise be deterred by the high gas fees on Ethereum-based alternatives. This advantage has been particularly valuable during periods of network congestion on other blockchains.

Raydium’s integration with OpenBook’s on-chain central limit order book creates a unique hybrid approach that sets it apart from traditional AMMs. This integration allows Raydium to offer the best of both worlds: the guaranteed liquidity of an AMM combined with the order matching efficiency of a limit order book. This approach has been well-received by the trading community, particularly those engaged in more complex trading strategies.

The platform’s permissionless nature has also contributed to its adoption. Any user or project can create a liquidity pool for any asset, which has led to a diverse range of tokens being available for trading on Raydium. This open approach has made Raydium a preferred platform for new token launches on Solana, further cementing its position within the ecosystem.

Raydium’s Price Journey

The RAY token has experienced significant price volatility since its launch, reflecting both project-specific developments and broader market trends. After its launch in February 2021, RAY saw substantial growth during the bull market of 2021, reaching an all-time high of $16.83 on September 12, 2021. This peak coincided with growing interest in Solana-based projects and the overall expansion of the DeFi sector.

However, like many cryptocurrencies, RAY experienced a significant downturn during the bear market that followed. The token reached an all-time low of $0.1344 on December 29, 2022, representing a decline of over 99% from its peak. This dramatic drop was influenced by both the broader crypto market downturn and specific challenges within the Solana ecosystem during that period.

Since then, RAY has shown signs of recovery. Throughout 2024 and early 2025, the token has been on an upward trajectory, benefiting from renewed interest in Solana and DeFi projects. In the 30 days leading up to April 23, 2025, RAY has increased by approximately 34.9%, demonstrating strong positive momentum. As of April 23, 2025, RAY is trading at $2.56, representing a significant recovery from its lows but still well below its all-time high.

Current Data & Interesting Statistics About Raydium

- Total Value Locked (TVL): Raydium currently has approximately $1.35 billion in TVL, making it a significant player in the Solana DeFi ecosystem.

- Market Capitalization/TVL Ratio: At 0.57, this ratio indicates that Raydium’s market cap is lower than its TVL, potentially suggesting that the token is undervalued relative to the actual assets locked in the protocol.

- 24-Hour Trading Volume: As of April 23, 2025, Raydium has a 24-hour trading volume of approximately $103.18 million, indicating active trading and liquidity.

- Circulating Supply: There are currently 290.8 million RAY tokens in circulation out of a total supply of 555 million.

- Token Allocation: 34% of RAY tokens were airdropped to liquidity providers over three years, 30% allocated for partnerships, 20% for team members, 8% for liquidity provisioning, and 6% for seed funding and community pool.

- Supported Blockchains: While primarily built for Solana, Raydium has expanded to support cross-chain functionality through Wormhole integration.

- Developer Activity: Raydium maintains active GitHub repositories for its frontend, SDK, and documentation, indicating ongoing development and improvement of the platform.

What Is The Future Of Raydium?

Raydium’s future looks promising as it continues to evolve within the rapidly growing Solana ecosystem. The platform’s roadmap includes further enhancements to its V3 interface, continued support for the Token-2022 standard, and expanded cross-chain functionalities. As Solana adoption grows, Raydium is well-positioned to capture increased trading volume and liquidity provision.

The team’s focus on capital efficiency through concentrated liquidity pools aligns with broader industry trends toward optimizing DeFi protocols. Additionally, Raydium’s launchpad services continue to attract new projects to the Solana ecosystem, creating a virtuous cycle of growth. With its established infrastructure and significant TVL, Raydium has created strong network effects that could help it maintain its position as a leading AMM on Solana.

The success of Raydium will largely depend on the broader adoption of Solana and the continued innovation within the Raydium ecosystem. If Solana continues to gain market share as a high-performance blockchain, Raydium stands to benefit significantly as one of its cornerstone DeFi protocols.

The High-Velocity Future Of Decentralized Finance

Raydium represents a significant evolution in the automated market maker model, leveraging the speed and efficiency of Solana to provide a superior trading experience. From its humble beginnings in early 2021, it has grown into a cornerstone of the Solana DeFi ecosystem with over a billion dollars in total value locked. The platform’s innovative approach to liquidity provision, combining both concentrated liquidity pools and constant product pools, offers flexibility for traders of varying expertise levels.

As the DeFi landscape continues to evolve, Raydium’s emphasis on permissionless access, capital efficiency, and cross-chain functionality positions it well for continued growth. While the RAY token has experienced significant volatility, the underlying protocol continues to demonstrate utility and attract users. For those looking to engage with DeFi on Solana, Raydium offers a battle-tested platform that balances innovation with reliability, making it a key player in the future of decentralized finance.