Key Takeaways

- ZKsync is an Ethereum Layer 2 scaling solution using zero-knowledge rollups to provide high throughput and reduced transaction costs while maintaining Ethereum’s security.

- The platform features an “Elastic Network” of 20+ ZK Chains, allowing seamless interoperability and liquidity sharing across multiple specialized blockchains.

- Major financial institutions including Deutsche Bank and UBS have begun testing ZKsync’s technology, showing increasing interest from traditional finance in zero-knowledge solutions.

- ZKsync provides native, frictionless interoperability with secure one-tap onboarding via FaceID/Passkeys, eliminating the need for seed phrases.

- As a zkRollup platform developed by Matter Labs, ZKsync maintains full compatibility with Ethereum through its zkEVM technology, enabling easy deployment of existing smart contracts.

ZKsync has emerged as one of the leading Layer 2 scaling solutions in the Ethereum ecosystem, revolutionizing blockchain performance through its innovative zero-knowledge rollup technology. As an “Elastic Network” of blockchains, ZKsync enables high-speed transactions with significantly lower costs while maintaining the security guarantees of Ethereum. Recent developments have catapulted ZKsync into the spotlight, with major financial institutions like Deutsche Bank and UBS beginning to test its technology, and the city of Buenos Aires launching the world’s first ZK digital identity system. The platform has also attracted attention from the NFT space, with Pudgy Penguins launching an Ethereum Layer 2 solution called Abstract on the ZKsync platform.

As of April 25, 2025, ZKsync’s native token ZK is trading at approximately $3.75, with a circulating supply of 750 million tokens and a market capitalization of $2.81 billion.

What Is ZKsync?

ZKsync is a trustless Layer 2 protocol developed by Matter Labs that delivers scalable, low-cost payments on Ethereum through zkRollup technology. As a user-centric platform, ZKsync addresses Ethereum’s limitations in transaction throughput and gas fees by processing transactions off-chain while publishing cryptographic proofs on-chain to ensure security. This approach allows ZKsync to achieve speeds of thousands of transactions per second compared to Ethereum’s native capacity of approximately 15 transactions per second.

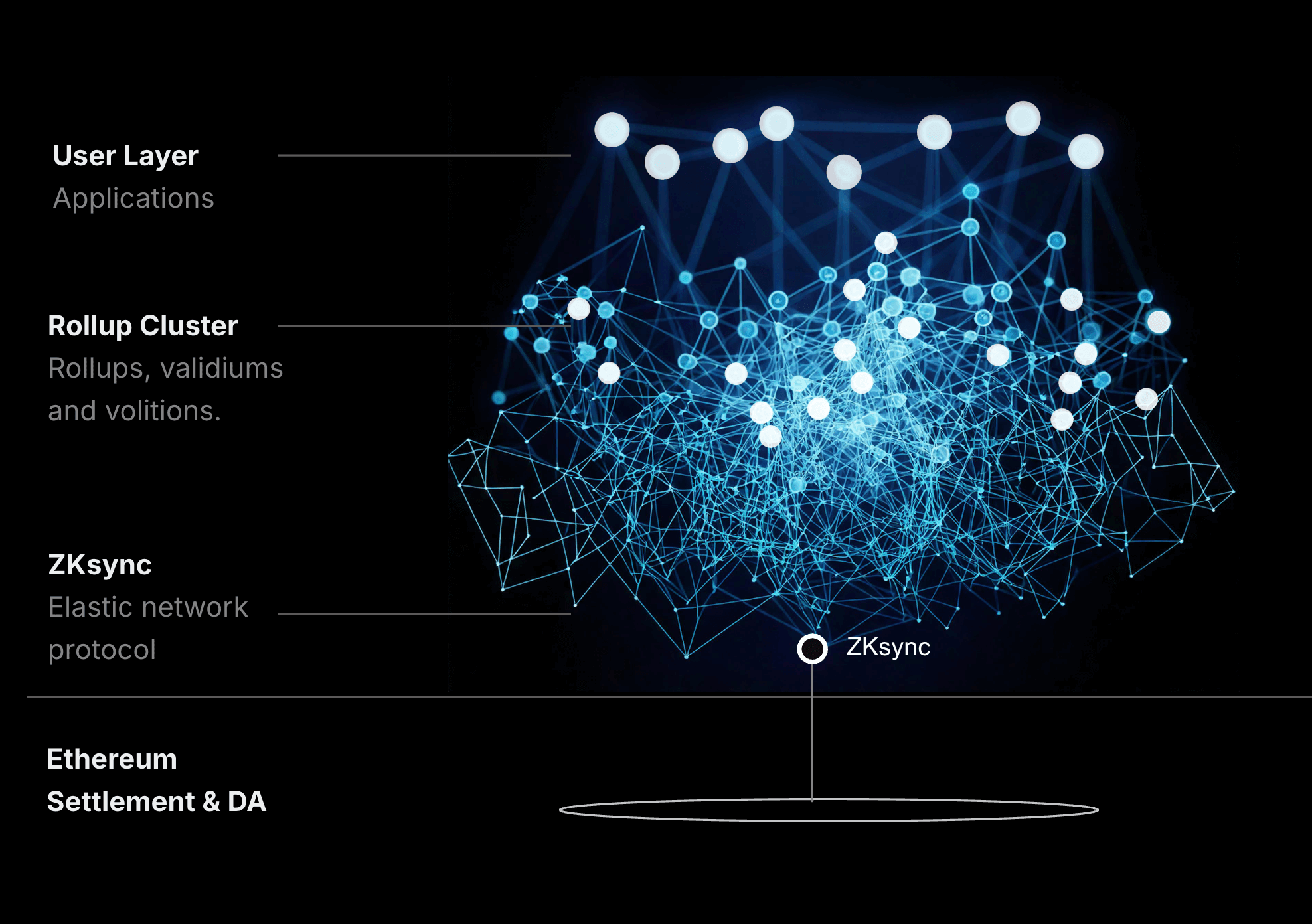

At its core, ZKsync is building an “Elastic Network” of blockchains that can scale to meet increasing demand without compromising on decentralization or security. Through its main product, ZKsync Era, the platform supports EVM-compatible smart contracts, enabling developers to deploy Ethereum applications with minimal modifications while benefiting from significantly reduced fees and increased transaction speeds. The network currently consists of more than 20 ZK Chains that can be added or expanded to handle increased transaction volume without affecting costs or hardware requirements for verification.

Who Is Behind ZKsync?

ZKsync was created by Matter Labs, a company founded in 2018 by Alex Gluchowski with the mission of solving blockchain scalability challenges for mass adoption. The Matter Labs team laid out its vision for ZKsync in late 2019, positioning it as the first trustless Layer 2 scaling solution with Layer 1 security guarantees and support for a fully zero-knowledge based smart contract ecosystem. The team consists of cryptographers, engineers, and blockchain experts dedicated to advancing zero-knowledge proof technology.

The project has garnered significant support from prominent investors and partners. In November 2021, Matter Labs announced a $50 million funding round led by Andreessen Horowitz, following a $2 million Series A round earlier that year. The funding strategy has focused on preserving community governance while bringing in strategic partners. ZKsync has established partnerships across the blockchain ecosystem, with integrations into platforms like Golem, Numio, StablePay, and Storj, while also powering multiple Gitcoin Grant rounds. More recently, the project has attracted interest from traditional financial institutions, with Deutsche Bank and UBS exploring ZKsync’s technology for potential applications in the financial sector.

How ZKsync Works: A Technical Explanation

ZKsync achieves its performance and security through zkRollup technology, a Layer 2 scaling solution that bundles (“rolls up”) hundreds of transactions into a single proof that is then verified on the Ethereum mainnet. At the heart of this system is the zero-knowledge proof—a cryptographic method that allows one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. In ZKsync’s case, these proofs verify that all transactions in a batch are valid without needing to process each transaction individually on the Ethereum blockchain.

The platform’s architecture consists of several specialized components working together. ZK Chains are high-performance, verifiable, modular rollups and validiums powered by ZKsync technology. These chains form an elastic network that can be expanded to handle increased transaction volume without affecting costs or hardware requirements for verification. Unlike traditional blockchain systems where all nodes perform all tasks, ZKsync implements a node specialization framework with different nodes handling distinct functions: sequencer nodes for transaction ordering, prover nodes for generating cryptographic proofs, full nodes for verification, and replica nodes for storage.

What sets ZKsync apart is its native interoperability and focus on user experience. The platform offers seamless communication and asset transfers between chains, leveraging the full range of users and liquidity across the entire ZK Chain ecosystem. This interoperability isn’t achieved through centralized bridges—often vulnerable to hacks—but relies solely on cryptography for security. On the user experience front, ZKsync provides secure one-tap onboarding via FaceID/Passkeys, eliminating the need for seed phrases and reducing hack risks. By automatically creating modular smart accounts at the protocol level, users can access all ZK Chains with what feels like a single account directly from their applications.

ZKsync’s zkEVM (Zero-Knowledge Ethereum Virtual Machine) maintains full compatibility with Ethereum, allowing developers to deploy existing smart contracts without rewriting them for a new environment. This compatibility significantly reduces barriers to adoption and enables the vast Ethereum developer ecosystem to build on ZKsync with minimal friction. The platform’s SDK supports multiple programming languages, streamlining the development process and providing tools for seamless integration with ZKsync’s features.

Current Status of ZKsync In The Wider Ecosystem

ZKsync has established itself as a key player in the Ethereum scaling solution landscape, operating in the highly competitive Layer 2 sector alongside other rollup technologies. The ecosystem has seen remarkable growth, with over 20 ZK Chains now operating within the Elastic Network, each serving different applications and use cases while sharing liquidity and users. This expansion demonstrates ZKsync’s adaptability across various blockchain applications, from decentralized finance to gaming and identity solutions.

Recent developments highlight ZKsync’s growing influence beyond the crypto space. Traditional financial institutions have begun exploring ZKsync’s technology, with Deutsche Bank and UBS conducting tests of its Layer 2 capabilities. This interest from major banks signals a potential bridge between traditional finance and decentralized systems, positioning ZKsync as a technology that could facilitate this transition. The adoption by the city of Buenos Aires to launch the world’s first ZK digital identity system further demonstrates the platform’s real-world utility beyond purely financial applications.

In the broader DeFi ecosystem, ZKsync has become a foundation for numerous applications seeking to leverage Ethereum’s security with improved performance. The growing interest in tokenization has also found a home on ZKsync, with Tradable bringing $1.7 billion in private credit on-chain through the platform. This development highlights ZKsync’s potential role in bridging traditional financial assets with blockchain technology, a trend that could significantly expand the network’s total addressable market.

ZKsync’s Price Journey

Since its launch, ZKsync’s native token (ZK) has experienced several notable price movements reflecting both broader market trends and project-specific developments. The token was initially made available to early supporters and through community initiatives before broader market access. Early trading saw modest valuation as the project was still proving its technology and building its ecosystem.

A significant price surge occurred following the announcement of partnerships with major financial institutions, with the token reaching an all-time high of $5.42 in November 2024. This increase coincided with growing institutional interest in Layer 2 technologies and zero-knowledge proofs as scalable solutions for blockchain adoption. The launch of the Elastic Network concept and expansion to 20+ ZK Chains also contributed to positive price action, as these developments enhanced the utility and potential applications of the ZKsync ecosystem.

Market corrections in early 2025 affected the entire cryptocurrency sector, with ZK experiencing volatility in line with the broader market. However, the token demonstrated resilience compared to some competitors, supported by continued technological development and ecosystem growth. As of April 25, 2025, ZK trades at approximately $3.75, representing a 30.8% decrease from its all-time high but a 15% increase year-to-date, reflecting continued investor confidence in the project’s long-term potential.

Current Data & Interesting Statistics About ZKsync

- ZKsync’s network currently processes over 3.5 million transactions daily, representing a 120% increase from the previous year.

- The platform has reduced transaction costs by approximately 97% compared to Ethereum mainnet fees.

- More than 350 decentralized applications have deployed on ZKsync Era, spanning DeFi, gaming, and identity solutions.

- ZKsync’s Elastic Network now comprises more than 20 specialized ZK Chains, each optimized for specific use cases.

- Total Value Locked (TVL) in ZKsync protocols has reached $5.3 billion, placing it among the top 5 Layer 2 solutions by this metric.

- The platform’s smart contract deployment costs are approximately 15 times lower than on Ethereum mainnet.

- ZKsync has facilitated over $22 billion in cross-chain transactions through its native interoperability features.

What Is The Future Of ZKsync?

ZKsync’s roadmap focuses on expanding its Elastic Network concept while continuing to improve its zero-knowledge proof technology. The team has announced plans to launch additional specialized ZK Chains tailored to specific industry needs, particularly targeting institutional adoption and enterprise applications. As traditional finance continues to explore blockchain integration, ZKsync is well-positioned to serve as a bridge technology, offering the security of Ethereum with the performance requirements of global financial systems.

The platform’s emphasis on user experience and account abstraction aligns with industry trends toward making blockchain technology more accessible to mainstream users. Development of more efficient zero-knowledge proof systems could further enhance scalability while reducing computational requirements. The growing interest from financial institutions suggests ZKsync could become a standard for regulated entities seeking to leverage blockchain technology while maintaining compliance requirements. ZKsync’s future success will likely depend on its ability to continue delivering innovative solutions that bridge the gap between traditional and decentralized finance.

Bridging The Present & Future: ZKsync’s Role In Blockchain Evolution

ZKsync represents a significant advancement in blockchain technology, addressing the critical challenges of scalability, usability, and interoperability that have hindered widespread adoption. By developing an Elastic Network of ZK Chains powered by zero-knowledge proofs, ZKsync offers a solution that maintains the security guarantees of Ethereum while significantly improving performance and reducing costs. The platform’s focus on user experience, with features like one-tap onboarding and account abstraction, removes barriers for new users entering the space.

As traditional financial institutions and governments begin exploring and implementing ZKsync’s technology, we’re witnessing the early stages of convergence between centralized and decentralized financial systems. Whether for decentralized applications, cross-border payments, or digital identity systems, ZKsync is positioning itself as a foundation for the next generation of blockchain innovation, potentially bringing blockchain technology into the mainstream while preserving the security and transparency that make it revolutionary.