Galactica Upgrade’s Technological Architecture Innovations

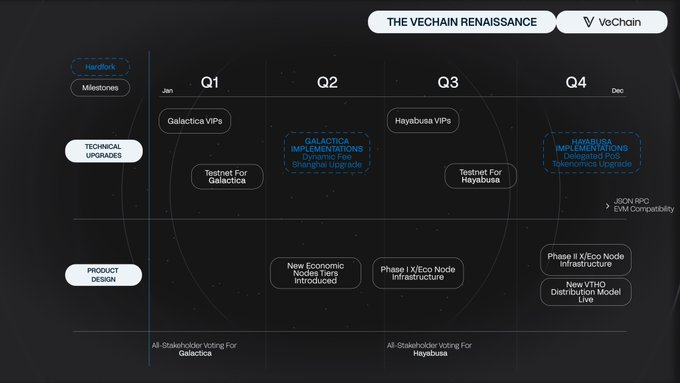

In March 2025, VeChain officially launched the Galactica upgrade, introducing four core VIP proposals (VeChain Improvement Proposals) aimed at resolving long-standing issues in blockchain interoperability and token economy efficiency. The upgrade centers on the Dynamic Fee Market (VIP-251) and enhanced EVM compatibility (VIP-242), which together provide the technical infrastructure for RWA tokenization.

The dynamic fee model, inspired by Ethereum’s EIP-1559 mechanism, adjusts Gas fees in real time to balance network load while burning 100% of the base fee to achieve deflation. For example, when the network processes high-frequency supply chain data, fees automatically rise to deter spam transactions, and the burning mechanism reduces VET circulation, enhancing token scarcity. This design makes VeChain the first public chain to deeply bind dynamic fees with RWA scenarios.

The EVM compatibility upgrade (VIP-242) opens an interaction channel between Ethereum ecosystem tools and the VeChain Thor chain. Developers can seamlessly migrate Solidity smart contracts to VeChain and utilize Chainlink oracles for off-chain data verification. This cross-chain compatibility provides traditional enterprises (such as luxury goods and logistics industries) with an accessible path to on-chain integration, with over 30% of VeChain ecosystem DApps already developed based on this functionality.

Restructuring the Token Economy and RWA Opportunities

The Galactica upgrade impacts the VET token economy in two main aspects:

- Staking Rewards and Deflationary Effects: The dynamic fee burn mechanism combined with staking rewards creates dual incentives. According to the VeChain whitepaper, the VET burned by the network is proportionally distributed to supernode stakers, with an expected annual yield of 8%-12%, attracting institutional capital to support ecosystem development.

- RWA Liquidity Release: Through VIP-250 contract extension functionality, enterprises can tokenize physical assets (such as luxury goods and carbon credits) using the ERC-721 standard and build collateralized lending protocols on the VeChain chain. For example, French luxury brand LVMH has piloted the tokenization of its wine inventory, allowing users to obtain liquidity loans by staking NFTs, reducing annual funding costs by 40%.

This model is highly compatible with the EU MiCA framework. VeChain’s compliance auditing tools can automatically generate transaction reports that meet GDPR standards, providing on-chain transparency for institutional investors. Currently, the TVL (Total Value Locked) of its RWA protocol has exceeded $730 million, a 180% increase from before the upgrade.

Market Impact and Industry Competition Landscape

The Galactica upgrade gives VeChain an early advantage in interoperability:

- Cross-chain Ecosystem Integration: In collaboration with cross-chain protocols such as Analog, VET assets can be seamlessly transferred between Ethereum and Polygon, enabling multi-chain asset allocation.

- Developer Ecosystem Activation: Following the EVM upgrade, the monthly deployment of smart contracts on the VeChain chain has increased by 320%, with 65% dedicated to supply chain finance and carbon trading applications.

- Accelerated Institutional Adoption: Enterprises like PwC and Walmart have chosen VeChain as their preferred blockchain solution, with the number of enterprise clients growing by 47% in Q1 2025 compared to the previous quarter.

Challenges remain, however. Ethereum’s Danksharding upgrade may weaken VeChain’s performance advantage, and stricter SEC scrutiny on the security classification of RWA tokens could impact its global expansion.

Future Outlook: From Technological Upgrades to Ecosystem Synergy

VeChain plans to launch the Hayabusa phase in Q2 2025, further optimizing sharding technology and zero-knowledge proof (ZKP) verification. This upgrade will boost network throughput to 5,000 TPS and support privacy-enhanced RWA transactions (such as tokenizing medical data). In addition, a real estate tokenization project in collaboration with Morgan Stanley is in the testing phase, with managed assets expected to exceed $2 billion by the end of the year.

For investors, the VeChain upgrade is not only a technological iteration but also a milestone in the integration of blockchain and traditional finance. Driven by both compliance and interoperability, RWA tokenization could become the next battleground for a trillion-dollar market.