Key Takeaways

- GameFi merges blockchain technology with gaming, creating play-to-earn models where players earn cryptocurrency and NFTs.

- The GameFi market is projected to grow from $21.91 billion in 2025 to $200.72 billion by 2034, with a CAGR of 28.50%.

- Blockchain ensures true ownership of in-game assets, allowing players to trade or sell them across platforms.

- GameFi platforms integrate DeFi tools like staking and lending, fostering complex, community-driven economies.

- Challenges include security risks, regulatory uncertainty, and market volatility affecting GameFi adoption.

GameFi, short for “Gaming Finance,” represents a revolutionary fusion of blockchain technology and traditional gaming, creating an innovative ecosystem where players can earn tangible economic value through gameplay. This emerging phenomenon combines elements of decentralized finance (DeFi) with gaming mechanisms to establish play-to-earn (P2E) models that transform gaming from purely recreational activities into potential income sources. The GameFi market has witnessed remarkable growth, with projections indicating expansion from approximately $21.91 billion in 2025 to as much as $200.72 billion by 2034, representing a compound annual growth rate (CAGR) of 28.50%. This substantial growth trajectory underscores the increasing mainstream appeal of blockchain gaming platforms and their potential to disrupt traditional gaming paradigms.

This Innovation and Tech article explores how GameFi is redefining digital ownership and economic participation by merging blockchain infrastructure with gaming ecosystems to create play-to-earn economies and decentralized player-driven platforms.

Understanding The GameFi Ecosystem

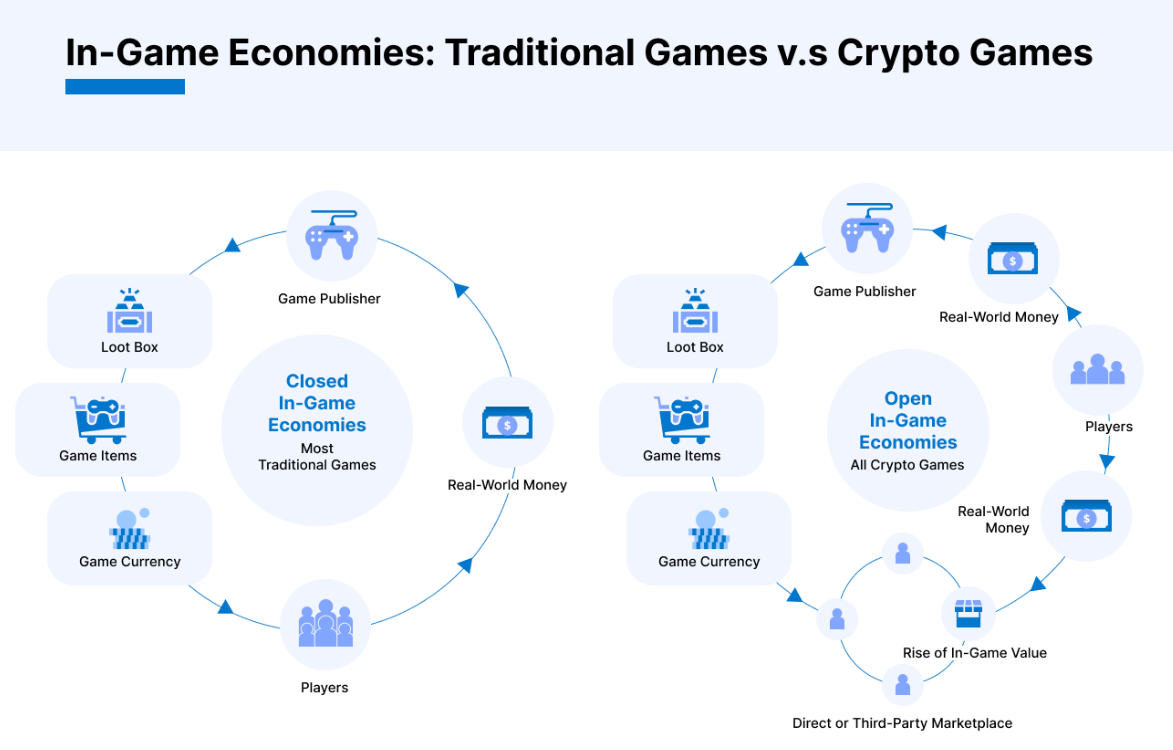

At its core, GameFi represents a paradigm shift in gaming ownership and rewards structures. Traditional gaming models operate on a “pay-to-play” basis, where players purchase games upfront or make in-game purchases without receiving real-world value in return. In contrast, GameFi introduces a revolutionary “play-to-earn” mechanism where in-game achievements translate to cryptocurrency rewards and digital asset ownership. This ownership extends beyond the confines of the game itself, allowing players to trade, sell, or utilize these assets across multiple platforms and even convert them into real-world value.

The technological foundation of GameFi relies on blockchain infrastructure, primarily through tokenization and non-fungible tokens (NFTs). Game assets such as characters, weapons, land, and cosmetic items exist as unique digital tokens on the blockchain, providing players with verifiable ownership that cannot be altered or removed by developers or centralized entities. This fundamental shift in ownership dynamics creates new economic incentives for players, transforming gaming from a purely consumption-based activity to an investment opportunity with potential returns.

The integration of financial mechanisms within gaming environments creates complex economies that mirror real-world financial systems. Many GameFi platforms incorporate various DeFi tools, including lending, borrowing, staking, and yield farming, expanding the potential economic activities beyond simple gameplay. Players can participate in governance through decentralized autonomous organizations (DAOs), vote on game development decisions, and potentially share in the platform’s revenue streams, creating a truly community-driven ecosystem that traditional gaming companies cannot match.

Exploring GameFi’s Market Surge & Player Engagement

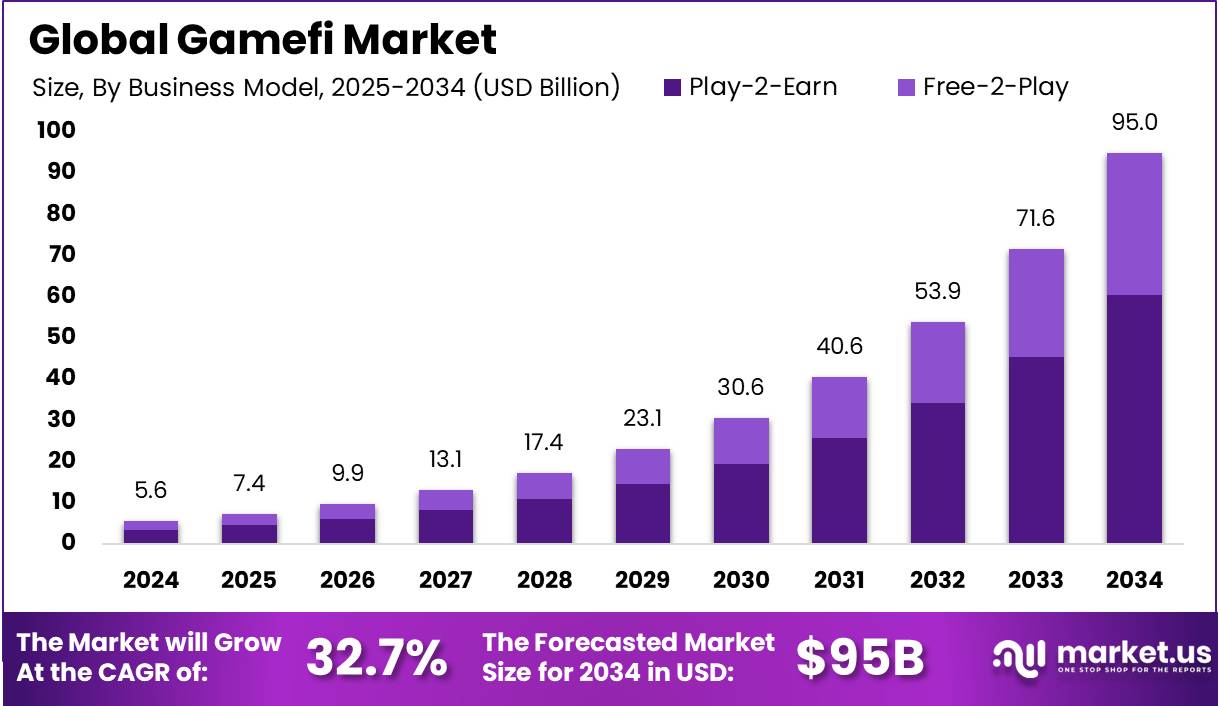

The GameFi sector has demonstrated exceptional growth potential, with various market analyses projecting substantial expansion. According to research from Business Research Insights, the global GameFi market is expected to reach $23.51 billion in 2025, while more optimistic projections suggest the market could reach $95 billion by 2034, growing at an impressive CAGR of 32.7%. This growth trajectory surpasses many traditional gaming segments, highlighting the increasing mainstream appeal of blockchain-based gaming experiences.

North America currently dominates the GameFi landscape, accounting for approximately 45.1% of the global market share in 2024, with revenues reaching $2.5 billion. This regional concentration reflects higher cryptocurrency adoption rates and technological accessibility, though emerging markets are increasingly participating in the GameFi ecosystem. The play-to-earn model has demonstrated particular appeal in developing economies, where gaming rewards can supplement or even replace traditional income sources. Notably, role-playing games (RPGs) have emerged as the most popular genre within the Web3 gaming space, representing 22% of all blockchain games according to a 2023 report by Game7, followed by action games at 17%.

What Sets GameFi Apart: Key Features & Benefits

The fundamental value proposition of GameFi centers on true asset ownership and financial incentivization. Unlike traditional games where players never truly own their in-game assets, blockchain technology enables verifiable ownership through NFTs that exist independently of the game’s central servers. This ownership model allows players to freely trade assets on secondary markets, creating liquidity and real-world value for virtual items that previously held value only within closed gaming ecosystems.

The financial incentive structures within GameFi platforms vary considerably but typically include native cryptocurrency tokens, NFT rewards, and various economic activities. Players can earn through completing in-game tasks, participating in tournaments, renting out virtual assets to other players, or developing in-game content and experiences. For instance, platforms like The Sandbox allow users to purchase virtual LAND as NFTs, develop unique games and experiences on this digital real estate, and monetize these creations when other players engage with them. This creator economy expands economic participation beyond skilled gameplay, allowing various forms of contribution to be financially rewarded.

The community-driven governance models employed by many GameFi platforms represent another significant departure from traditional gaming. Rather than centralized decision-making by development studios, blockchain-based games often incorporate decentralized governance mechanisms that allow token holders to vote on development priorities, economic parameters, and even revenue distribution models. This democratization of game development potentially aligns player and developer incentives more effectively than traditional models, though it introduces new complexities in balancing stakeholder interests and maintaining game integrity.

GameFi’s Growing Pains: Challenges To Wider Adoption

Despite its promising growth trajectory, GameFi faces substantial challenges that could impede mainstream adoption. Security concerns remain paramount, with blockchain games having experienced numerous hacks, exploits, and scams that undermine user trust. The highly technical nature of cryptocurrency wallets, private key management, and blockchain transactions presents significant barriers to entry for casual gamers accustomed to streamlined gaming experiences without financial risk.

The regulatory environment surrounding GameFi remains uncertain in many jurisdictions, creating potential legal and compliance challenges for both developers and players. The integration of financial incentives and real-world value within games raises questions about gambling regulations, securities laws, and taxation requirements that vary significantly across different regions. This regulatory uncertainty creates operational risks for developers and potential legal exposures for players participating in play-to-earn economies without clear understanding of their tax obligations and legal responsibilities.

Market volatility represents another substantial challenge, as the value of in-game assets and reward tokens can fluctuate dramatically based on cryptocurrency market conditions rather than game fundamentals. This volatility potentially undermines the stability of in-game economies and can create misaligned incentives where financial speculation takes precedence over gameplay enjoyment. Additionally, many GameFi projects struggle with developing sustainable economic models that can withstand market downturns and maintain player engagement beyond initial token price appreciation.

What’s Next For GameFi?

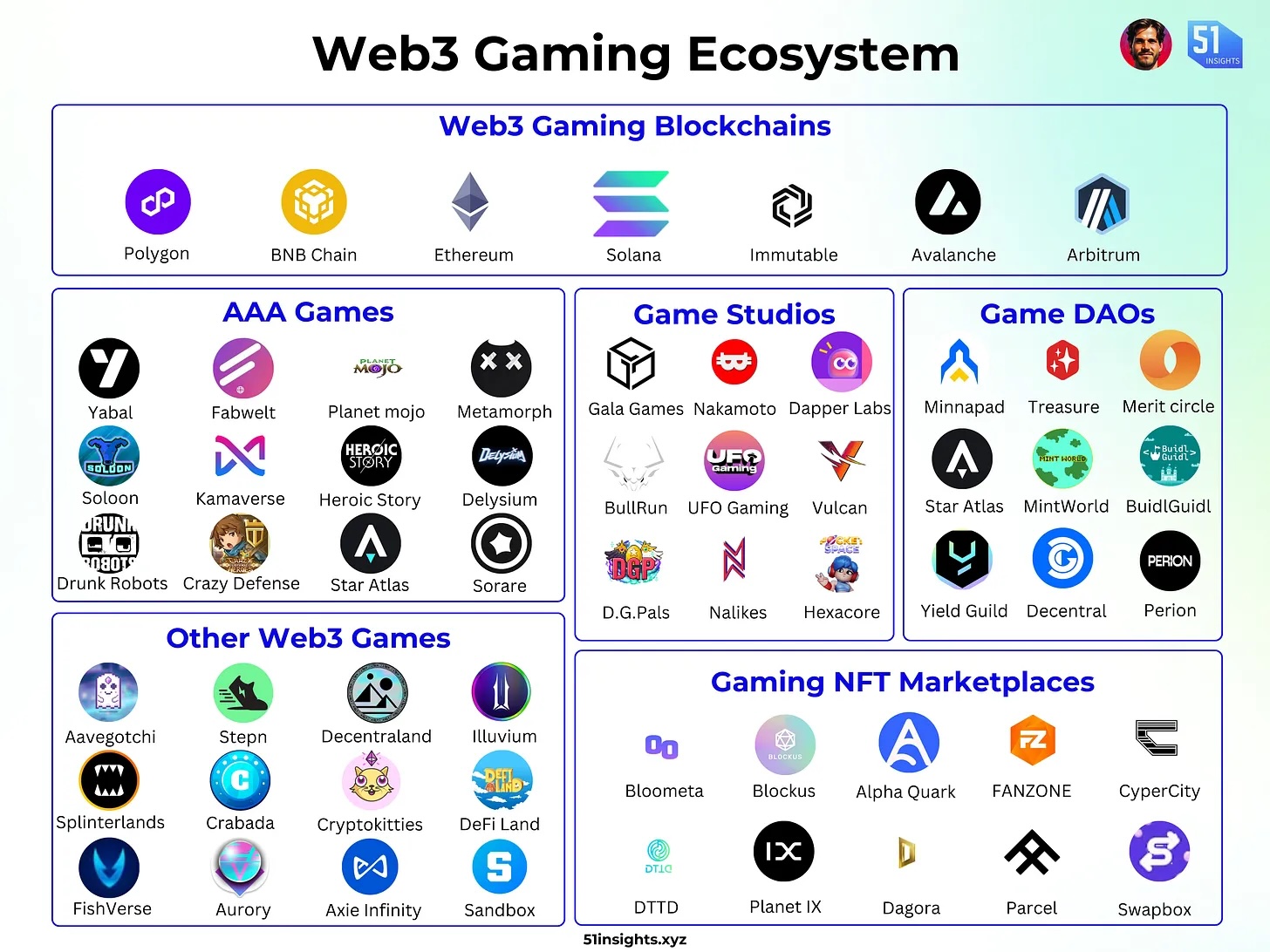

The future development of GameFi likely depends on overcoming the current trade-offs between blockchain integration and gameplay quality. Current blockchain games often prioritize economic mechanisms over engaging gameplay, but industry trends indicate movement toward higher-quality gaming experiences that incorporate blockchain elements more seamlessly. The increasing development of AAA and AA blockchain games represents a significant step in this direction, with these higher-budget titles potentially bridging the quality gap between traditional and blockchain gaming.

Technological improvements in blockchain infrastructure will likely accelerate GameFi adoption by addressing current limitations. Advancements in Layer 2 solutions, cross-chain interoperability, and improved user interfaces can reduce transaction costs, increase processing speed, and simplify the onboarding experience for mainstream gamers. Leading chains like opBNB, Ronin, and Immutable X have already demonstrated improvements in transaction capacity, reduced gas fees, and enhanced scalability that make GameFi more accessible to casual players without technical blockchain knowledge.

GameFi’s Transformation Of Gaming & Finance

GameFi represents a transformative convergence of gaming and finance that challenges fundamental assumptions about virtual asset ownership and player compensation. By leveraging blockchain technology to create verifiable digital ownership and real economic value from gameplay, GameFi platforms have established a rapidly growing ecosystem that merges entertainment with investment opportunities. Despite current limitations in gameplay quality, technical accessibility, and economic sustainability, the projected market growth suggests significant potential for mainstream adoption.

The future evolution of GameFi will likely focus on creating more sustainable economic models, improving gameplay experiences, and reducing technical barriers to entry. As blockchain technology continues to mature and regulatory frameworks develop, GameFi may increasingly bridge the gap between virtual entertainment and real-world economics, potentially transforming how we perceive the value of time spent in digital environments and offering new economic opportunities for players worldwide.