Key Takeaways

- Stablecoins provide a stable store of value in emerging markets, countering local currency volatility in countries like Venezuela, Turkey, and Argentina.

- They enable cost-effective, near-instant cross-border remittances, reducing transaction fees by up to 40% compared to traditional systems.

- Dollar-pegged stablecoins, like USDT and USDC, dominate in emerging markets due to their reliability and widespread adoption on blockchains like TRON and Ethereum.

- Stablecoins promote financial inclusion by offering accessible financial services in regions with limited banking infrastructure.

- Regulatory challenges, such as monetary policy risks, highlight the need for balanced frameworks to maximize stablecoin benefits in emerging markets.

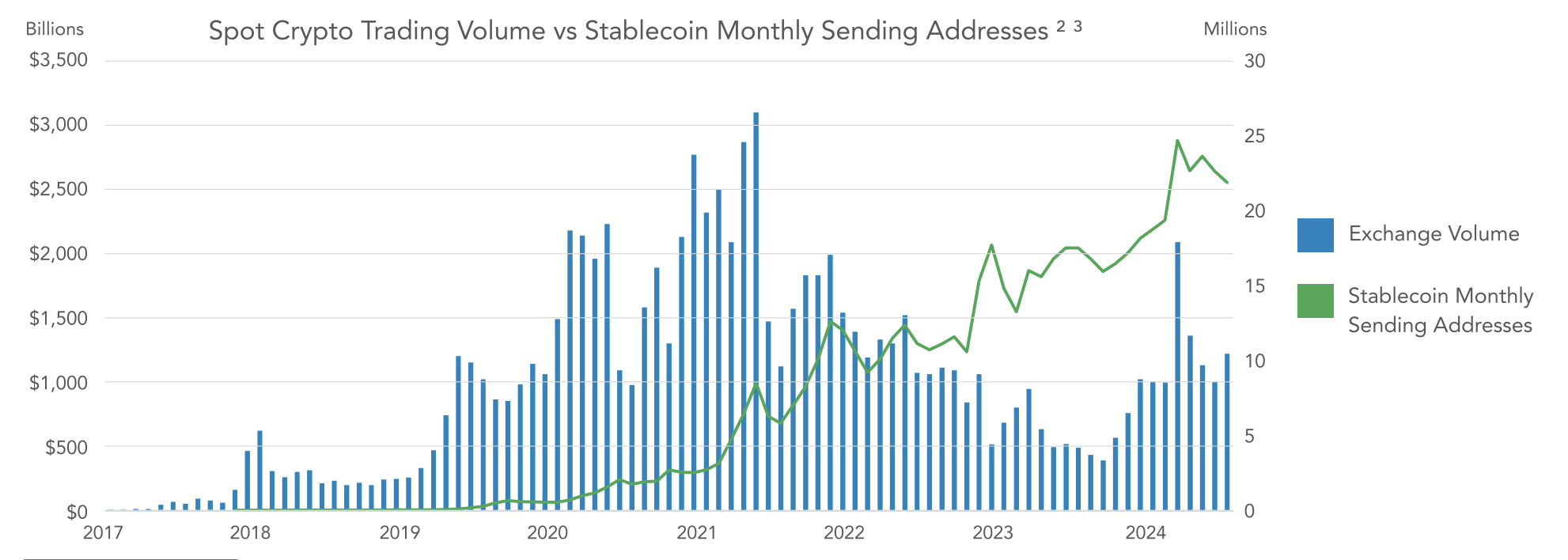

Stablecoins have emerged as a cornerstone of the cryptocurrency market, facilitating over two-thirds of global crypto transactions in recent months. These digital currencies maintain stable values by pegging to assets like the U.S. dollar, addressing the volatility of cryptocurrencies such as Bitcoin and Ethereum, which often hinders their use in everyday transactions. As the cryptocurrency ecosystem evolves, understanding stablecoins, their mechanisms, benefits, and risks is essential for investors, regulators, and users navigating this dynamic space, particularly in emerging markets serving critical economic functions.

Stablecoins As Stability Anchors In Volatile Economies

In emerging markets plagued by currency instability, stablecoins offer a compelling alternative to traditional financial instruments. Countries like Venezuela, Turkey, Argentina, and Nigeria have experienced significant economic volatility, driving citizens toward dollar-pegged stablecoins as a store of value. For instance, in Venezuela, which represents “the world’s leading stablecoin and use case capital,” these instruments have become vital for the estimated 8 million displaced people sending money home. Similarly, the Turkish lira’s sharp decline against the US dollar in 2021 worsened inflation and import costs, making stablecoins an increasingly attractive option for Turkish businesses seeking stability and lower transaction costs.

The phenomenon of currency substitution through stablecoins is particularly pronounced in economies with high inflation rates. Guillermo Goncalvez, CEO of El Dorado, a Latin American-focused P2P exchange, noted that as Venezuelans turned to the dollar due to devaluation, stablecoin remittances skyrocketed, proving they are a viable alternative when traditional systems fail. This mirrors findings in Argentina, where the peso lost over 90% of its value against the USD in the past five years, making stablecoins an attractive option for preserving purchasing power.

Cross-Border Payments & Remittance Revolution

Stablecoins excel as mediums of exchange, offering faster, cheaper cross-border transactions than traditional systems. Using a mid-range fee of 3% for traditional systems, stablecoins could potentially reduce these costs by 40% to approximately 1.8%. According to data from a16z, sending $200 from the U.S. to Colombia via stablecoins costs less than $0.01, compared to $12.13 using traditional methods. This cost efficiency is particularly valuable in remittance corridors like Nigeria-US, Mexico-US, and Brazil-Europe, where stablecoins facilitate cheaper transactions while maintaining near-instant settlement times.

The adoption of stablecoins for remittances has seen significant growth in transaction volumes. Yellow Card, a platform enabling fiat-to-crypto conversion, doubled its annual transaction volume to $3 billion in 2024 from $1.5 billion in 2023. Conduit, which enables stablecoin payments for import-export businesses in Africa and Latin America, saw its annualized TPV jump to $10 billion from $5 billion. Lagos-based Juicyway has processed $1.3 billion in total payment volume to date. These figures demonstrate the growing acceptance of stablecoins as a practical solution for cross-border value transfer in emerging markets.

Technical Implementations & Regional Preferences

The stablecoin landscape is dominated by dollar-backed tokens, which maintain their value through reserves of traditional currencies, primarily the U.S. dollar, held in regulated institutions. Leading examples include Tether (USDT) and USD Coin (USDC), with USDT’s reserves managed by BlackRock and held at The Bank of New York Mellon, verified by Deloitte’s attestation reports for transparency. In emerging markets, USDT is widely used, especially for cross-border transactions and as a safeguard against local currency volatility. It is commonly transacted on the TRON blockchain due to lower transaction fees and faster processing times compared to Ethereum.

Regional preferences for stablecoin infrastructure are evident. In Indonesia, for example, Pintu, one of the largest crypto platforms in the country, reports that Ethereum remains the most popular network for USD-based stablecoin transfers (50%), followed by Binance Chain (25%), Tron (8%), and Solana (4%). USDT is heavily favored over USDC, contributing to more than 90% of total on-chain transfers made by their users. This preference for USDT in emerging markets is often attributed to its network effects, user trust, liquidity, and established track record relative to other stablecoins.

Economic Impact & Financial Inclusion

Stablecoins have become instrumental in promoting financial inclusion in emerging markets. In regions with limited banking infrastructure, these digital currencies offer a low-cost, accessible alternative for transactions and remittances. Many individuals in areas like Sub-Saharan Africa and Southeast Asia lack access to USD-denominated banking services, and stablecoins are bridging this gap, empowering millions to store value and conduct transactions easily.

The impact extends beyond individual users to businesses operating in emerging markets. For digital companies with dollar costs, stablecoins provide a valuable hedge against local currency volatility. Businesses operating across multiple countries benefit from stablecoins for managing cash flow in different currencies and making payments to employees, clients, or suppliers internationally. As noted by DolarApp, a global financial app for Latin America using stablecoins, in countries where dollar banking is restricted (such as Mexico, Colombia, and Brazil), stablecoins enable users to hold USD values and convert at their discretion, providing transparency about exchange rates that traditional banks often obscure through hidden fees.

Regulatory Considerations & Challenges

Despite their growing utility, stablecoins face significant regulatory challenges across jurisdictions. Concerns range from monetary policy implications to financial stability risks. El Salvador’s 2021 monetary experiment to make Bitcoin legal tender demonstrated that while cryptocurrency adoption can increase financial inclusion, it comes at the cost of volatility in the medium of exchange. Economic modeling predicts that a one standard deviation decline in Bitcoin prices could cause a peak decline in output and consumption of approximately one percent, highlighting potential macroeconomic risks.

The Bank for International Settlements (BIS) has noted that while stablecoins present opportunities for cross-border payments, they also pose challenges. In jurisdictions where authorities determine that stablecoins may weaken the resilience of their domestic financial system or interfere with central bank objectives, these authorities might need to consider steps to mitigate risks to national payment and monetary systems. Currency substitution through stablecoins could undermine a central bank’s ability to control money supply or interest rates, eroding the effectiveness of monetary policy and financial policy control.

Research suggests that a potential solution to volatility concerns could be basket-based stablecoins. Empirical findings show that stablecoins derived from a basket of underlying currencies are less volatile than single-currency options, which could be fundamental for policy making in emerging markets with high levels of remittances. A “librae” (basket-based stablecoin) may preserve value during turbulent times better than a “libra” (single currency-based stablecoin), offering a more stable alternative to pure dollar-pegged tokens.

Future Trends & Integration With Traditional Finance

Stablecoins are increasingly finding integration points with traditional finance. Brazilian unicorn Nubank introduced a feature rewarding USDC holders with a 4% annual return, following a tenfold increase in customer-held USDC last year. Now, 30% of Nubank’s users have USDC in their portfolios. This integration extends to global fintech players like Venmo, Apple Pay, PayPal, Cash App, and Revolut, which already enable in-app stablecoin transactions.

Beyond consumer applications, stablecoins are reshaping global payroll systems. As remote work expands, startups like Rise allow companies to pay contractors using stablecoins, enabling businesses to pay in fiat while contractors receive stablecoins like USDC or USDT, avoiding currency volatility. This application is particularly valuable in emerging markets where traditional banking infrastructure may be unreliable or inaccessible.

Looking ahead, future trends include BigTech-issued global stablecoins, central banks exploring CBDCs, and deeper integration with traditional finance. Programmable features and enhanced interoperability across blockchain networks could expand stablecoin utility, creating a connected digital asset ecosystem and solidifying their role in global finance.

Stablecoins: Transforming Financial Stability In Emerging Markets

Stablecoins represent a significant innovation in addressing financial challenges unique to emerging markets. Combining blockchain efficiency with currency stability enables cross-border payments, promotes financial inclusion, and powers various applications in these regions. Their role in preserving value against inflation and facilitating efficient remittances makes them particularly valuable in economies with volatile currencies.

As the ecosystem matures, hybrid models and refined designs will likely optimize stability, decentralization, and efficiency. The integration of stablecoins into traditional financial systems and their growing acceptance by mainstream financial institutions signal their transition from a niche crypto product to a fundamental component of the global financial infrastructure. For emerging markets specifically, stablecoins offer a path to financial empowerment and economic resilience in the face of monetary uncertainty, provided that appropriate regulatory frameworks evolve to address both opportunities and risks.